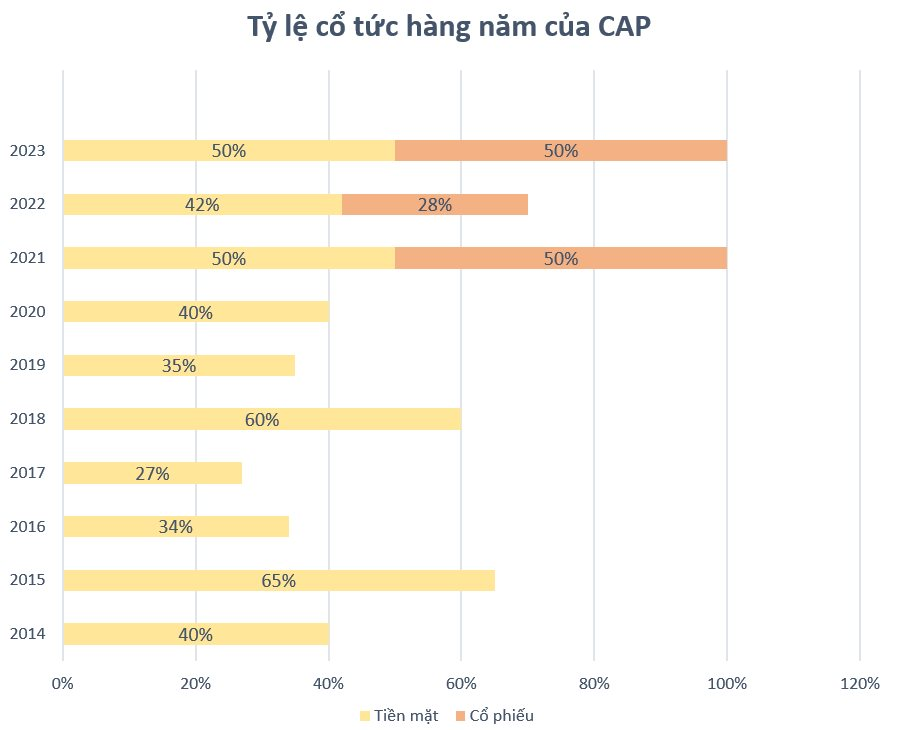

On March 19th, Yen Bai Food and Agricultural Products Joint Stock Company (ticker: CAP) will finalize the list of shareholders to implement the dividend payment for the fiscal year 2022-2023 with a total ratio of 100%. Specifically, 50% will be paid in cash (equivalent to 5,000 VND/share) and 50% will be paid in stock (for every 100 shares owned, an additional 50 new shares will be received).

With over 10 million shares outstanding, CAP will pay over 50 billion VND to shareholders and issue over 5 million new shares as dividends this time.

Once completed, the company’s charter capital will be increased to nearly 151 billion VND.

In this payment round, the group of shareholders related to CAP’s Chairman of the Board of Directors, Truong Ngoc Bien, will receive around 14 billion VND with a total ownership ratio of the group at 28.32%. Currently, Ms. Hoang Thi Binh, a member of the CAP Board of Directors and also the wife of Mr. Bien, is the largest shareholder in the company with a holding of 11.82% of the capital.

CAP is known as a rare gold mine producer on the stock market, alongside names like Hapaco (ticker: HAP), Fishipco (ticker: FSO) that also have gold business segments. However, CAP is still a highly sought-after name thanks to its stable business results and regular dividends with high ratios, even up to tens or hundreds of percent annually.

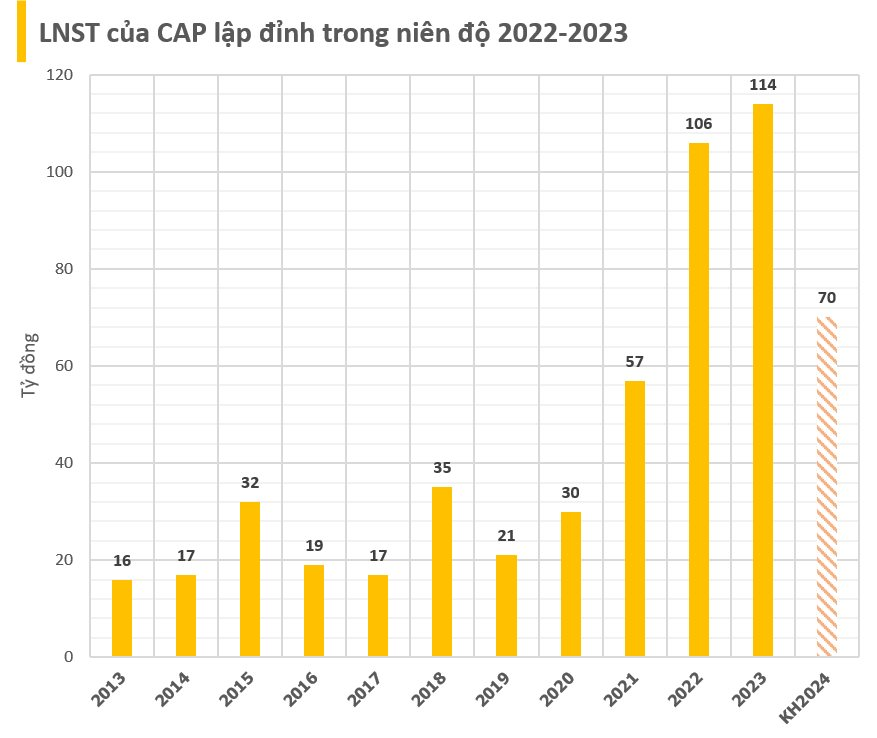

In the fiscal year 2022-2023 (from October 1, 2022 to September 30, 2023), CAP recorded an impressive performance. The company achieved a revenue of 611 billion VND, thereby setting a new profit record with a post-tax profit of 114 billion VND. In the business segments of the company in the 2022-23 fiscal year, cassava starch remains the largest revenue-generating product with 404 billion VND, an increase of 5% compared to last year. The paper substrate and gold segments earned 191 billion VND and 68 billion VND, respectively.

The profit from selling gold recorded over 13 billion VND, the paper substrate business made a profit of 73 billion VND, and the cassava starch business made a profit of 90 billion VND.

Entering the first quarter of the 2023-24 fiscal year (from October 1, 2023 to December 31, 2023), the company recorded a net revenue of 186 billion VND, an increase of about 18% compared to the same period. After deducting expenses, CAP achieved a post-tax profit of 14 billion VND, a decrease of about 31% compared to the same period in the previous fiscal year, thereby completing 33% of the revenue plan and 20% of the profit target.

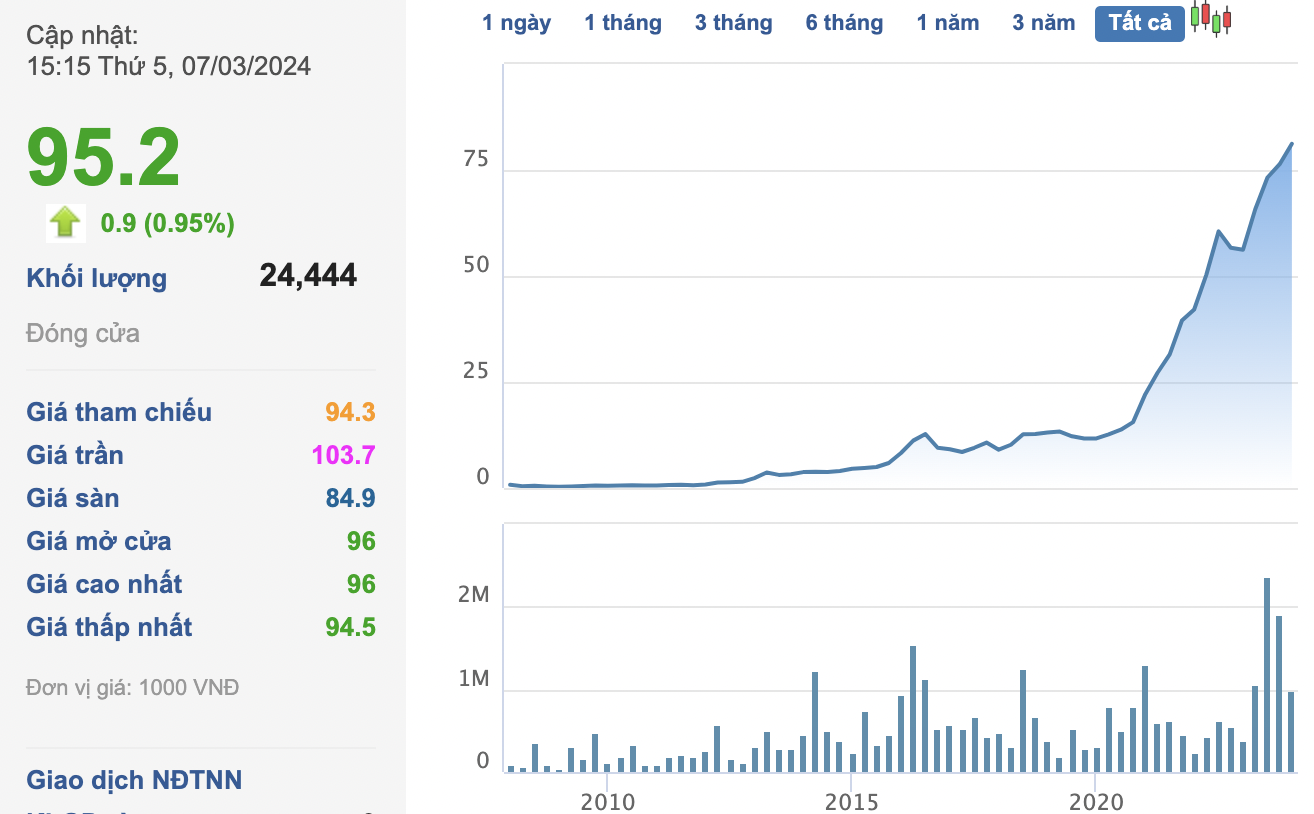

In the market, CAP’s stock price has recorded a good upward trend, closing at 95,200 VND/share on March 7th, an increase of about 20% compared to the beginning of 2024. This is the 12th consecutive session of increase for this stock and continues to be a record price level ever reached.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)