Analysts from IntoTheBlock note that increasing network activity is benefiting ETH investors.

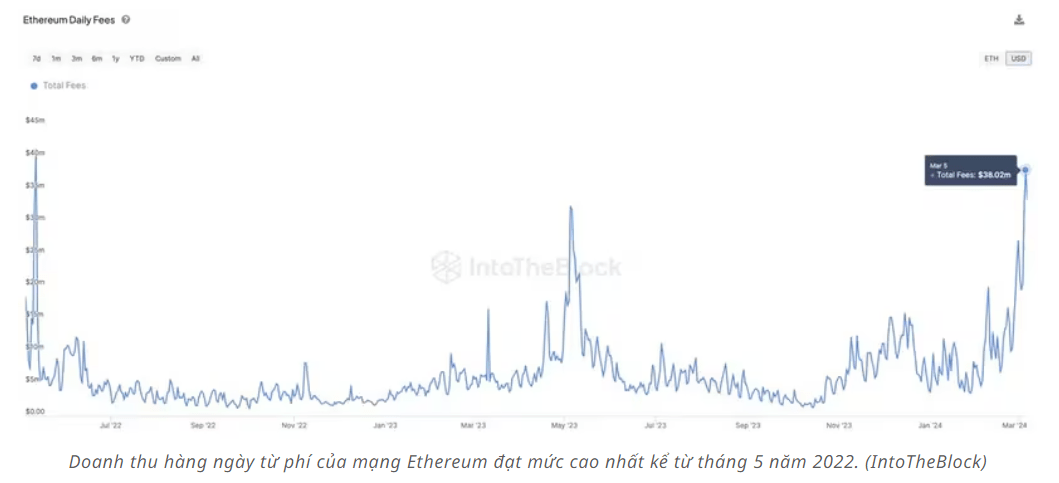

Ethereum network revenue reached a two-year high this week as the meme coin frenzy fueled blockchain activity.

IntoTheBlock data shows that Ethereum network fees revenue hit $193 million this week, the highest figure since May 2022 and a 78% increase from the previous week.

IntoTheBlock analysts report that activity on the main chain is being driven by increasing speculative activity with meme tokens.

Ethereum-based meme tokens like pepe(PEPE), shiba inu(SHIB), and floki(FLOKI) have more than doubled in price over the past week.

Meanwhile, trading volume on decentralized exchanges (DEXs) built on Ethereum has risen 40% to $20 billion this week, according to DefiLlama data.

According to Ultrasound.money data, ETH supply decreased by around 33,400 ETH (approximately $130 million at current prices) and inflation decreased by 1.45% annually in the past week.

On the other hand, the high activity has made the blockchain very expensive for users. IntoTheBlock notes that the average transaction cost (gas fee) on Ethereum has risen to $28 this week, making it “unusable” for many users.