The VN-Index has had a four-month streak of consecutive gains, with cumulative profits of 21.7% since the first increase and the 7th highest level out of 9 strong upward streaks since 2009. The market may face profit-taking pressure from some investors, but positive macroeconomic data is supporting expectations for market returns.

With balanced pulling and pushing factors, VDSC expects the VN-Index to fluctuate within a narrow range of 1,210-1,290 in March.

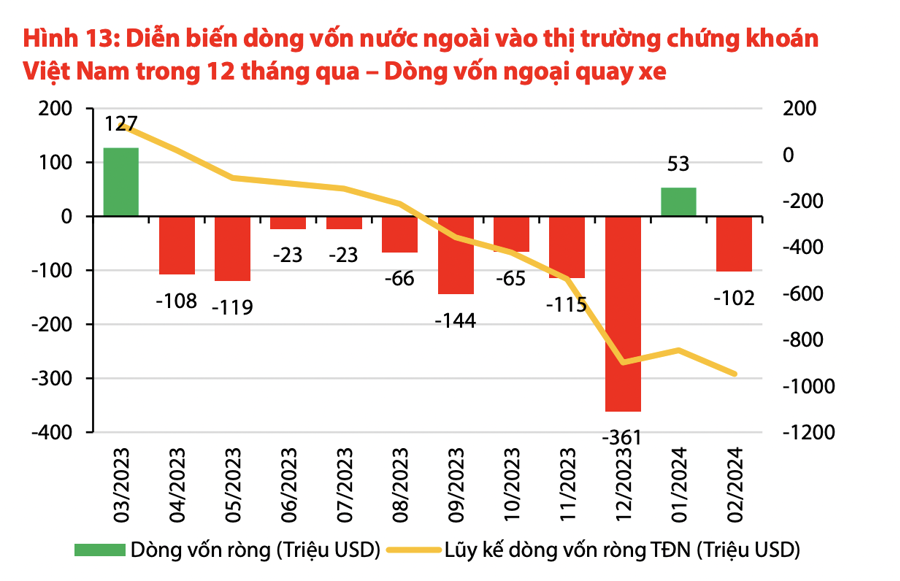

DO NOT EXCLUDE CONTINUED SELLING PRESSURE FROM FOREIGNERS

The policy meeting of central banks worldwide – especially the Bank of Japan (BOJ) – could herald a reversal of monetary policies, exerting pressure on the DXY index and alleviating the devaluation of the local currency.

In March, major central banks will convene to review interest rate policies. The interest rate policies of the Federal Reserve (FED), the Bank of England (BOE), and the European Central Bank (ECB) are believed to have peaked in previous meetings and are likely to be maintained in the next meeting, as policymakers are not yet confident about inflation data, which has not declined as expected.

Meanwhile, the BOJ is likely to end its super-loose monetary policy in its upcoming meeting. Inflation is approaching the 2% target, and most companies’ wage hikes will be announced in mid-March, providing a basis for policy reversal while ensuring stable inflation targets.

The interest rate policies of major central banks have peaked and are expected to enter a downward trend in the latter half of the year. When the BOJ starts to reverse its policy, it will narrow the interest rate differential and push USD/JPY down. With a large weight in the DXY basket, the BOJ’s policy reversal will be the first step in depreciating the US dollar before the Fed’s interest rate cuts take effect, thus alleviating the devaluation of the local currency.

By the end of February, the VN-Index’s trailing 12-month P/E ratio had exceeded 14 times (the VN-Index’s P/E ratio reached 14.5 times on February 29, 2023). Based on past observations, this is the preferred net-selling range for foreigners in the short term, when the Vietnamese stock market lacks major stories. Therefore, it is not excluded that this pressure will continue in the short term.

However, in the medium and long term, the net trading position of foreign investors will turn positive again, and they will accept a higher P/E ratio once major central banks begin their rate-cutting cycle and Vietnam improves the criteria for market upgrades.

According to a Bloomberg report, alongside the strength of the USD, the deep trading relationship between Southeast Asian countries and China is one of the psychological factors influencing capital flows into the Southeast Asian stock market in 2023, amid disappointments about China’s economic downturn for investors.

However, the revenue of listed enterprises in Southeast Asia mainly comes from the domestic market, so the impact of China’s downturn, if any, is not significant. VDSC expects that the Southeast Asian stock market, including Vietnam, with its promising profit outlook and attractive valuations at the current juncture, will be the preferred destination for foreign capital when the high interest rate policy in the long run is replaced by a clearer interest rate reduction path expected to start in the second half of 2024.

EXPECTED TO BE UPGRADED BY FTSE IN SEPTEMBER

FTSE Russell will announce its market ranking rating on March 28, 2024, and there is an expectation of a promotion in the September 2024 assessment. Vietnam was added to FTSE Russell’s watchlist in order to be eligible for secondary emerging market status in September 2018 and has met 7 out of 9 FTSE criteria.

After 5 years of review, Vietnam still cannot meet the remaining criteria mostly related to “Clearing and Settlement”. Specifically, the current legal regulations require the custodian to control investor orders so that investors have sufficient securities in their trading accounts before selling and must have 100% cash before placing buy orders (prefunding mechanism) to limit the risk of payment incapability before the securities are transferred to the investor’s account.

This is not in line with the Delivery versus Payment (DvP) mechanism, where money and securities must be settled simultaneously.

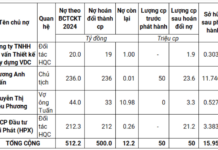

The solution to the above problem is still the implementation of the clearing and settlement mechanism, settling securities transactions based on the CCP (central counterparty) partner model. Currently, the CCP mechanism is being built with the KRX information technology system.

According to the latest updates from Ho Chi Minh City Stock Exchange (HoSE), the pilot transfer of the KRX securities system will take place in March, and the official operation of this system may start from May 2024. Therefore, it is not expected that the clearing and settlement mechanism will be completed to meet the upgrade requirements in the review in March. Instead, VDSC believes that the September review will be more feasible.