A large sell-off this morning has pushed liquidity to very high levels and if the afternoon session goes smoothly, today will surely be a record-breaking session. Assuming today’s afternoon trading is equivalent to yesterday’s afternoon, the total traded volume of both exchanges will exceed VND 30 trillion for the whole day. Due to many stuck buy and sell orders, the market will have to wait for 1-2 sessions to have a clear grasp.

If we only look at the morning session, it is clear that there has been a “selloff” phase. The price was pushed up at the beginning of the session, then selling pressure increased sharply, causing a series of stock drops. The afternoon will see a large amount of stocks entering accounts (total trading volume of both exchanges is VND 30.8 trillion on the first trading day of the week, with matched orders of VND 28 trillion). If the system operates normally, this afternoon will also be a highly matched session.

In sessions with system disruptions, looking at supply and demand or technical analysis is not reliable. In terms of normal logic and psychology, the morning session experienced selling pressure, and the afternoon will see more stocks entering the market, increasing pressure. This is a great opportunity to see how the money flows, if the support is good, there will be further growth opportunities. On the contrary, if there continues to be a large sell-off and prices drop significantly, it will be a very bad signal. However, if buy and sell orders cannot be executed, there is no way to verify. Even the slow system acts as a “soft circuit breaker” to soothe sentiment, and many stocks are pulled up by small demand afterwards.

VNI today has new pillars: SAB and GAS. MSN was sold off in the morning session, although the pressure was not enough to break the reference price, and in the afternoon it was pulled up. The impact of these pillars is not significant. Meanwhile, most other hot stocks started to be heavily sold off, and market breadth is more important than the index because if you want to sell, a rising index is a good condition to maintain strong sentiment. However, if specific stock prices start to fall or cannot increase with high liquidity, it means there are stocks being sold off. The more stocks decrease and the pattern changes from rising to falling, the more consistent the viewpoint is.

In the next few sessions, the market is likely to have very large trading volumes and should prepare for a downside scenario. When liquidity is too high, caution is always needed, as it could be the last FOMO capital coming in, especially after a series of sessions with high liquidity. At this time, new purchases should be avoided, and profit taking should be considered, especially for stocks entering strong resistance zones.

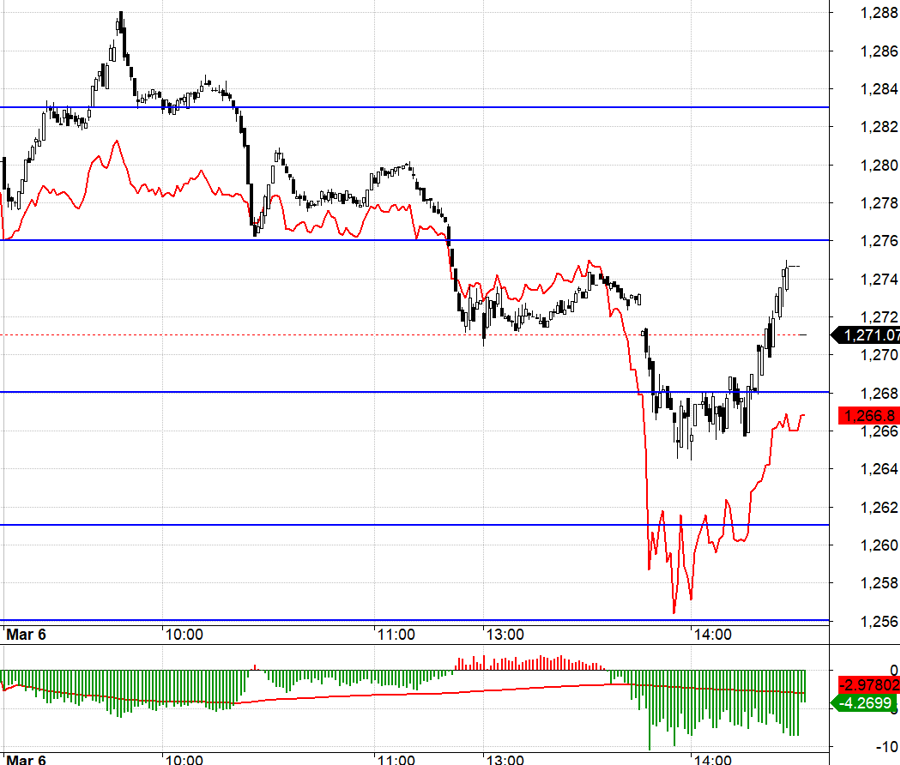

In the derivatives market today, the discount level remained quite wide during the early rise of VN30. When the pillars of this index such as MSN start to weaken without other stocks replacing them, it will be very difficult for the index to climb. Therefore, the probability of a decline after a growth phase is higher. Liquidity increased sharply early on, along with narrowing breadth, confirming the signal. The downside potential is even greater in the afternoon, but the system was disrupted. Although there were stuck order signals from around 1:30 pm, F1 quickly plummeted before that, and by around 2 pm, it maintained the widest basis. In general, when the system is unstable, trading should be avoided, especially when large basis signals like this occur.

There is not much information about supply and demand in this afternoon session, but the slow system will stabilize sentiment. Tomorrow’s market may rebound a bit before new stocks come in and appear. The strategy should be flexible Long/Short, depending on the situation.

VN30 closed today at 1271.07. The nearest resistance levels for tomorrow are 1277, 1284, 1291, and 1295. Support levels are 1266, 1261, 1255, 1250, 1242, 1237, and 1230.

“Stock blog” is a personal opinion and does not represent the views of VnEconomy. The views and evaluations are those of individual investors and VnEconomy respects the views and writing style of the author. VnEconomy and the author are not responsible for any issues related to the published evaluations and investment opinions.