The Ho Chi Minh Stock Exchange (HOSE) announced the last registration date for the Annual General Meeting in 2024 and the interim dividend payment for the third quarter of 2023 in cash of Vinamilk Joint Stock Company (code VNM-HOSE).

Specifically, on March 18, VNM will close the list of shareholders attending the Annual General Meeting (AGM) in 2024 and the third interim dividend payment in 2023.

Accordingly, the company plans to hold the General Meeting on April 25, using online meeting format like previous years. The specific meeting content will be updated and sent to shareholders according to legal regulations.

Regarding dividends, Vinamilk will advance the third quarter dividend for shareholders with a rate of 9% (1 share will receive VND 900). The payment date for dividends is expected to be April 26. Therefore, with nearly 2.09 billion outstanding shares, Vinamilk will have to spend about VND 1,881 billion to pay dividends this time.

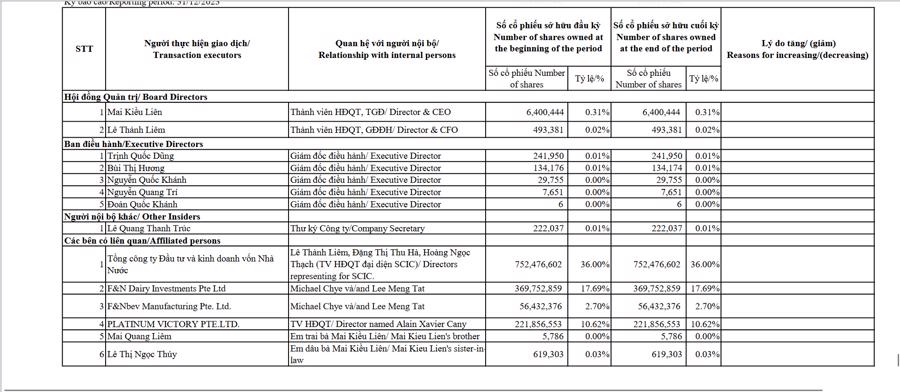

According to the 2023 management report, the State Capital Investment Corporation (SCIC) is the largest shareholder with 36% of capital, receiving VND 677 billion. F&N Group of Thai billionaire Charoen Sirivadhanabhakdi holds 20.39%, receiving VND 384 billion, and Platinum Victory Pte. Ptd owns 10.62% of capital, receiving nearly VND 200 billion.

Prior to this, Vinamilk has carried out 2 interim dividends in 2023, including the first dividend with a rate of 15% paid in early October 2023 and the second dividend with a rate of 5% just paid on February 28, 2024. Including the upcoming dividend, the total dividend rate that the company will distribute is 29%, equivalent to a total amount of over VND 6,000 billion.

Recently, in a meeting with investors, VNM stated its priority to focus on revenue growth and market share increase in 2024. Specifically, VNM expects its revenue in 2024 to increase by 5% compared to the same period, in line with expectations from VCSC.

Regarding the gross profit margin: As of the present time, VNM has finalized the raw milk prices for production until mid-2024. Thanks to the favorable raw milk prices, the management board expects the gross profit margin to improve by around 100 basis points compared to the same period, reaching 42% in 2024. However, this target is lower than VCSC’s expectations that the gross profit margin will recover by 180 basis points compared to the same period.

Regarding selling and administrative expenses (SG&A) to revenue ratio: VNM expects this ratio to increase to about 25% in 2024 (from 24% in 2023) to create conditions for revenue growth and market share increase – which are the focus of VNM this year.

Capital allocation in 2024: The planned investment capital is expected to be around VND 2-3 trillion for (1) a new dairy farm of Moc Chau Milk in the North and (2) a dairy farm in Tay Ninh in the South.

Growth in 2023 by industry: While Vietnam’s modern trade grew 5% compared to the same period, the traditional distribution channel (the main channel of VNM) decreased by 3% compared to the same period. In terms of industry, condensed milk had the strongest growth (single-digit growth compared to the same period in 2023), while infant formula milk had the largest decrease (more than 10% decrease compared to the same period in 2023).

The brand repositioning campaign achieved initial results with the market share of the water milk category increasing by 2.8 percentage points from July to December 2023. Compared to the same period, VNM maintained a market share of water milk at about 56% at the end of 2023.

Infant formula milk segment: In 2024, VNM sets a target to regain 1% market share in this segment. The company will hire a third-party consultant to (1) improve the marketing activities of the infant formula milk segment, and (2) restructure distribution channels to have more access to hospitals and modern retail channels. VNM plans to have a new packaging for infant formula milk in the first half of 2024.

Chinese export market: VNM has just re-entered the market in the second quarter of 2023 with new partners (specifically Changsha Yiyiyuan Dairy Company and Nam Quangzhou Fruit and Vegetable Market Management Co., Ltd). The management board focuses only on 2-3 SKU of condensed milk and yogurt in the Chinese market. The management board holds a cautious view of the potential contribution from exports from China at the present time.

Therefore, VCSC’s view is that VCSC sees positive signals when VNM invests in advertising and promotion costs to regain market share in (1) the water milk category and (2) the infant formula milk segment.

However, the management board is still cautious about broad-based consumption levels as well as the extent of gross profit margin recovery in 2024. After the meeting, VCSC sees a reduced adjustment risk for VCSC’s 2024 forecast, although more detailed evaluation is needed. Accordingly, VCSC currently has an “optimistic” recommendation for VNM with a target price of VND 76,100 per share.

At the end of the session on March 8, VNM’s stock price decreased by 2.78% to VND 70,000 per share, up nearly 4% in the past month. Vinamilk’s market capitalization reached approximately VND 146,300 billion, ranking 10th on the list of the most valuable enterprises on the stock exchange.