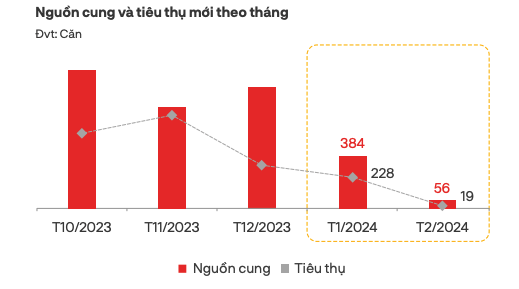

According to the market report on the real estate market in Ho Chi Minh City and surrounding areas in the first two months of 2024, in the apartment segment, the new supply reached 440 units, only 66% compared to the same period, mainly concentrated before Lunar New Year, mainly distributed in Ho Chi Minh City, Binh Duong and Ba Ria – Vung Tau. The consumption of new supply decreased by 53% compared to the same period, partly affected by the extended Lunar New Year holiday. In which, the mid-end apartment segment accounted for 76% of the supply and 93% of the new consumption in the whole market, mainly concentrated in the western region of Ho Chi Minh City.

Policies such as quick payment discounts, extended payment terms, launching gifts, … are still widely applied by developers to stimulate the market. The primary selling price level has not fluctuated much, locally recording a 3% – 6% increase in some projects in Ho Chi Minh City with complete legal status, construction progress, and quick handover.

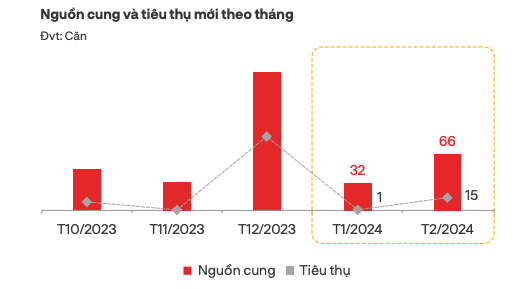

In terms of the townhouse/villa segment, it was recorded that in 2Q/2024, the new supply reached 98 units, still at a scarce level and slightly decreased by 27% compared to the same period. However, the new consumption rate remained low, reaching only 16% of the supply put on the market. Accordingly, Ho Chi Minh City is the leading locality in terms of market share with 52% of the supply and 94% of the new consumption.

“The areas of Long An, Ba Ria – Vung Tau, Tây Ninh recorded a scarcity of newly launched projects in the first two months of 2024. Despite the pressure of rising input costs, the primary price level has not fluctuated much compared to the previous launch.”

“With that are policies such as discounts, banking support, extended payment schedule, … applied by developers to stimulate the market. The secondary price level tends to be flat compared to the end of 2023, with average liquidity, transactions mainly occurring in projects with guaranteed construction progress, reasonable price levels, clear legal status, and developed by reputable developers in the market.”

“It is expected that in the coming months, the new supply of townhouses/villas will slightly increase compared to the same period in 2023, but there are unlikely to be any significant changes in the short term. The new launch projects will mainly focus on Ho Chi Minh City, Long An, Dong Nai, and Binh Duong.”

“In the land segment, this area has a new project and 3 projects in the next phase launched in the area. This provides 138 plots to the market, a 14% decrease compared to the same period last year.”

“Meanwhile, new consumption recorded 7 plots, a 25% decrease. Transactions focus on the product group with an average price of about 21.5 million VND/sqm.”

“In terms of regions, Long An is the leading locality in terms of market share and new consumption volume in the region, with the rates reaching 60% and 58% respectively. Binh Duong and Dong Nai account for 25% and 15% of the supply, respectively. Tây Ninh, Ba Ria – Vung Tau, and Ho Chi Minh City did not record any new supply.”

“New land prices in Long An range from 17.2 – 54.9 million VND/sqm; in Binh Duong, it is about 14.5 – 16 million VND/sqm; in Dong Nai, it is about 12.3 – 13.7 million VND/sqm.”

“In general, the primary price level has not fluctuated much compared to the previous launch. Incentive policies, extended payment terms, profit commitments, … continue to be applied by developers to stimulate demand.”

“The secondary market tends to remain stable compared to the end of 2023. The market liquidity is average, with completed infrastructure projects, legal paperwork … attracting the attention of investors.”

“With DKRA, it is expected that the new supply in the coming months will be promising, with a majority of products focusing on the bordering areas of Ho Chi Minh City.”