The Ho Chi Minh Stock Exchange (HoSE) has announced the acceptance of the listing registration file of DSC Securities Joint Stock Company (DSC) (code: DSC). Accordingly, DSC Securities will register to list more than 204.8 million shares on HoSE. The date of receiving the listing registration file is March 1st.

DSC Securities, formerly known as Da Nang Securities, was established in 2006 with a charter capital of 22 billion VND. DSC has been traded on the UPCoM market since January 2018 with the code DSC. In 2021, the company changed its name to DSC Securities and relocated its headquarters to Hanoi, while increasing its charter capital to 1 trillion VND.

In 2023, DSC Securities further increased its charter capital to 2.048 trillion VND through offering nearly 100 million shares to the public and issuing nearly 5 million ESOP shares. In terms of shareholder structure, DSC Securities has two major shareholders, including 1 organization, NTP Investment Joint Stock Company, holding nearly 34.2%, and 1 individual, Mr. Nguyen Duc Anh (born in 1995) – Chairman of the Board of Directors, holding over 35.6%.

On March 25th, DSC Securities will hold its annual General Meeting of Shareholders for 2024 at the Conference Room, 2nd Floor, Thanh Cong Tower, 79 Dich Vong Hau Street, Dich Vong Hau Ward, Cau Giay District, Hanoi.

Regarding the business results of 2023, DSC Securities recorded operating revenue of over 438 billion VND, 2.6 times higher than the previous year. After-tax profit in 2023 reached nearly 120 billion VND, 3.6 times higher than the previous year and exceeded 56% of the set plan.

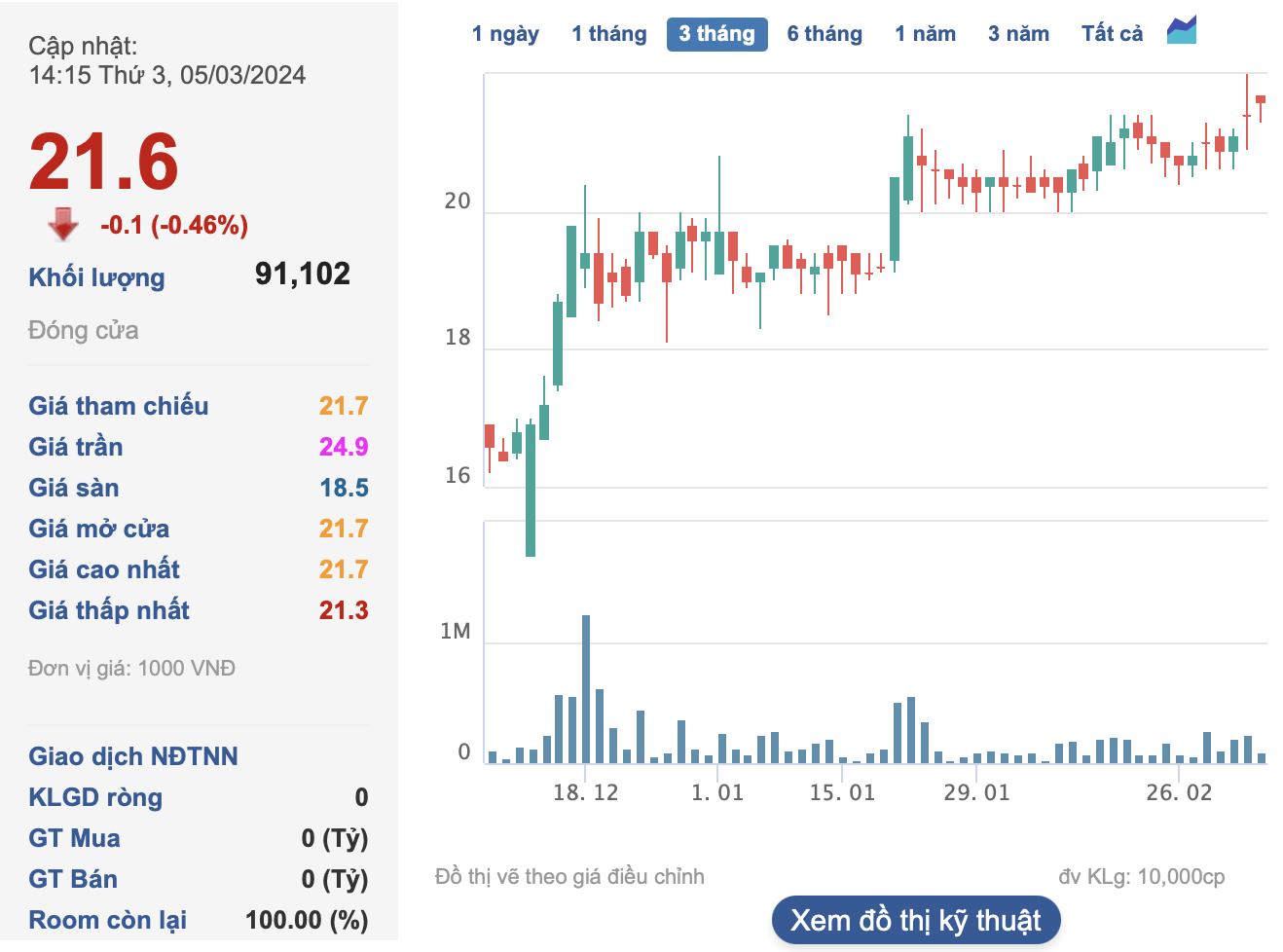

In the market, DSC shares are trading around 21,600 VND/share, up nearly 10% compared to the beginning of the year. The corresponding market capitalization is approximately 4,400 billion VND.