|

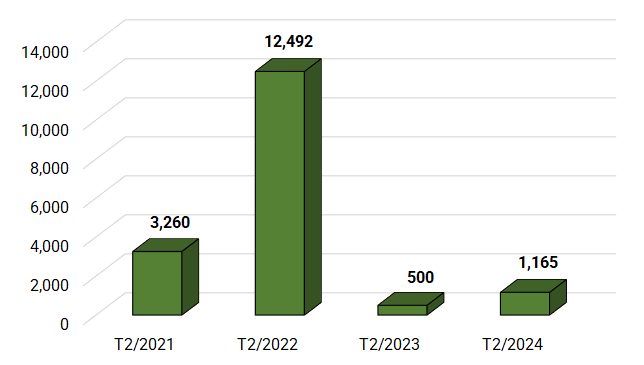

The value of corporate bond issuances in February 2024 for the past 4 years (unit: billion VND)

Source: VietstockFinance

|

The total value of bond issuances in the past month reached 1.16 trillion VND, which is modest but still double the figure of the same period last year, when Son Kim Real Estate Investment only raised 500 billion VND. However, it is still much lower than the 12.5 trillion VND in 2022, the peak period of “cheap money,” and the 3.2 trillion VND in 2021.

The real estate group has not had any “activity” after the first two months of 2024. The same can be said for the banking group, while in the last month of 2023, this group raised up to 55,000 billion VND.

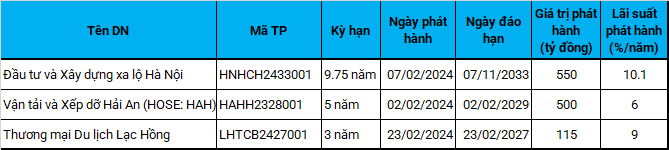

Xa Lo Ha Noi Investment and Construction, Hai An Loading and Unloading Transport (HOSE: HAH), and Lac Hong Travel Commerce are the three issuers of corporate bonds in February 2024, with the respective amounts of 550 billion VND, 500 billion VND, and 115 billion VND.

In a disclosure to the Hanoi Stock Exchange (HNX), Xa Lo Ha Noi Investment and Construction announced that it had successfully issued 5,500 bonds on February 7, 2024, raising 550 billion VND.

The bond has an interest rate of 10.1% per year, with a maturity period of 117 months from February 7, 2024, to November 7, 2033. This is also the only bond series being circulated and disclosed on HNX by this company.

The buyback plan is set to reach a minimum of 60 billion VND in the first year and a minimum of 115 billion VND by the 60th month. This means that after half of the term, the issuing organization will repurchase at least 20% of the face value of the bonds.

It is known that Xa Lo Ha Noi Investment and Construction is a subsidiary of Ho Chi Minh City Infrastructure Investment Joint Stock Company (HOSE: CII). In the recent second extraordinary General Meeting of Shareholders 2023, the parent company’s shareholders approved an investment in bonds issued by the subsidiary itself, with an amount of 523 billion VND.

Hai An Loading and Unloading Transport (HOSE: HAH), the “giant” in maritime transport, successfully raised a lot of 500 bonds under the code HAHH2328001 with a face value of 1 billion VND per bond, equivalent to a total amount of 500 billion VND. The Company currently has this only bond series in circulation and discloses information on HNX.

The bond has a term of 5 years, a fixed interest rate of 6% per year, and matures on February 2, 2029. The bond is restricted from transfer for one year for securities investors from the completion date of the public offering.

This is a convertible bond, without warrants and with collateral assets. Specifically, the conversion price is 27,300 VND per share, determined based on the conversion price not lower than 1.1 times the book value of one share of the Company based on the consolidated financial statements for the third quarter of 2023, which is 24,643 VND per share and has been approved at the 2023 General Meeting of Shareholders.

The collateral asset is the HAIAN BELL ship owned by HAI AN Container Transport Company, valued at over 207 billion VND. In addition, the Company will also use a newly constructed ship owned by the Company as collateral.

With the amount raised, HAH will use nearly 477 billion VND for the payment of the HCY-266 ship construction contract, and the remaining over 23 billion VND will be used for monitoring and initial equipment costs for the HCY-266 ship.

Alternatively, HAH will use the money to build a new ship with the registration number HCY-268, with over 495 billion VND for payment of the HCY-268 ship construction contract, and the remaining nearly 5 billion VND for monitoring and initial equipment costs for the HCY-268 ship.

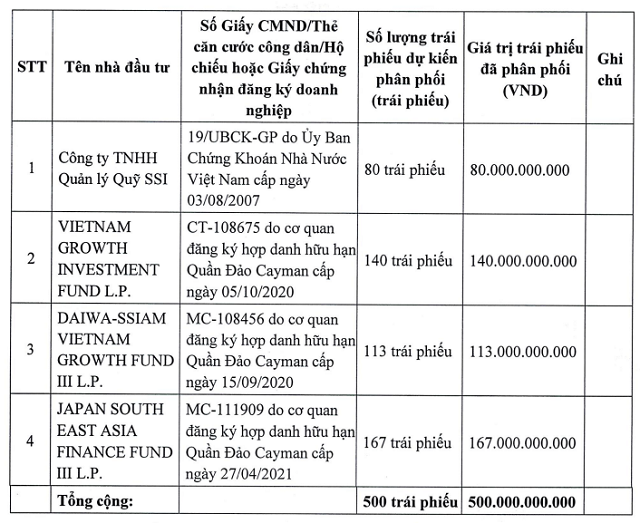

The value of bonds held by foreign investors after the offering accounted for 84%. According to the published list, the Japan South East Asia Finance Fund III L.P. (JSEAFF) purchased the most with 167 billion VND, the Vietnam Growth Investment Fund L.P. (VGIF) purchased 140 billion VND, the Daiwa-SSIAM Vietnam Growth Fund III L.P. (DSVGF) purchased 113 billion VND, and the SSI Asset Management Co., Ltd. (SSIAM) purchased 80 billion VND.

List of investors who bought bonds of HAH. Source: HAH

|

Recent developments show that Lac Hong Travel Commerce successfully raised 115 billion VND from a lot of 1,150 bonds with the code LHTCB2427001, with a face value of 100 million VND per bond, a term of 36 months until February 23, 2027, and an interest rate of 9% per year. This is also the first bond series the tourism company has issued and disclosed on HNX.

The company is headquartered in Kim Boi District and operates in the tourism service sector at the Serena Resort Kim Boi in Hoa Binh province.

|

The value of corporate bond issuances in February 2024

Source: Consolidated

|