Buy FPT shares with a target price of 120,000 dong per share.

BIDV Securities (BSC) maintains a buy recommendation on FPT Corporation (HOSE: FPT) and raises the target price to 120,000 dong per share due to its high growth potential in foreign markets and the education sector.

In 2024, the demand for digital transformation in foreign markets (Japan, US, APAC, EU) for FPT will remain high, driven by the demand for AI, which is expected to explode in 2024, and the trend of shifting data storage and processing to cloud platforms and data centers.

BSC believes that this is a strong growth driver for FPT, not only in 2024 but also in the next 5-6 years. The company’s leadership has set a target of reaching $5 billion in foreign markets (equivalent to an annual growth rate of 25%) by 2030.

In addition, there is room for FPT to improve its market share in foreign markets through active M&A activities, with competitive prices compared to other competitors such as China and India (15-20% lower).

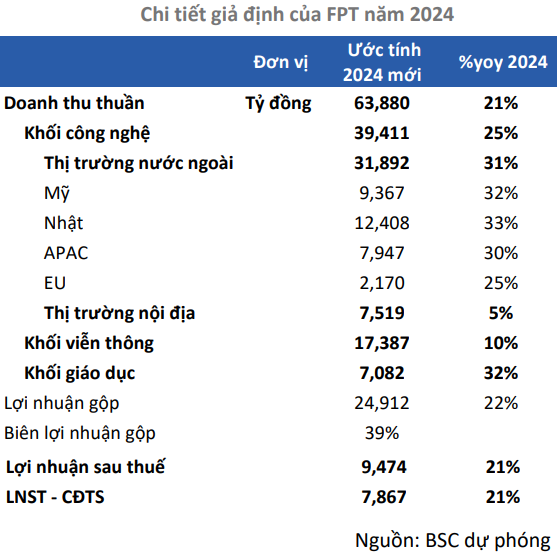

BSC forecasts that FPT‘s prospects in the Japanese market will increase by 33% compared to the same period, APAC will increase by 30% with strong growth momentum, and the US market will increase by 30% in recovery in 2024.

In addition, the potential from the education sector, with higher profit margins, will contribute more to the company’s profit structure. In 2024, the education sector is expected to increase by 32% compared to the same period, maintaining the high growth momentum of previous years.

BSC also maintains the view that the telecommunications sector will grow by 10% compared to the same period in 2024, with the main drivers coming from the PayTV and Datacenter segments.

Finally, BSC expects FPT to achieve net revenue and net profit of VND 63,880 billion and VND 7,867 billion, respectively, in 2024, an increase of 21% compared to the previous year, equivalent to an EPS of 5,755 dong per share.

Read more here

Buy VCS shares with a target price of 70,000 dong per share

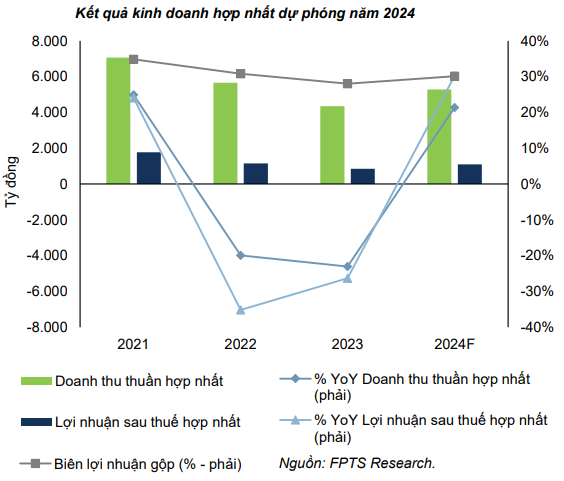

In 2024, FPT Securities (FPTS) expects the consolidated revenue growth prospects of Vicostone JSC (HNX: VCS) to continue to come from the artificial stone business (including both its own production and the purchase of Phenikaa & Style Stone’s output), which typically accounts for 75-80% of the company’s annual consolidated revenue.

FPTS forecasts that Vicostone’s consolidated net revenue in 2024 will reach VND 5,284 billion, an increase of 21.4% compared to the same period, with the proportion of finished stone sales, merchandise sales, and raw material sales being 46.1%, 31.7%, and 13.9%, respectively, in the context of civil construction activities in the key export markets of the US and the domestic market of VCS expected to recover in 2024.

The company’s gross profit margin is projected to be 30.1%, an increase of 2.1 percentage points compared to the actual level in 2023, despite an expected 3% decrease in selling prices due to increased competition among Vietnamese artificial stone producers for export. However, the prices of polyester resin and raw stone materials are expected to continue to decline since mid-2022, supporting the improvement of the gross profit margin.

The projected finance costs are VND 108.8 billion, an increase of 7.3% compared to the same period. As for selling and business management costs, the projected amounts are VND 179.7 billion (an increase of 14.8%) and VND 56.3 billion (a decrease of 4%), equivalent to 3.4% and 1.1% of revenue, respectively. After deductions, Vicostone’s after-tax profit is expected to reach VND 1,102 billion in 2024.

Assessing its potential and possible risks, FPTS recommends buying VCS shares with a target price of 70,000 dong per share.

Read more here

Buy PNJ shares with a target price of 110,060 dong per share

Vietcombank Securities (VCBS) recommends buying Phu Nhuan Jewelry Joint Stock Company (HOSE: PNJ) shares with a target price of 110,060 dong per share, equivalent to a target P/E ratio of 16x based on the positive outlook for the recovery of the jewelry market and the growth of offline stores.

VCBS highly values PNJ for its ability to adapt to difficulties and develop core capabilities for breakthroughs. Specifically, the company plans to open 36 new stores in 2023, despite narrowing competition, primarily focusing on the northern and central regions.

In addition, PNJ‘s biggest success comes from expanding its customer base (an increase of 17% compared to the same period) despite a decline in overall market demand. The younger generation in rural areas of the northern provinces is a market with the strongest purchasing power in the three regions and is still an area for PNJ to further develop, as the number of stores in the Red River Delta region, the northern mountainous region, and the North Central Coast is still low.

Furthermore, PNJ has changed its product mix to increase the proportion of high-margin products to offset a portion of the decline in net revenue.

In terms of future prospects, VCBS believes that Vietnam is one of the leading gold markets in Southeast Asia, with an estimated consumption volume of 55.5 tons of gold per year. However, the jewelry market still accounts for a small proportion (~21%) due to rapid income growth and the trend of spending on luxury items. Therefore, this brokerage firm believes that there is still a large growth potential for leading companies such as PNJ.

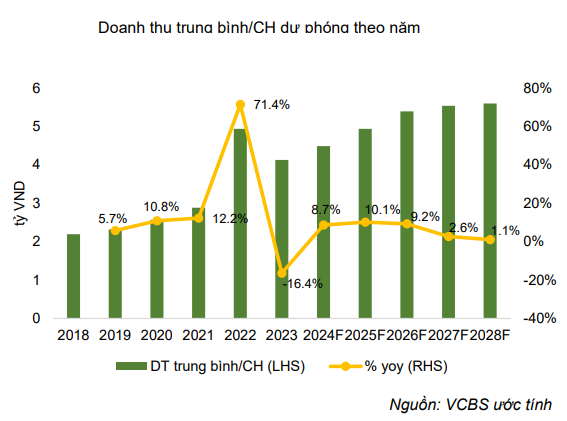

PNJ‘s growth strategy focuses on opening new stores and increasing revenue from existing stores. VCBS expects PNJ to continue to open 35-40 new stores per year, primarily focusing on the northern regions, and to maintain 8-10% revenue growth from existing stores over the next 2 years, based on expectations of jewelry demand recovery, especially in the second half of 2024.

VCBS projects that PNJ‘s net revenue and net profit in 2024 will reach VND 39,387 billion (an increase of 18.9% compared to the same period) and VND 2,395 billion (an increase of 21.5%), respectively, while the stock is currently trading at an attractive level with a P/E ratio of 14.6, which is 80% lower than the industry average.

VCBS also notes that investment risks may arise from slower-than-expected recovery of jewelry demand, which may hinder the revenue growth of stores and the expansion of the system.

Read more here

—