The issuance of bonds is a normal and fundamental operation of the Central Bank. In Vietnam, according to BSC’s statistics, the State Bank has regularly carried out this operation multiple times a year during the period 2018-2023.

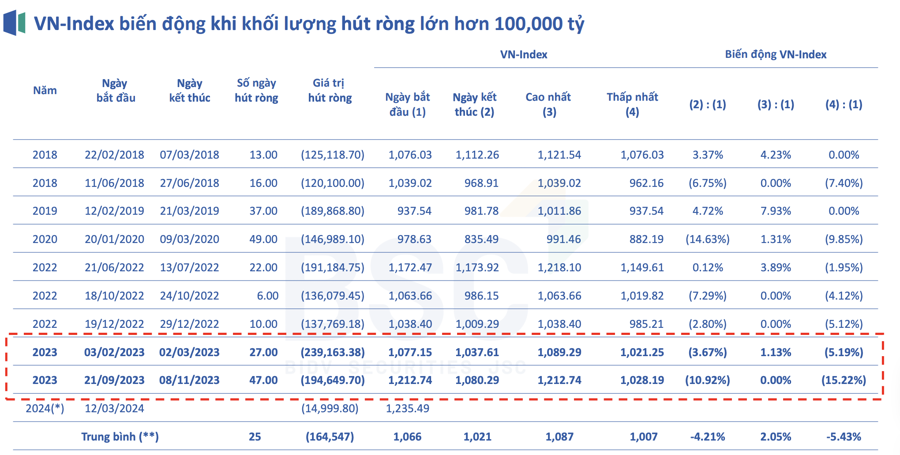

Specifically, the State Bank conducts net withdrawals on average about 9.4 times a year, with an average number of days per withdrawal of about 13.4 days. The average net withdrawal value per cycle is VND 47,647 billion. The largest net withdrawal value per cycle is VND 239,163 billion in the period from September 21 to November 8, 2023.

The statistics also show that when the net withdrawal volume is less than VND 100,000 billion, there is a higher probability of VN-Index increase. When the net withdrawal value is below VND 50,000 billion and below VND 100,000 billion, the probability of VN-Index decrease during the withdrawal cycle is 33.3%.

On the contrary, when the net withdrawal volume reaches VND 100,000 billion or more, there is a higher probability of VN-Index decrease. When the net withdrawal value is above VND 100,000 billion, the probability of VN-Index decrease during the withdrawal cycle is 66.67%. The average probability of VN-Index decrease during net withdrawals is 50%.

For example, during the period 2023, the State Bank conducted net withdrawals twice with volumes of VND 239 billion and VND 194 billion respectively, resulting in VN-Index decreases of 5.19% and 15.22% respectively. In January 2020, the State Bank conducted a net withdrawal of VND 146 billion, resulting in a 9.85% decrease in VN-Index.

The reopening of bond net withdrawal operations by the State Bank from March 12, 2024 has some similarities and differences compared to the period from September to November 2023.

Looking back at the period in November 2023, the USD/VND exchange rate increased sharply by 3.48% from the beginning of Q3 2023 to September 21, 2023), the DXY Index increased by 1.74%; Excess system liquidity: Citad’s balance is about VND 400 trillion compared to the required reserve of about VND 280 trillion; Interbank interest rates from July 2023 were at a low level of less than 1%.

The State Bank issued bonds again from September 21 to November 8, 2023, with a net withdrawal of VND 194,649.7 billion during this period. The exchange rate decreased by 0.29% from September 21 to November 8, 2023, and continued to decline until the end of November 2023; Overnight interbank interest rates increased by more than 2% during the period from September 21 to October 25, 2023 – in response to the State Bank’s money withdrawal measures, but quickly decreased again.

In this issuance, the exchange rate increased sharply due to the interest rate difference between VND and USD; DXY Index increased (but still at a low level of 102.8); Fed signaled a delay in interest rate cuts from Q1 to Q2 2024. The estimated net withdrawal scale is about VND 100,000 – 150,000 billion with a term of 28 days and an average interest rate of 1.40%.

“When the net withdrawal volume is low, the stock market’s fluctuations are not clear, indicating that this information does not have a significant impact. Net withdrawals from over VND 100,000 – 150,000 billion, there is a fairly high probability of VN-Index decrease, especially in the Retail, Financial Services (securities), Real Estate, and Chemicals sectors,” emphasized BSC.

However, according to BSC, investors need to observe the following indicators: Exchange rates (including free exchange rates), DXY; Net withdrawal scale – issuance interest rate along with overnight interbank interest rates. Industries that have experienced significant point declines in the past serve as indicators of the degree of impact on the stock market if any.

“The bond net withdrawal activity is a normal business operation, a regulatory tool, and does not imply a change in policy. Investors should not be overly concerned but should objectively evaluate the information in the market to have appropriate investment strategies,” BSC recommended.

Previously, Mr. Huynh Minh Tuan, Director of Mirae Asset Securities Company’s Head Office, also proposed two scenarios of money withdrawal through bonds by the State Bank.

Scenario 1: SBV conducts slight withdrawals, estimated at about VND 120,000 – 150,000 billion, for just over 1 week with a rate of VND 15,000 per session, if the crypto and gold trends show signs of cooling down.

Scenario 2: SBV conducts strong bill withdrawals to prevent the medium-term target exchange rate, estimating that SBV will withdraw about VND 180,000 – 200,000 billion, the largest amount in this period, if the crypto and gold trends are on an upward trend, continuously reaching new ATHs, and with high price momentum, causing the free exchange rate to break the 26,000 threshold or higher.

The predicted data is based on the money withdrawal actions through bonds in Q3 2023 by SBV as well as based on the current excess liquidity in the banking system (about VND 230,000 billion).

Assessing the impact on the stock market, according to expert Huynh Minh Tuan, the recent period has maintained a liquidity volume of over VND 23,000 billion per session thanks in part to the excess liquidity in the financial system and record low interest rates flowing into the economy. With the tightening of excess capital in interbank systems, it is possible to be concerned that the buying demand of the stock market will decrease to some extent due to short-term liquidity risks and investor risk management.

“The SBV’s bill withdrawals are not expected to affect the deposit-lending interest rate structure of the banking system in the second quarter, given that credit growth has yet to show significant improvement. However, we should look at the risk of increased speculation in crypto and gold as a local short-term risk for Vietnam, and regulators are recognizing this risk. After this period, we can expect a better trend for the market,” Mr. Tuan said.