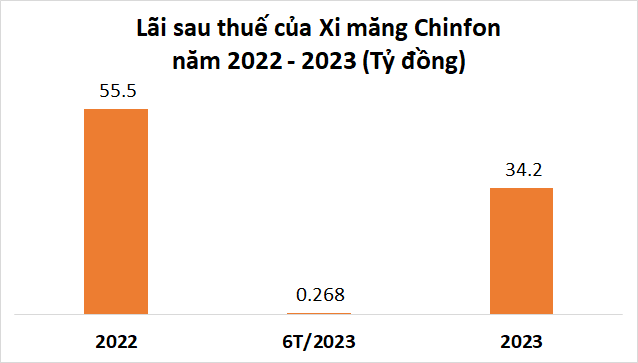

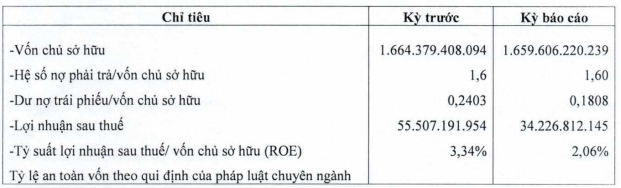

According to the announcement on the Hanoi Stock Exchange (HNX), Chinfon Cement recorded a post-tax profit of over 34 billion VND in 2023, a decrease of 38% compared to the previous year. As a result, the return on equity (ROE) also decreased from 3.34% to 2.06%.

Notably, in the first six months of 2023, Chinfon Cement’s post-tax profit was only over 268 million VND, which is less than 1% of the annual profit.

Source: VietstockFinance

|

As of the end of 2023, Chinfon Cement’s equity capital was nearly 1.66 trillion VND, which is almost unchanged compared to the beginning of the year. The debt-to-equity ratio remained at 1.6 times, corresponding to a debt of over 2.655 trillion VND.

The bond-to-equity ratio decreased from 0.2403 times to 0.1808 times, equivalent to 300 billion VND, a decrease of 25%. The company has paid over 15 billion VND in bond interest on March 24, 2023.

Source: HNX

|

The bond lot with the code CFCCH2126001 was issued on September 24, 2021, with a total issuance of 400 billion VND, a term of 60 months (maturity on September 24, 2026), and an interest rate of 7% per year. The proceeds will be used to increase the company’s operating capital. The bond is secured by Chinfon Cement’s assets. The consulting organization for the offering, issuing agent, registration agent, depository, payment and transfer agent is Vietnam Commercial Bank for Foreign Trade or Vietcombank Securities Limited (VCBS).

Chinfon Cement was established in 1992 as a joint venture between Chinfon-Vietnam-Holding Co., Ltd., Hai Phong City People’s Committee, and Vietnam Cement Industry Corporation. After 30 years of operation, the company currently owns a cement plant in the Northern region and a clinker grinding plant in the Southern region. According to information from HNX, the company has a charter capital of over 1.319 trillion VND.

Chinfon Cement’s profit evaporates in the first six months