According to research data from the Vietnam Association of Realtors (VARS), the apartment price index in Hanoi and Ho Chi Minh City in 2023 increased by 38 and 16 percentage points respectively compared to 2019.

In the Hanoi market, apartment prices have been continuously increasing in both the primary and secondary markets. Meanwhile, apartment prices in Ho Chi Minh City have started to enter a cycle of price increases along with a slow decline in prices in high-end, luxury projects in the secondary market.

The reason for this is the surge in housing demand while land resources are running low, the housing supply continues to decline, combined with the increasing urban land value due to infrastructure and public service upgrades, which is the driving force behind the continuous establishment of new apartment price levels in recent years.

It is worth noting that the strong increase in housing demand comes not only from actual living needs but also from a large number of investment demands as rental prices for existing and new apartments in residential areas continue to increase after the period of social distancing, especially in the current market recovery context.

Meanwhile, the latest report from Batdongsan.com.vn shows that the level of interest in nationwide apartment sales in January 2024 increased by 66% compared to the same period in 2023, and the number of real estate listings also increased by 46%. Specifically, the search volume for apartments in Hanoi increased by 71% compared to the same period, while in Ho Chi Minh City it increased by 59%. This trend is also occurring in most other provinces and cities.

VARS expects that by mid-2025, when the laws related to land and real estate come into effect, apartment prices will decrease.

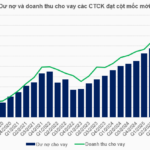

In terms of credit sources, consumer credit for real estate purchases in the first months of 2024 continues to decline from 2023 despite loan interest rates being maintained at a low level. Due to uncertainties regarding inflation, interest rates, etc., borrowing money to buy a house and paying monthly debts with amounts over 10 million VND has become a burden for many families, as they do not have strong confidence in their future employment and income situations.

However, at the moment, housing loans have slightly increased at some joint stock commercial banks with diverse real estate ecosystems, as people have begun to invest again.

VARS forecasts that in the short term, apartment prices in the centers of major cities will continue to rise, especially in the affordable and mid-range segments. Meanwhile, prices of upscale, luxury projects may see a slight decrease.