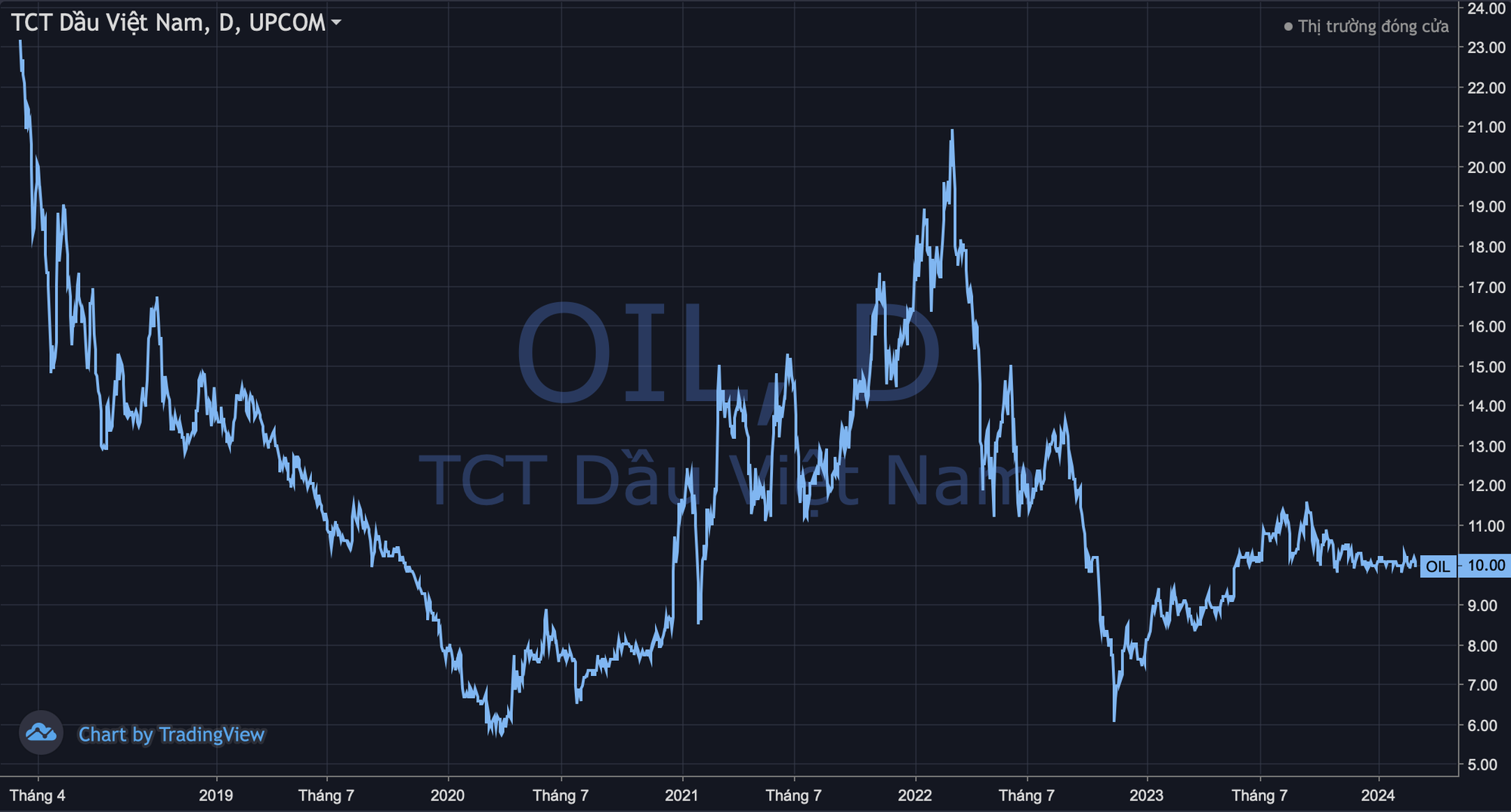

In the first 3 IPO blockbusters of 2018, PV Oil stocks (OIL) were listed on the stock exchange later than the others. Exactly 6 years ago today (7th March 2018), OIL stocks debuted on the UPCoM with a reference price of 20,200 VND per share.

Similar to BSR and POW, OIL also made a strong impression on its debut day with a very active trading session. The stock showed an increase of more than 36% before closing at 24,200 VND per share, equivalent to nearly 20% increase on the first trading session. The trading volume reached 8.3 million shares, leading in liquidity on the UPCoM.

Although it had a dream-like beginning, this stock followed the same path as its “companions” BSR and POW before it. During the Covid downturn, the OIL stock price dropped to about 1/4 of its listing price. From there, the stock started a strong upward trend. However, a wave that lasted until the beginning of 2022 was still not enough to bring the shareholders back to profit.

Afterwards, OIL stock fell sharply and once again hit its historical low in mid-November 2022 before rebounding to around par value as it is now. The market capitalization currently stands at around 10,300 billion VND, only half of its listing time.

Going back to the end of January 2018, PV Oil’s IPO session was very successful with nearly 4,000 investors participating and a double amount of orders compared to the shares offered. PV Oil sold all 206.8 million shares at an average price of 20,196 VND per share. Therefore, loyal shareholders of PV Oil have been in a heavy loss since the IPO until now.

Many “sharks” are interested, but the divestment plan is still uncertain

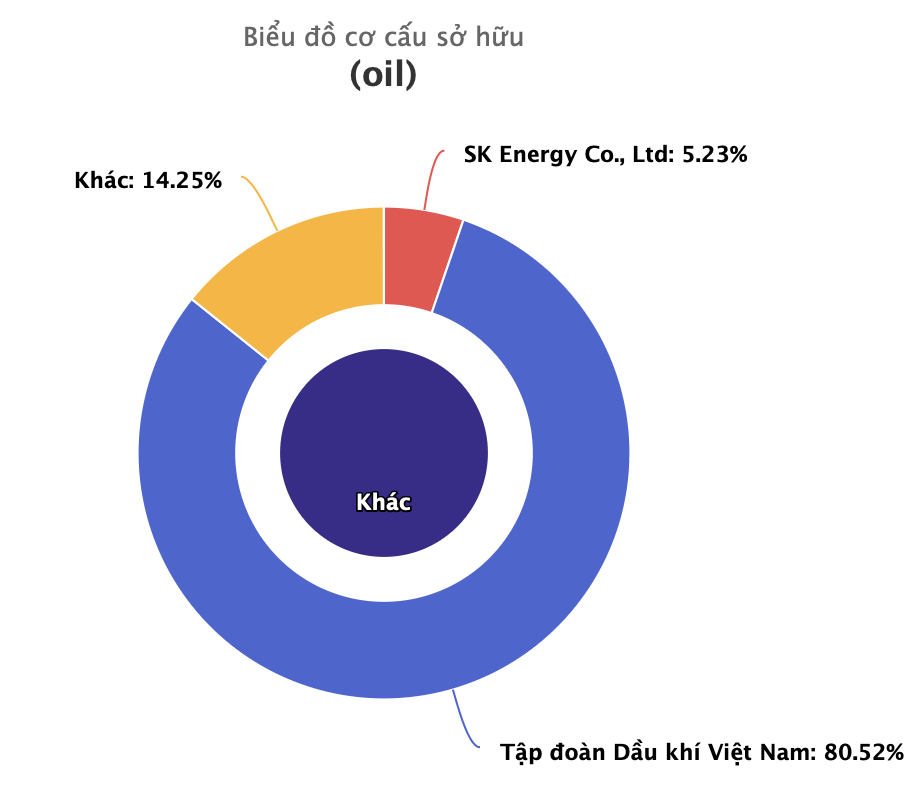

PV Oil was established in June 2008 based on the consolidation of the Petrochemical Trading Company (Petechim) and the Petroleum Processing and Trading Company (PDC). The company has a charter capital of over 10,300 billion VND, with Vietnam Oil and Gas Group (PVN) holding 100%.

According to the approved equitization plan, besides preferential sales to employees with 0.18%, IPO of 20%, PV Oil will sell 44.72% of shares to strategic shareholders. The maximum ownership ratio for foreign investors is 49% of charter capital. At that time, many foreign “giants” such as Shell, Demitsu, Kuwait Petroleum International, Puma, SK… and two domestic investors, Sacom Investment Fund and Sovico Holdings, expressed their interest in investing in PV Oil.

However, there has been no strategic share acquisition deal so far. PVN still holds more than 80% of shares in PV Oil and the plan to divest to 35% as proposed in the equitization plan is still on hold.

Instead, “sharks” are buying shares through the exchange. A typical example is SK Energy Co., Ltd. (South Korea), which officially became a major shareholder of PV Oil since November 2018 after buying 3.55 million OIL shares to raise ownership to 54.1 million shares (5.23%). Until now, this organization is still the only foreign shareholder holding more than 5% of PV Oil’s capital.

Impressive Revenue but meager profit

PV Oil is the only unit responsible for the export and crude oil business for PVN, providing crude oil from the domestic source to the Dung Quat Oil Refinery (managed and operated by Binh Son Refinery and Petrochemical Joint Stock Company (BSR)) with an average output of 7 million tons per year. In addition, the company also processes, manufactures condensate and E5 gasoline.

The supply of petroleum products by PV Oil comes from the Dung Quat and Nghi Son oil refineries accounting for about 70%, while the company’s own blending and production accounts for about 15 – 20%, and the rest is imported from ASEAN countries, China, South Korea, etc., within the quota assigned by the Ministry of Industry and Trade.

In terms of distribution, PV Oil has about 2,200 retail gas stations (including 1,500 agents), ranking second after Petrolimex with 5,500 stations. The market share of PV Oil’s retail petroleum products is also second nationwide with about 18%, just behind Petrolimex. The company plans to increase its market share to 35% through M&A activities and expanding its retail stores.

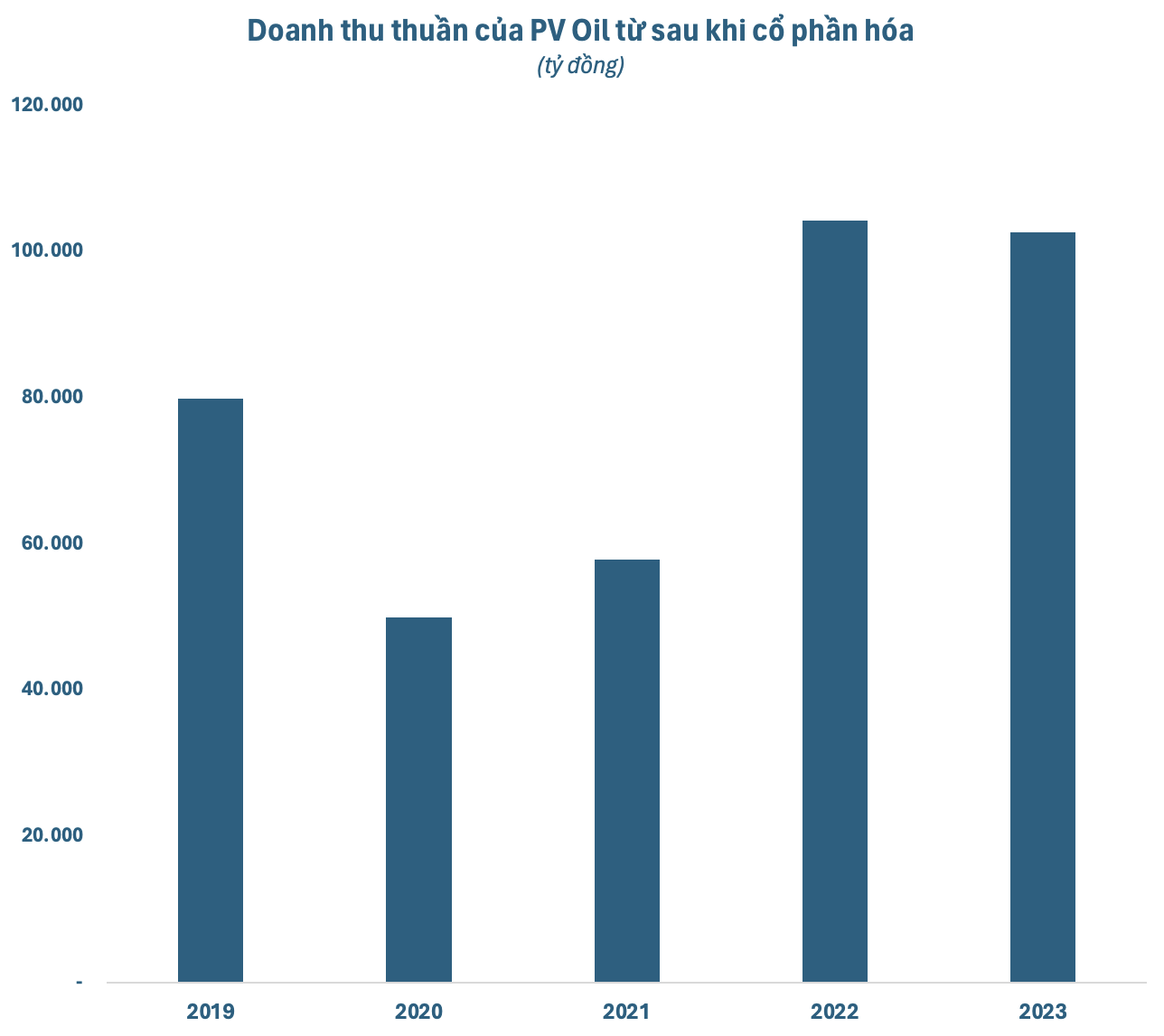

With a nationwide network of retail stores, it’s not surprising that PV Oil’s revenue is remarkable, ranking among the top listed companies. In the past 2 years (2022-2023), PV Oil recorded annual gross revenue of over 100,000 billion VND, equivalent to an average of about 270 billion VND per day.

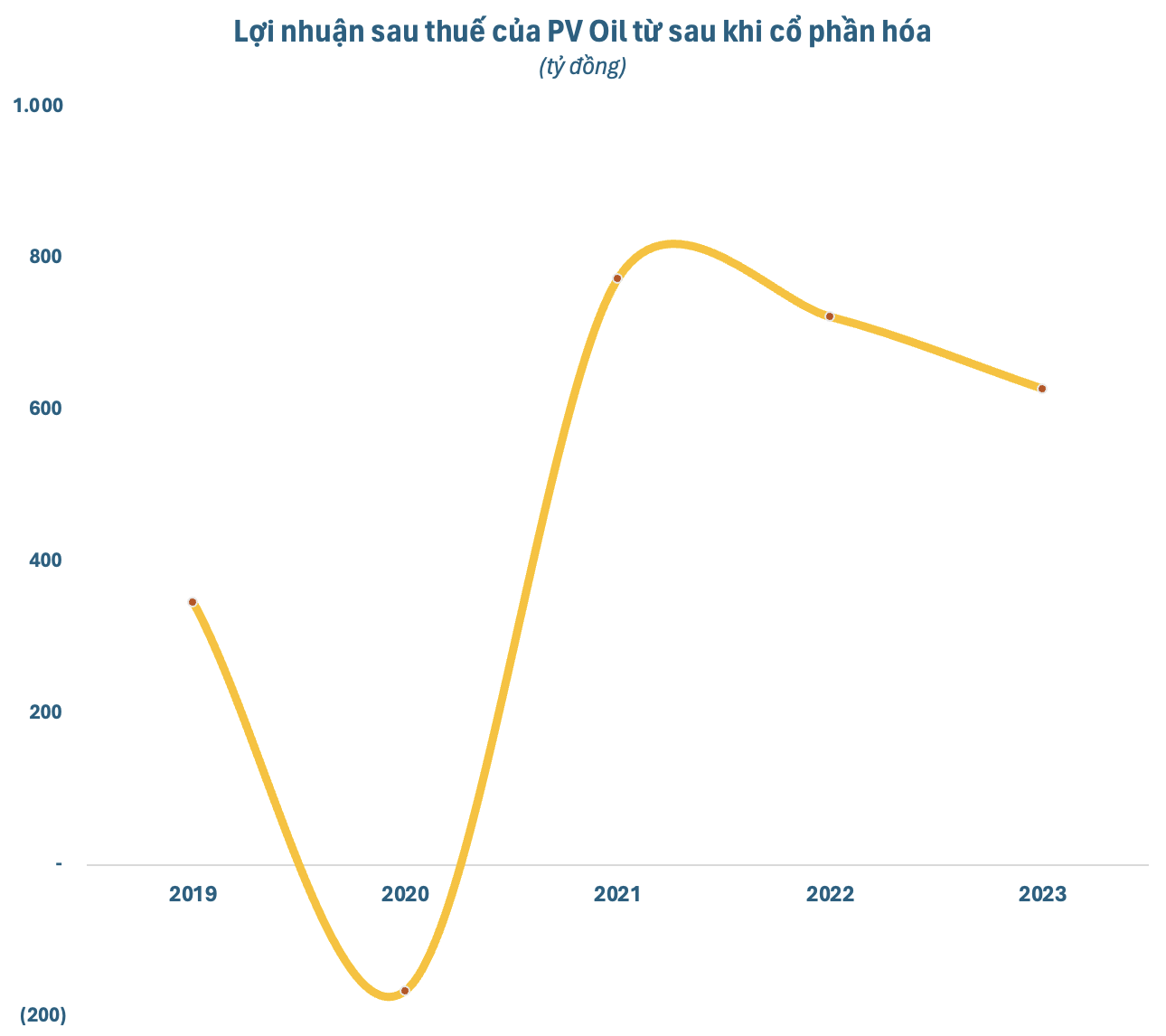

However, PV Oil’s profit margin is quite thin, only a few hundred billion VND per year, and it fluctuates regularly. The net profit margin is persistent below 1%, even with loss-making years. At the end of 2023, PV Oil still has accumulated losses of nearly 882 billion VND, mainly from before the equitization in the middle of 2018. This is one of the barriers that prevented the plan to transfer listing to HoSE (Ho Chi Minh Stock Exchange) of PV Oil from being carried out.

In addition to traditional business areas, PV Oil also has ambitious plans in new fields. For example, in 2022, PV Oil cooperated with VinFast to install nearly 300 electric vehicle charging stations at PV Oil gas stations nationwide. This cooperation is considered the initial step in implementing the strategy to become a diversified energy supplier for transportation, not only for gasoline and oil but also for electricity and hydrogen in the future. Moreover, PV Oil also plans to participate in the JetA1 fuel supply sector.