The VN-Index went through a correction with some initial knee-jerk reactions before partially recovering towards the end of the session. At the end of March 6, the VN-Index closed at 1,263 points, down 7 points compared to the previous session. Money flow remained steady with trading liquidity on HOSE reaching over 23 trillion VND.

Regarding the market outlook for the coming sessions, brokerage houses believe that the fluctuations are necessary to release short-term profit-taking pressure as the indicators are in the overbought zone. However, the upward trend of the market can still continue after the correction period.

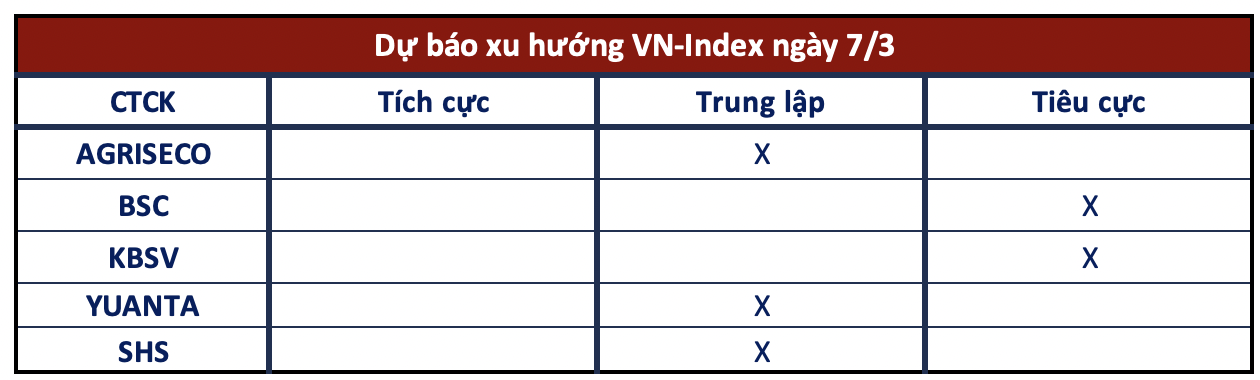

Fluctuations may continue

Agriseco Securities

On the technical chart, the increasing profit-taking pressure caused the VN-Index to sharply reverse after successfully filling the Gap Down zone at 1,275-1,277 points. The support level around 1,250 continues to play a reliable role, helping the index gradually narrow its decline towards the end of the session. Agriseco Research believes that the fluctuations are necessary to release short-term profit-taking pressure as the indicators are in the overbought zone. With the upward trend still maintained, investors are advised to limit buying during bullish movements and only increase short-term trading positions during correction phases around the mentioned support level.

BSC Securities

The market has started to fluctuate as it approaches the 1,280 threshold. In the upcoming sessions, the VN-Index may continue to retest this resistance level, and the fluctuations will likely intensify when the trading volume is within the range of 1,280 – 1,300.

Avoid chasing in hot uptrends

KBSV Securities

Widespread corrective actions are evident in almost all sectors, indicating strong selling pressure and dominance in most trading sessions. The inertia of the correction may continue to affect the index in the near future. However, after a prolonged bullish streak, the current developments are understandable, and the expected upward trend is expected to return soon under the positive movement of the money flow, with the support level being approached around 1,240 (+-5).

Investors are advised to avoid chasing in hot uptrends and only partially lock in profits for positions held when the index or target stocks approach the nearby support levels.

Yuanta Securities

The market may return to its upward trajectory, and the VN-Index may retest the resistance level at 1,268 points. At the same time, the market shows signs of entering a short-term accumulation phase, so the money flow may differentiate among different stock groups. Additionally, there are short-term risks, but Yuanta believes that the market is not in a worrisome stage, and the correction phase generally occurs when the market is at a short-term resistance level and the technical indicators are in the overbought zone.

SHS Securities

Today’s session saw a correction in the market, and correction sessions are still a good signal to further consolidate short-term accumulations. After the correction, the VN-Index may continue to rise towards the strong resistance level of 1,300 points. However, SHS does not highly assess the possibility of a strong uptrend formation for the VN-Index, but instead leans towards the scenario that after the end of the enthusiastic phase, it will adjust back within the range of 1,150 – 1,250 points.