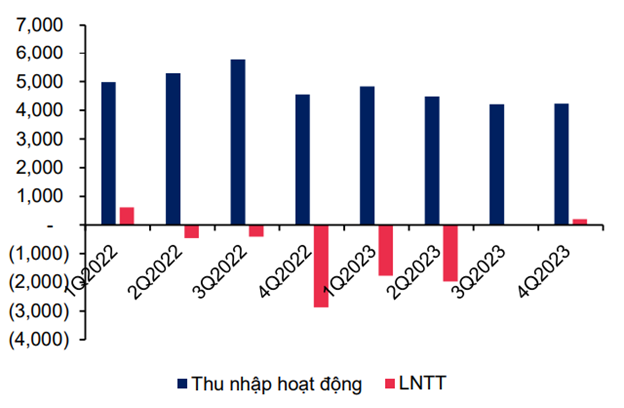

According to a newly published report on March 4th, MBS Research revealed that in the fourth quarter of 2023, FE Credit recorded VND 4,234 billion in operating income, a decrease of nearly 7% compared to the same period last year. Operating expenses in the fourth quarter also decreased by nearly 33%.

Provisions for credit losses in the fourth quarter reached VND 2,162 billion, a decrease of over 53%. This is the second consecutive quarter that FE Credit has seen a decrease in provisions compared to the same period last year. As a result, FE Credit’s pre-tax profit in the fourth quarter reached VND 208 billion, while it incurred a loss of VND 1,774 billion in the same period last year.

Thus, after 5 consecutive quarters of losses (since the second quarter of 2022), FE Credit has shown signs of recovery in the last 2 quarters of 2023, especially in the fourth quarter.

|

FE Credit’s business results from the first quarter of 2022 to the fourth quarter of 2023 (Unit: Billion VND)

Source: MBS Research

|

At the end of 2023, FE Credit recorded operating income of VND 17,756 billion, a decrease of 13.8% compared to the previous year, and a pre-tax loss of VND 3,529 billion (compared to a loss of VND 3,937 billion in 2022).

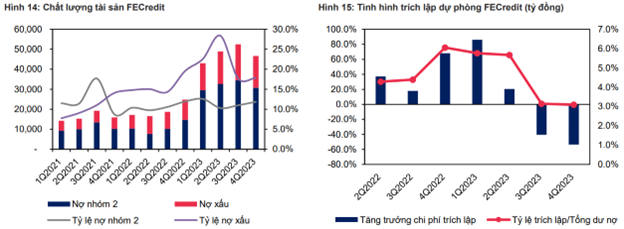

Both operating expenses and provisions for credit losses decreased by over 10% compared to 2022. Non-performing loans and group 2 debts at the end of 2023 for FE Credit reached nearly 12% and nearly 18%, increasing slightly by 90 and 10 basis points respectively compared to the third quarter of 2023.

FE Credit’s asset quality has improved significantly and shown signs of bottoming out since the second quarter of 2023 (NPL and group 2 debts reached over 28% and over 10%).

Source: MBS Research

|

The MBS Research team believes that FE Credit’s consecutive pre-tax profit and signs of bottoming out in asset quality indicate that the pressure for provisions in the coming quarters will gradually decrease.

In addition, the declining trend of loan growth has also begun to slow down and bottom out in the third quarter of 2023, increasing expectations that FE Credit can regain positive growth momentum in 2024. MBS Research predicts that FE Credit’s outstanding loans could reach 16.1% in 2024.

FE Credit, formerly a Consumer Credit Division of Vietnam Prosperity Joint Stock Commercial Bank (VPBank, HOSE: VPB), has successfully transformed its consumer credit operations into a new independent entity named FE Credit Financial Company Limited Liability One Member Limited Liability Company of Vietnam Prosperity Joint Stock Commercial Bank (known as FE Credit Brand) since February 2015.

In October 2021, VPBank completed the sale of 49% of FE Credit’s charter capital to SMBC Consumer Finance Company (SMBCCF), a wholly-owned subsidiary of Sumitomo Mitsui Financial Group of Japan. At the same time, FE Credit Financial Company Limited Liability One Member Limited Liability Company of Vietnam Prosperity Joint Stock Commercial Bank was renamed into FE Credit Financial Company Limited Liability One Member Limited Liability Company of Vietnam Prosperity Joint Stock Commercial Bank SMBC.