The outflows of ETF in February 2024 mainly came from the redemptions of DCVFM VN30 ETF (with net redemptions of nearly 347 billion VND), Xtrackers FTSE Vietnam ETF (with net redemptions of over 309 billion VND), and DCVFMVN Diamond ETF (with net redemptions of over 277 billion VND).

On the other hand, Fubon FTSE Vietnam ETF and VanEck Vectors Vietnam ETF saw inflows of 203.8 billion VND and 31.8 billion VND, respectively.

EVF and OCB have been added to the index baskets of FTSE Russell. On March 1, 2024, FTSE Russell announced the results of the quarterly review of indices, including the FTSE Vietnam Index and FTSE Vietnam All-Share Index.

According to the announcement, EVF shares will be added to the FTSE Vietnam Index, while EVF and OCB shares will be added to the FTSE Vietnam All-Share Index. No stocks will be removed from these two indices. The new indices will take effect from March 18, 2024. Therefore, the deadline for ETF funds to replicate these indices and complete the portfolio rebalancing is March 15, 2024.

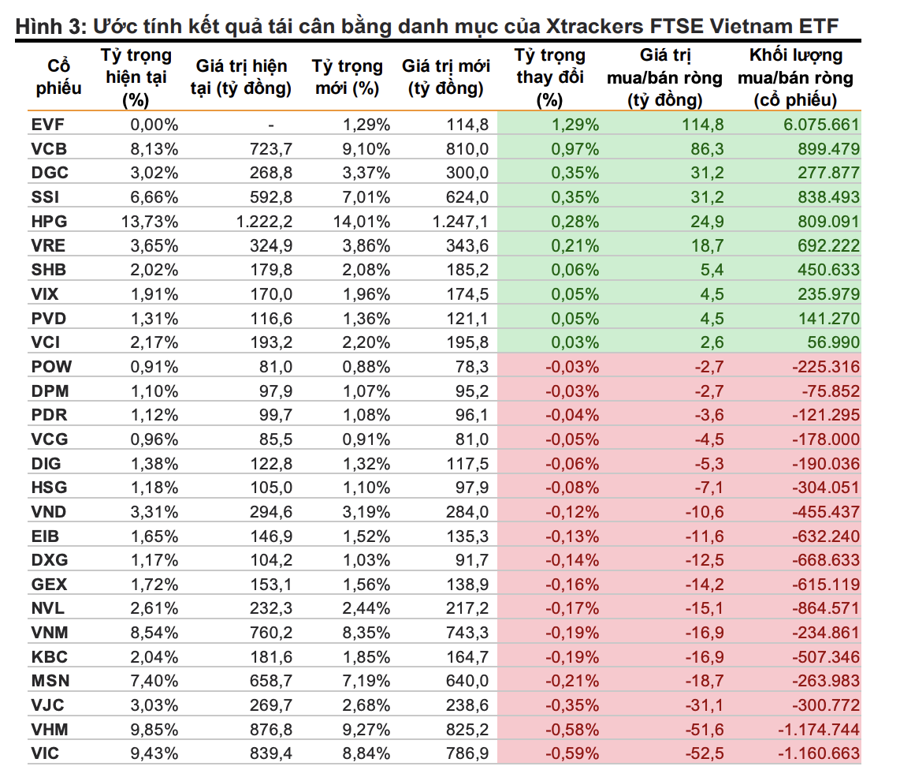

Xtrackers FTSE Vietnam ETF currently has total assets under management of over 8,900 billion VND, which tracks the performance of the FTSE Vietnam Index. Based on the review results by FTSE Russell, VNdirect estimates that in the Q1/24 rebalancing period, the stocks that Xtrackers FTSE Vietnam ETF will buy the most include EVF and VCB, with corresponding volumes of 6.07 million shares (~114.8 billion VND) and nearly 0.9 million shares (~86.3 billion VND).

Meanwhile, VIC and VHM may be the stocks that this ETF will sell the most, with volumes of 1.16 million shares (~52.5 billion VND) and 1.17 million shares (~51.6 billion VND), respectively.

For foreign investors, they have turned into net sellers just one month after being net buyers.

The net selling value of foreign investors in February 2024 was over 1,446 billion VND, and the cumulative net selling value in the first two months of the year was nearly 273 billion VND. In February 2024, foreign investors net sold over 2,768 billion VND on HOSE and over 363 billion VND on HNX, while net buying over 1,686 billion VND on Upcom.

The stocks that foreign investors net bought the most in February 2024 were BHI, MSB, DGC, HPG, and SSI. On the other hand, the stocks that foreign investors net sold the most were MWG, VNM, VPB, GEX, and MSN.

As of the end of February, the trailing P/E ratio of VN-Index has exceeded 14 times (VN Index P/E ratio reached 14.5 times on February 29, 2023). Regarding foreign capital flows, according to VDSC, based on past observations, this is the preferred net selling zone for foreign investors in the short term when the Vietnamese stock market lacks big stories. Therefore, this pressure may continue in the short term.

However, in the medium and long term, the net trading status of foreign investors will reverse positively and accept a higher P/E ratio once major commercial banks begin the interest rate cutting roadmap and Vietnam improves criteria to be upgraded to a higher market status.

“Southeast Asian stock markets, including Vietnam, with attractive profit prospects and pricing at the current time, will be the preferred destination for foreign capital when the high interest rate policy in the longer term is replaced by a clearer interest rate reduction roadmap, which is expected to start in the second half of 2024,” VDSC expects.