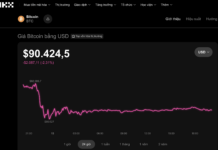

Last week, the price of bitcoin continuously set new records, reaching a peak of over $70,000 on Friday. Some investors and experts believe that the law of supply and demand is a key factor behind the explosive growth of the world’s largest cryptocurrency.

Similar to the price of basic commodities like gold, oil, or soybeans, the price of bitcoin is highly sensitive to changes in demand. In the case of bitcoin, demand has surged after the US authorities allowed the establishment of bitcoin exchange-traded funds (ETFs) earlier this year, following a long delay. These funds directly purchase and hold bitcoin on behalf of investors who want to invest in bitcoin but do not want to directly trade the asset. The flow of funds from such investors has prompted ETFs to buy bitcoin to meet the demand, driving up the price.

LIMITED SUPPLY, INCREASING DEMAND

However, bitcoin differs from basic commodities in that its supply is limited, and this is a force that can lead to sudden price increases.

The computer code that underpins bitcoin imposes an unchangeable limit of 21 million bitcoins. Over 90% of this limit has already been created. To create more bitcoins within this limit, computers that mine bitcoins run algorithms and are rewarded with new bitcoins. However, the process of mining can only create around 900 new bitcoins per day at the moment, and this rate will decrease next month after a regular event called “halving”. The ultimate supply of bitcoin will stop increasing when the last bitcoin is mined, expected around 2140.

“Bitcoin is one of the scarcest assets in the world and is becoming scarcer every day,” said Alex Thorn, head of research at cryptocurrency firm Galaxy Digital, in an interview with the Wall Street Journal.

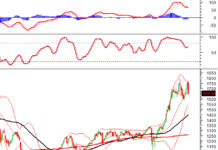

No one can be sure if bitcoin will continue to rise. The current high price may encourage investors to sell bitcoin to take profit. Previous bitcoin bull markets have been followed by severe downturns. For example, after reaching a record high in November 2021, the price of bitcoin fell more than 70% in 2022. In addition, skeptics of cryptocurrencies still see bitcoin as a speculative asset with no intrinsic value.

According to data from Coinmarketcap.com, the price of bitcoin was trading at nearly $67,900 as of 9am this morning (March 11), Vietnam time. Although it has dropped from the record high of over $70,000 set on Friday, the price of bitcoin has still risen nearly 60% since the beginning of this year.

Economically speaking, the supply of bitcoin does not have fundamental elasticity, meaning that the supply of this cryptocurrency does not respond flexibly to price fluctuations. Commodities with this characteristic tend to have higher price volatility than other commodities.

Natural gas producers cannot pump more gas in the short term to take advantage of higher prices. However, in the long run, high gas prices will encourage miners to seek out new gas fields. Similarly, when gold prices rise over a long period of time, gold miners will prospect for new gold mines.

But bitcoin is different.

The rules built into the bitcoin code specify the rate at which miners can bring new bitcoins to the market, and this rate decreases by half each time there is a “halving” – an event that occurs every 4 years. Previously, bitcoin prices rose before such “halvings” because investors believed that the supply of bitcoin would become tighter. The idea of having a fixed maximum supply of bitcoin was proposed by Satoshi Nakamoto, the anonymous creator of bitcoin, who wrote that this design would help bitcoin become an asset unaffected by inflation.

“Fundamentally, bringing additional supply to the bitcoin market is impossible,” said Steven Lubka, head of private-client service at cryptocurrency investment firm Swan Bitcoin.

A HUGE AMOUNT OF BITCOIN IS “STATIC”

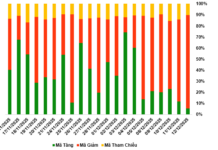

Because of this, bitcoin is highly sensitive to increasing demand. The newly established bitcoin ETFs in the US have been aggressively accumulating bitcoin since their launch in January. On January 11, the first 9 bitcoin ETFs began trading, in addition to the Grayscale Bitcoin Trust, which had already existed and was converted into an ETF. Since then, nearly $8 billion has flowed into these ETFs.

As of last Tuesday, 5% of the total global supply of bitcoins was held by ETFs and other investment funds, up from 4.4% before the establishment of US bitcoin ETFs, according to estimates from cryptocurrency research firm ByteTree.

When ETFs buy bitcoin to meet investor demand, they often rely on proprietary trading firms like Cumberland – a member of Chicago-based trading giant DRW Holdings – or Jane Street Capital, based in New York. These cryptocurrency trading desks operated by these firms scour digital asset markets to find large amounts of bitcoin to fulfill the orders from the ETFs.

Some analysts believe that it has become increasingly difficult to buy bitcoin from large holders. Public blockchain data shows that most of the supply of around 19.6 million bitcoins worldwide is held in virtually static wallets – either because these digital assets are owned by long-term holders who have no intention to sell, or perhaps because the owners have lost their passwords and cannot access their wallets.

In a report published last week, analyst Manuel Villegas of Swiss private bank Julius Baer said about 80% of the global supply of bitcoin has not been transferred in the past 6 months. With the influx of ETF flows and data showing limited available bitcoin for sale on exchanges, this “might be a precursor to even tighter supply,” Billegas emphasized.

However, some experts say that many bitcoin holders who are willing to sell have already sold during the recent price surge, and this is the reason why the price of bitcoin is showing signs of leveling off.

Rob Strebel, a manager at DRW, said Cumberland has not had difficulty finding bitcoin to meet the demands of ETFs in recent weeks. He revealed that the company acquired much of that bitcoin from larger investors who bought bitcoin at lower prices and took advantage of the current high prices to cash out.

“When the price of an asset rises parabolically, as we are seeing with bitcoin, it is natural to take profit. Especially when investors remember the bitcoin price spike in 2021 and what happened afterwards, they see it as a time to sell some of their bitcoin,” Strebel said.