Stable oil prices

Oil prices are relatively stable as markets weigh new economic data from China against increasing supply from the Western Hemisphere.

As of the close on March 7th, Brent crude remained stable at $82.96 per barrel, while WTI dropped $0.2 to $78.93 per barrel.

China’s higher export growth suggests that global trade is shifting positively as policymakers strive to boost economic recovery.

Despite a 5.1% increase in China’s crude oil imports in the first few months of this year compared to the previous year, total imports are decreasing, continuing the declining trend of the largest importing country in the world.

The global oil market is well supplied as demand growth slows and supply increases from the Americas. Crude oil inventories in the US increased last week, marking the sixth consecutive weekly increase.

Fuel consumption in India, the world’s third-largest oil importer and consumer, increased by 5.7% in February compared to the same month last year, supported by strong factory activity.

Gold hits new record

Gold prices reached their highest level ever as bets on loose US monetary policy and safe-haven demand increased due to central bank buying and the recovery of the global economy.

Spot gold rose by 0.4% to $2,156.93 per ounce, hitting a record high of $2,164.09 earlier. COMEX gold for April delivery closed up 0.2% at $2,165.2 per ounce.

Chairman Powell says the Fed is not far from gaining confidence that inflation is heading towards the Fed’s 2% target, which would allow them to begin cutting interest rates. Traders are now pricing in a 74% likelihood of a rate cut by the Fed in June, compared to 63% on February 29th.

While an increase in global spot prices is expected to dampen consumption during the wedding season in India, the world’s leading buyer China has seen a surge in safe-haven demand.

Copper and zinc reach 5-week highs

Copper prices hit their highest level in 5 weeks due to better-than-expected Chinese trade data, while zinc rallied as cuts in production at a large Korean smelter boosted prices.

Three-month copper on the London Metal Exchange rose by 0.8% to $8,641 per tonne, the highest level since January 31st. COMEX copper increased by 1.2% to $3.92 per pound.

China’s export and import growth in the first two months of this year exceeded expectations, according to customs data.

The price of zinc on the LME also reached a 5-week high due to a 20% reduction in output at Young Poong’s Seokpo smelter plant in South Korea. Increased buying from China, along with ongoing supply shortages, has also contributed to the increase in zinc prices.

Iron ore increases on new hopes for Chinese stimulus

Iron ore prices rose on comments from Chinese officials that rekindled hopes for more economic stimulus, despite weak underlying fundamentals.

The May iron ore contract on China’s Dalian Commodity Exchange closed up 1.83% at 890 CNY ($123.64) per tonne.

Import data showed that China’s iron ore imports increased by 8.1% to 209.45 million tonnes in the first two months of 2024, a record high for the January-February period.

In Shanghai, rebar prices were relatively stable, while hot-rolled coil increased by 0.23%, steel wire rod increased by 0.25%, and stainless steel increased by 0.22%.

Natural rubber rises for the 3rd consecutive day

Rubber prices in Japan rose for the third consecutive session as some domestic labor unions achieved significant wage gains, despite the yen’s limiting gains.

The rubber contract for August delivery on the Osaka Exchange closed up 0.1 JPY or 0.03% at 300 JPY ($2.02) per kg.

In Thailand, rubber prices for May delivery increased to 620-622 USD per tonne from 615 USD per tonne the previous week, with expectations of stable demand as the new crop arrives next week.

In Vietnam, 5% broken rice was offered at around 580 USD per tonne, down from 600 USD per tonne a week ago but up from 575 USD earlier this week.

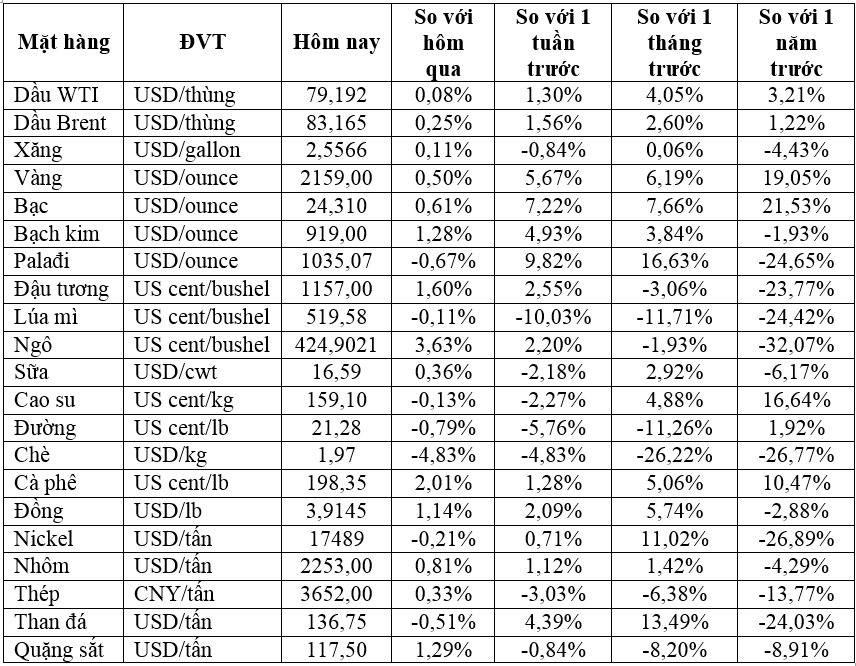

Key commodity prices as of March 8th