Source: SBV

|

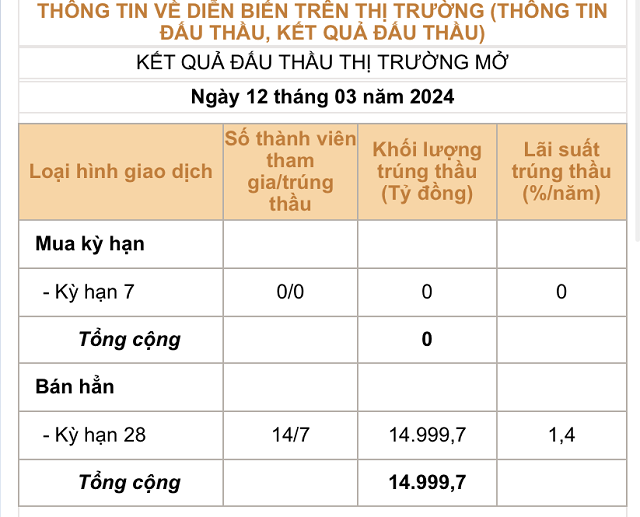

On March 12, the State Bank of Vietnam (SBV) successfully completed a bond issuance through open market operations, with a total volume of 15,000 billion dong, with a term of 28 days.

The interest rate bidding mechanism was used and the winning bid rate remained at 1.4% per annum for a term of 28 days. The number of bidders has improved from 6 out of 18 members in the first session on March 11 to 7 out of 14 members in today’s session.

Therefore, in two consecutive days (March 11-12), the central bank has absorbed nearly 30,000 billion dong from the banking system through bond issuance.

In general, the bond issuance by the central bank is a tool in monetary policy, which is a common practice of central banks to adjust short-term liquidity conditions in the system. The purpose of bond issuance is to absorb excess market liquidity to reduce short-term exchange rate speculation pressure.

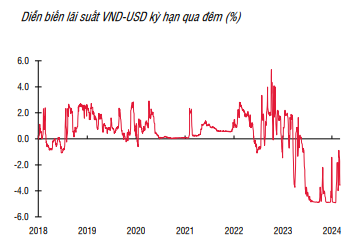

In the domestic context, the overnight interbank interest rate for the Vietnamese dong (VND) was below 1% prior to the bond issuance (0.77% per annum on March 8) when liquidity was abundant in the system with slow credit growth in February. This has led to a significant difference in interbank interest rates between the Vietnamese dong and the US dollar (USD) (there were times when the rate was negative, leading to a strong demand for holding USD rather than VND).

Specifically, as of March 8, the VND interbank interest rate for overnight transactions was around 0.80% per annum. Meanwhile, the USD interbank interest rate closed at 5.2% per annum for overnight terms. Thus, currently, the VND interbank interest rate forovernight transactions is much lower than the USD interest rate in the same market (0.8% per annum versus 5.2% per annum).

Source: SSI Research

|

In a previous weekly monetary market report (February 26 – March 1), SSI Research experts stated: “Unlike the positive trend usually seen at the beginning of the year, exchange rate pressure is gradually increasing, partly due to the prolonged negative VND-USD interest rate differential, which leads to increasing capital outflows or strong import demand for production materials in the first two months of the year.

Moreover, the significant difference between domestic and international gold prices has not shown clear improvement and has made exchange rate fluctuations in the free market more unpredictable. The large disparity between the free and quoted exchange rates has also led to significant speculative trends.

Actions taken by the central bank to stabilize the exchange rate can be considered, and in the short term, the resumption of bond issuance may be expected. However, the increasing demand for foreign currency from import-export businesses and the sale of foreign reserves can also be taken into account.”

Therefore, the bond issuance by the central bank can help adjust system liquidity in the short term, and from there, it is expected to push down the interbank interest rate for the Vietnamese dong, helping to reduce the interest rate differential between the USD and the VND.

In line with this view, experts from BIDV Securities Company (BSC) also believe that the State Bank of Vietnam is activating the bond issuance tool to regulate domestic currency liquidity, helping to cool down the exchange rate in the context of continuous sharp increases.