Latest Savings Interest Rates at PGBank

Starting today (March 13), Prosperity and Development Commercial Joint Stock Bank (PGBank) has officially adjusted its savings interest rates by 0.1-0.3 percentage points for terms ranging from 1 to 18 months.

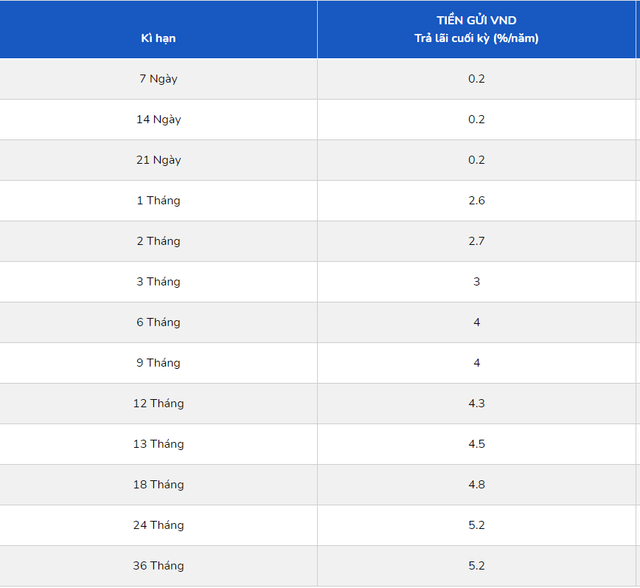

Accordingly, the bank has reduced the interest rates by 0.3 percentage points for the 1-3 month term: 2.6% (1 month), 2.7% (2 months), and 3% per annum (3 months).

The interest rates for 6 – 9 month term deposits have decreased by 0.1 percentage points to 4% per annum.

PGBank has lowered the interest rates by 0.3 percentage points for the 12-month, 13-month, and 18-month terms to 4.3%, 4.5%, and 4.8% per annum respectively.

Meanwhile, the savings interest rates for the 24-36 month terms remain unchanged at 5.2% per annum. This is also the highest interest rate for term deposits at PGBank at this time.

This is the second time PGBank has lowered term deposit rates in March.

Latest Savings Interest Rates at PGBank.

Latest Savings Interest Rates at NCB

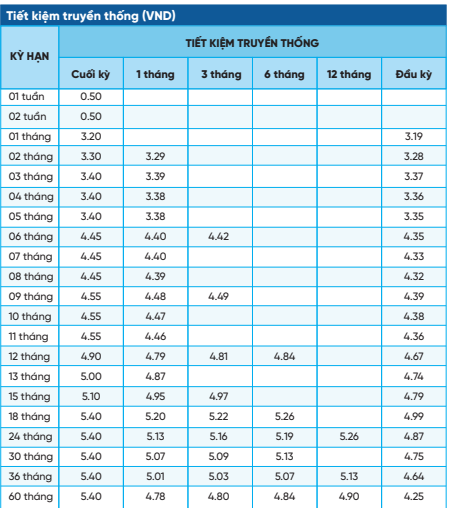

Also today, the interest rate table for savings at NCB has been adjusted. Accordingly, the traditional savings interest rates range from 3.3 to 5.4%, decreasing an average of 0.2 percentage points compared to the previous adjustment.

The highest savings interest rate at NCB is 5.4% for the 18 to 60-month terms.

The interest rates for the 15-month term is 5.1%. The interest rates for the 12-month and 13-month terms are 4.9% and 5% respectively, reduced by 0.3 percentage points compared to the most recent adjustment.

Meanwhile, NCB has lowered the interest rates by 0.3 percentage points for the 9-10 month term, remaining at 4.45% per annum.

The savings interest rates for terms below 6 months range from 3.2 to 3.4% per annum.

Latest Savings Interest Rates at NCB.

Recently, Military Commercial Joint Stock Bank (MB) officially announced its new interest rate table since March 12. Accordingly, the bank has reduced interest rates by 0.1-0.2 percentage points for deposits of 1-36 months. The bank applies the highest interest rate of 5.6% per annum for the 24 to 60-month term and the lowest interest rate of 2.1% per annum for the 1-month term.

Techcombank has also adjusted the savings interest rates for terms below 6 months. The new interest rate table, lower than the previous rates, takes effect from March 11, 2024. The highest interest rate, applied for terms of 12 months and above, is 4.5% per annum, and the lowest interest rate is 2.35% per annum for the 1-2 month term.

Some other banks that have adjusted their savings interest rates include: GPBank, PVcomBank, VPBank, ACB, BVBank, BaoViet Bank,…