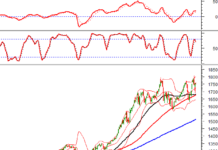

In February 2024, VN-Index continued to increase by about 90 points (+7.6% compared to the previous month) and closed at 1,252.73 points; extending the streak of consecutive monthly gains to four. This development is somewhat in line with the positive context of the global stock market.

Market liquidity in February saw a surge of 38% compared to the previous month – the highest average trading value since September 2023. Bright spots came from the strong participation of individual investors with continuous net buying, totaling 6.5 trillion dong. In contrast, foreign investors continued to be net sellers with over 2.7 trillion dong, of which ETFs continued their withdrawal trend.

Mirae Asset Securities in its updated strategy report still maintains a positive view on Vietnam’s economic growth prospects in 2024 with key drivers from public investment, FDI attraction, and many positive changes from policy side to shape sustainable growth prospects.

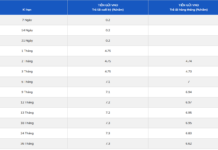

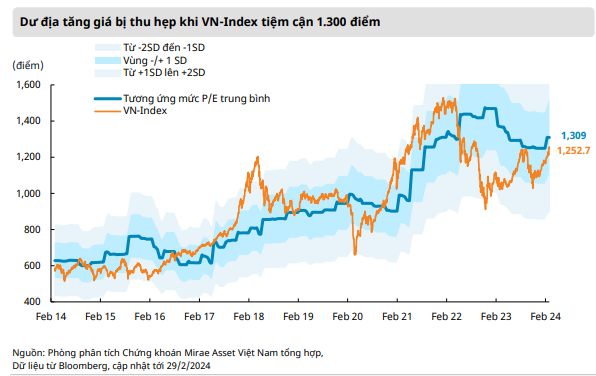

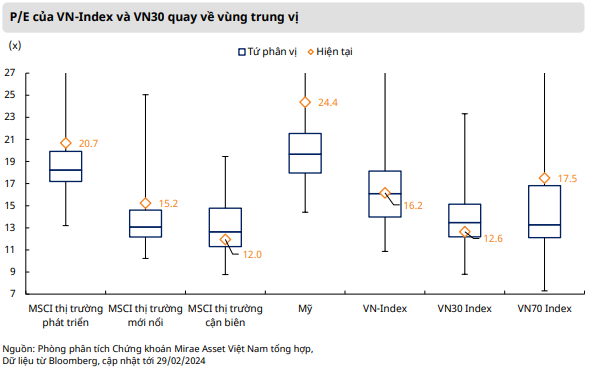

However, Mirae Asset believes that with the current strong upward trend, the room for further growth of VN-Index has been narrowed as it approaches the 10-year average P/E ratio (corresponding to 1,309 points). The point increase also brought the HOSE index back to the median range at 16.2 times compared to 14.9 times in January.

In another development, Mirae Asset notes that VN30’s P/E ratio is still relatively low in history, fluctuating around 12.6 times and lower than the median level of 14 times – although it has increased significantly compared to the P/E of 11.6 at the end of January. This partly explains that the majority of the momentum for the increase in VN-Index and market capitalization growth is attributed to key sectors such as banking, real estate, and materials.

On the other hand, Mirae Asset also notes some risks such as uncertainty about the timing and scale of Fed interest rate cuts in 2024; the impact of high global interest rates on debt refinancing, business operations, and consumption; the prolonged difficulties in the real estate industry of some major countries; low growth risks in Europe; geopolitical risks.