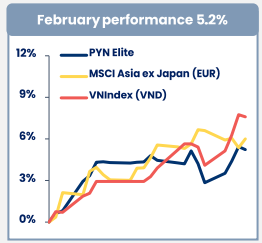

Maintains consistent growth rate in the first 2 months of the year

|

PYN Elite’s performance compared to the VN-Index

Source: PYN Elite Fund

|

VN-Index ended the second trading month of 2024 with positive results, rising nearly 8% compared to the end of January, reaching 1,252.73 points (end of session on 29/02/2024). Banking stocks continued to lead the market with a higher increase than the VN-Index.

|

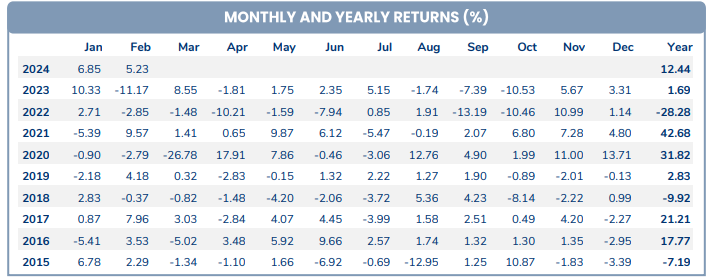

PYN Elite’s investment performance from 2014 to 2023

Source: PYN Elite Fund

|

Despite more than half of the largest investments pouring into “bank” sector, PYN Elite Fund recorded a 5.2% investment performance increase in February 2024, lower than the increase of the VN-Index.

Explaining the reasons, the investment fund stated that despite the strong growth of VN-Index thanks to the boost from “bank” stocks, the stagnation of STB stocks combined with a 1% depreciation of VND against USD led to lower investment performance compared to the increase of the VN-Index.

However, overall in the first two months of this year, PYN Elite’s investment performance has increased by 12.44%, slightly higher than the 10.9% increase of the VN-Index.

Many positive factors support the stock market in 2024

According to PYN Elite Fund, at the end of February, Prime Minister Pham Minh Chinh chaired a conference to implement the tasks of developing the stock market in 2024.

At this event, the Prime Minister emphasized the determination to upgrade the Vietnamese stock market from the frontier to the emerging market in 2025 and set deadlines for important milestones such as the new KRX trading system and the solution to pre-funding issues.

In addition, in a letter to investors on February 26, Mr. Petri Deryng, Director of PYN Elite Fund, expressed his expectation that the Vietnamese stock market will bring positive returns to investors in 2024.

“Based on the developments of VN-Index, it can be seen that domestic investors are ready to participate in the market,” he said.

The head of PYN Elite also assessed that Vietnam’s currency market has normalized with stable liquidity in the banking system and interest rates brought down to attractive levels. “We believe that listed companies will achieve a profit growth of over 20% in 2024,” Mr. Petri expressed.

Furthermore, Mr. Petri also mentioned that the banking sector is currently the largest sector on the stock market, and therefore, this sector is expected to bring significant profit growth. Stocks, especially banking stocks, are still priced low compared to previous years.

Accordingly, he believes in the growth potential of large banking stocks as the economy continues to recover with a loose monetary policy providing favorable conditions.

Consumer spending will see stronger growth in the second half of the year

In terms of macroeconomics, PYN Elite Fund said that in the first 2 months of 2024, exports increased by 19.2% compared to the same period last year in many sectors. Manufacturing industry increased by 5.9% compared to the same period, but still lagged behind exports. With increased orders and reduced inventory, factory production is expected to be strengthened.

Public investment increased sharply by 21.8% compared to the same period, FDI disbursement increased by 9.8% to reach 2.8 billion USD. FDI registration increased by 38.6% to reach 4.3 billion USD.

PMI increased to 50.4 in February from 50.3 in January, due to higher output as orders increased. Retail sales growth slightly increased to 8.5% in February, from 8.1% in January.

Therefore, experts from PYN Elite predict that consumer spending will see stronger growth in the second half of 2024, thanks to an improved labor market along with the recovery of the export sector.