Dat Phuong Group Joint Stock Company (DPG-HOSE code) announces the Board of Directors’ resolution on the repurchase of all outstanding bonds.

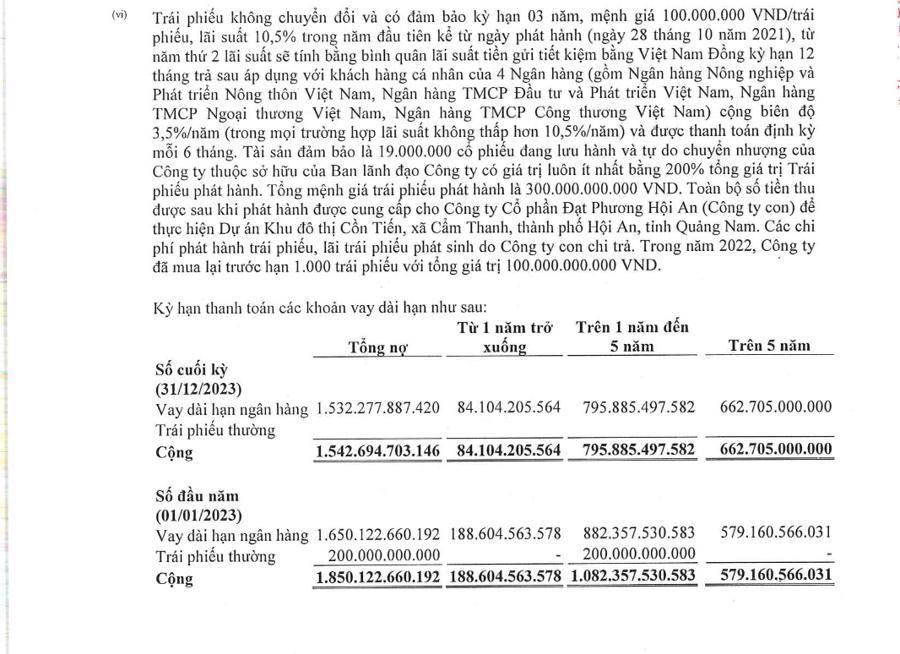

In particular, Dat Phuong will repurchase all DPG12101 bonds (issued on October 28, 2021 and maturing on October 28, 2024, with an interest rate of 10.5% per year). The bonds have a face value of 300 billion dong and have repurchased 100 billion dong with a remaining balance of 200 billion dong. The repurchase period is expected to be from May 24 to June 24.

The funds for the repurchase come from the cash flow from business operations.

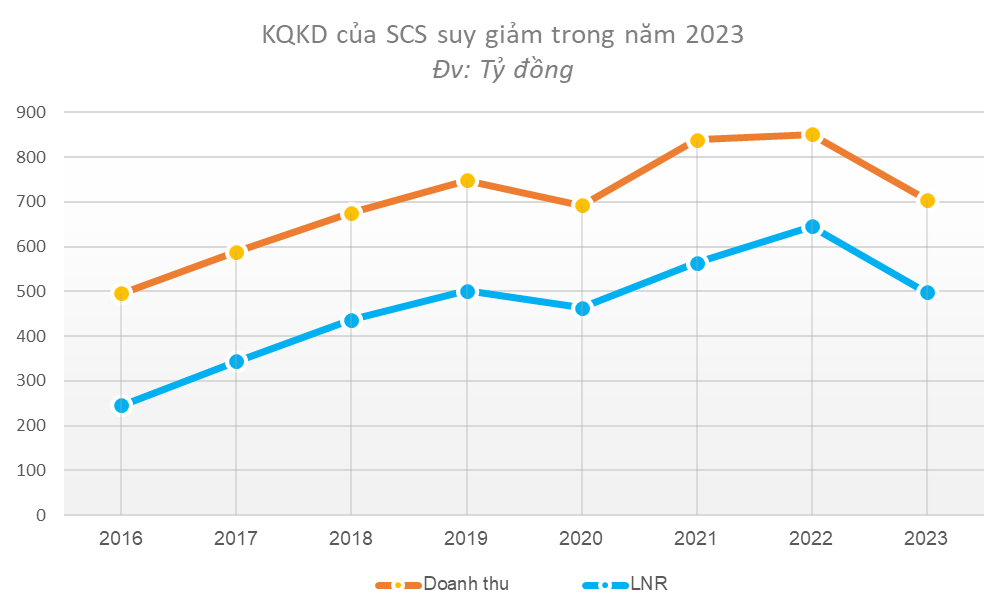

According to the financial report for the fourth quarter of 2023, DPG’s revenue reached 1,423 billion dong, an increase of 30% compared to the same period last year (1,094 billion dong). The after-tax profit reached 121 billion dong, a decrease of 15% compared to the same period last year (143 billion dong). For the full year 2023, DPG’s revenue reached 3,450 billion dong, an increase of 4% compared to the previous year (3,319 billion dong). The after-tax profit reached 288.8 billion dong, a decrease of 44% compared to the previous year (519 billion dong).

In 2023, DPG aims to achieve 3,436 billion dong in revenue and 287.6 billion dong in after-tax profit. Therefore, the company has simultaneously exceeded the revenue and profit targets by 0.4%.

As of December 31, 2023, DPG’s total assets reached 6,698 billion dong, an increase of 9% compared to the beginning of the year (6,139 billion dong). Cash and cash equivalents reached 1,272 billion dong, an increase of 8%. Bank deposits in the “investment held until maturity” account reached 379 billion dong, an increase of 85%.

Inventory increased by 1.2% to 1,105 billion dong over the past year; liabilities increased by 10% to 4,342 billion dong; equity reached 2,356 billion dong, an increase of 6.7% compared to the beginning of the year; undistributed after-tax profit increased from 1,015 billion to 1,158 billion dong.

According to the notes in the financial report, Dat Phuong Group recorded a short-term bond liability with a value of 200 billion dong. This bond issuance is secured by 19 million DPG shares owned by the company’s Board of Directors. The funds raised from the bond issuance were provided to Dat Phuong Hoi An Joint Stock Company (a subsidiary) to implement the Cồn Tiến Urban Area project in Cẩm Thanh commune, Hoi An city, Quang Nam province.

It is known that on March 20, Dat Phuong will finalize the list of shareholders attending the 2024 Annual General Meeting, which is scheduled to be held in April 2024.

At the end of the trading session on March 15, DPG’s stock price increased by 1,200 dong to 41,750 dong per share, a 4.77% increase over the past 5 sessions.