Stock Market Update: Maritime and Shipping Stocks Soar

On March 14, the stock market couldn’t continue the positive momentum from the previous day as the VN-Index dropped 6.25 points to 1,246.26. However, market liquidity remained high at 27,926 billion VND.

Today’s attention was focused on maritime and shipping stocks as they surged together. Notably, PVTrans’ PVT stock hit the daily limit at 28,850 VND, marking its highest price in the past six months.

Congratulations to PDN stock of Dong Nai Port for nearly reaching the daily limit with a 6.42% increase to 116,000 VND. Other impressive performers included SPG (up 5.08%), VNA (up 4.47%), VTO (up 3.77%), and VSC (up 2.95%). Leading maritime transport company HAH also recorded a 1.81% increase.

Ports Benefit from Rising Service Fees

The surging transportation rates in recent times have been a positive signal for the maritime industry. According to Trading Economics, after a calm period earlier this year, the Baltic Dry Index (BDI) – a crucial index for the shipping industry – has reached 2,370 USD, an 82% increase in just two months.

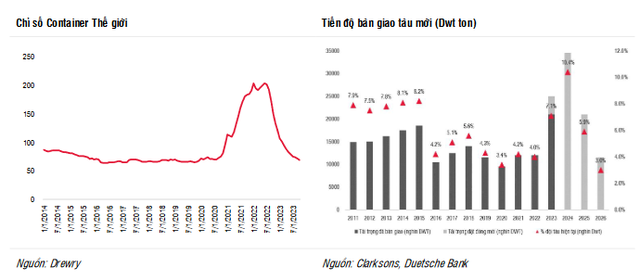

Meanwhile, the Drewry World Container Index (WCI) has remained high over the past year, despite some recent cooling down.

According to SSI Research, another growth driver for the shipping industry comes from geopolitical tensions. The ongoing geopolitical tensions (Russia-Ukraine war, Israel-Hamas-Hezbollah conflicts in the Middle East, recent Houthi attacks on cargo ships in the Red Sea, etc.) will support the industry, especially maritime transportation. These conflicts lead to longer sea routes, reducing supply and supporting freight transportation.

In SSI Research’s view, the geopolitical tensions have partly affected shipping and charter rates for oil tankers (due to the impact of the Russia-Ukraine war since 2022) in 2023 and are potential drivers for container shipping rates in 2024.

Ports indirectly benefit from this theme as TEU revenue tends to increase in favorable years for the shipping industry, such as in the developments of 2021 and 2022. Additionally, port operators benefit from increased service fees for container handling, which have risen by about 10% for cross-docking ports and deep-water ports compared to Circular 54/2018/TT-BGTVT, effective from February 15, 2024.

Potential of Maritime and Shipping Industry in 2024

Regarding the potential of ports and shipping in 2024, SSI Research suggests that the main theme for ports this year will be the recovery of throughput due to improving import-export demand (especially the replenishment of inventories in the US/Europe) while supply remains stable until 2025.

Firstly, for port operators, based on our basic scenario where the US economy grows slowly but does not experience a hard landing/recession with significant job losses/income, and retail companies stockpile inventory after reducing it for the past 1.5 years. The next interest rate cut by the central bank will be another supportive factor for consumer spending and production, all of which help increase cargo volume and handling at ports.

Secondly, SSI Research believes that the growth in throughput may be higher for deep-water ports (15% YoY growth in activities more focused in the US/Europe market) compared to cross-docking ports (7% YoY growth, mainly focused on the domestic Asia market). This will benefit companies with deep-water ports such as Gemapdept and VIMC.

In terms of supply, SSI Research finds that the increase in port capacity will not change much until 2025 when some large deep-water ports become operational, including PHP’s Lach Huyen 3&4, HATECO’s Lach Huyen 5&6, Gemalink 2A, and Gemadept’s Nam Dinh Vu 3. These ports have a total capacity of 3.3 million TEUs, equivalent to 12% of Vietnam’s container throughput in 2023.

Regarding shipping companies, vessel capacity will see a significant increase in 2024 as the number of new vessels delivered is expected to account for 10.4% of the total fleet supply, the highest since 2010. According to Clarkson, supply is expected to exceed demand by 3.1% in 2024. However, in the current situation at the Suez Canal, SSI Research expects higher TEU-mile to absorb part of the excess supply, potentially putting less pressure on the profits of shipping companies.

C

Freight rates are predicted to gradually stabilize as supply and demand reach a better balance, albeit remaining high compared to historical levels. However, escalating or prolonged tensions in the Red Sea are considered supportive factors for cargo transportation in a tight supply-demand situation for oil tankers due to the Russia-Ukraine conflict. Therefore, SSI Research will continue to choose oil transport-related stocks such as PVT, which benefit from this geopolitical tension theme.

General cargo transportation continues to hold promise due to both supply and demand driving vessel tonne-miles. In terms of demand, after a strong recovery in 2023, the growth of dry cargo can be supported by both short-term factors (US harvest season, restricted passage through the Panama Canal) and long-term factors (China’s coal and iron demand, ongoing geopolitical tensions).

In terms of supply, risks to the growth of supply are insignificant as the number of new ship orders currently represents a historically low 8% of the existing fleet. Therefore, the analyst position believes that dry bulk shipping rates will remain high and volatile in such an environment, creating opportunities and challenges for dry bulk shipping companies like VOS and VNA.