After a week of volatile trading with sudden liquidity, the stock market continued to have a strong but more positive week of trading. The VN-Index fluctuated by over 40 points. After a sharp decline at the beginning of the week, the index rebounded well in the following two sessions. However, strong correction pressure in the last two sessions at the resistance level of 1,280 points caused the Index to reverse its gains. At the end of Friday’s trading session, the VN-Index still increased by 1.32% compared to the previous week to 1,263.78 points.

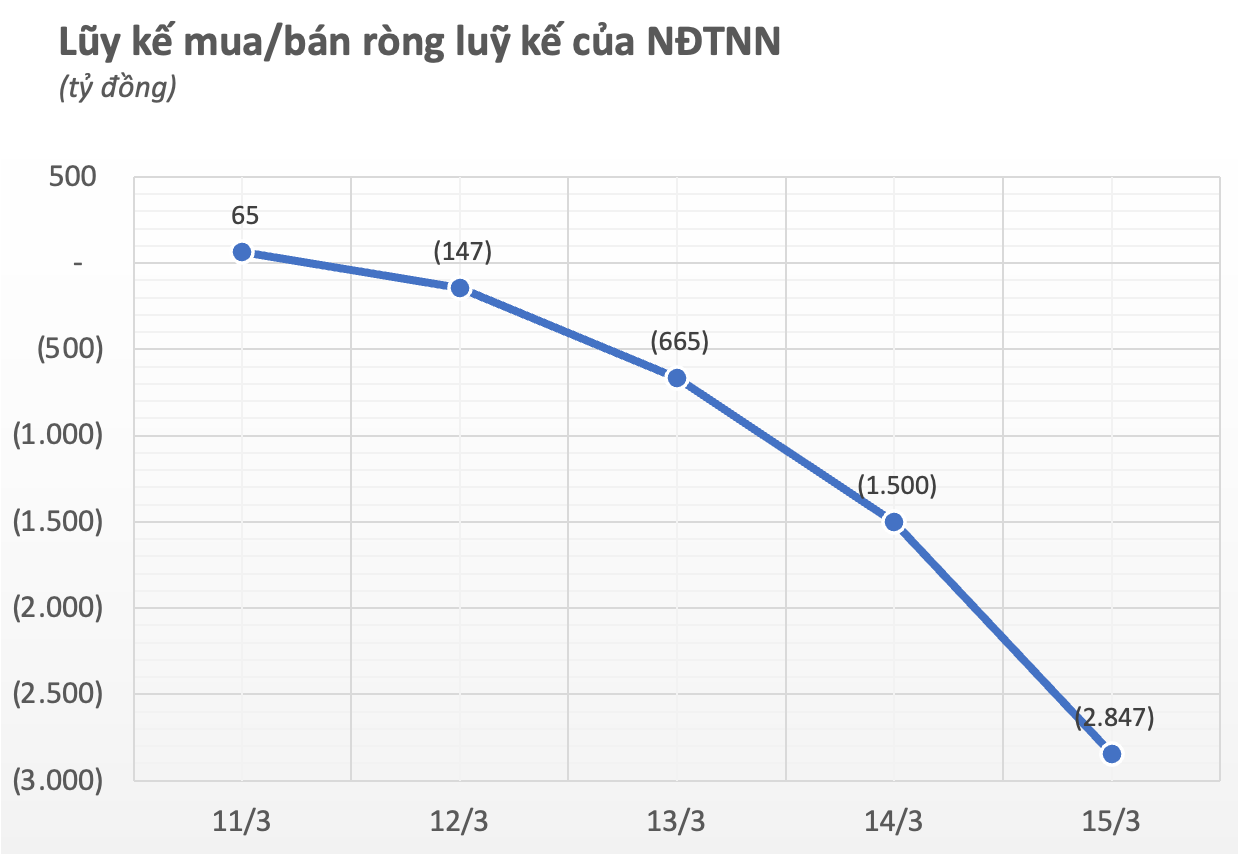

Last week was also the week of restructuring for the three largest foreign ETF funds in the Vietnamese market, including VNM ETF, FTSE Vietnam ETF, and Fubon ETF. Therefore, this may be the reason for the sudden selling pressure from foreign investors in the market. The total net selling value for the week was 2,847 billion dong, of which net selling volume was 2,843 billion dong in trading and net selling volume was 4 billion dong in agreements.

This is the second consecutive week of net selling by foreign investors in the entire market, with the highest value in three months, since the week of December 11-15, 2023 (net selling of 3,350 billion dong).

Looking at each exchange during the week, foreign investors net sold 2,606 billion dong on HoSE, net sold 88 billion dong on HNX, and net sold 152 billion dong on UPCoM.

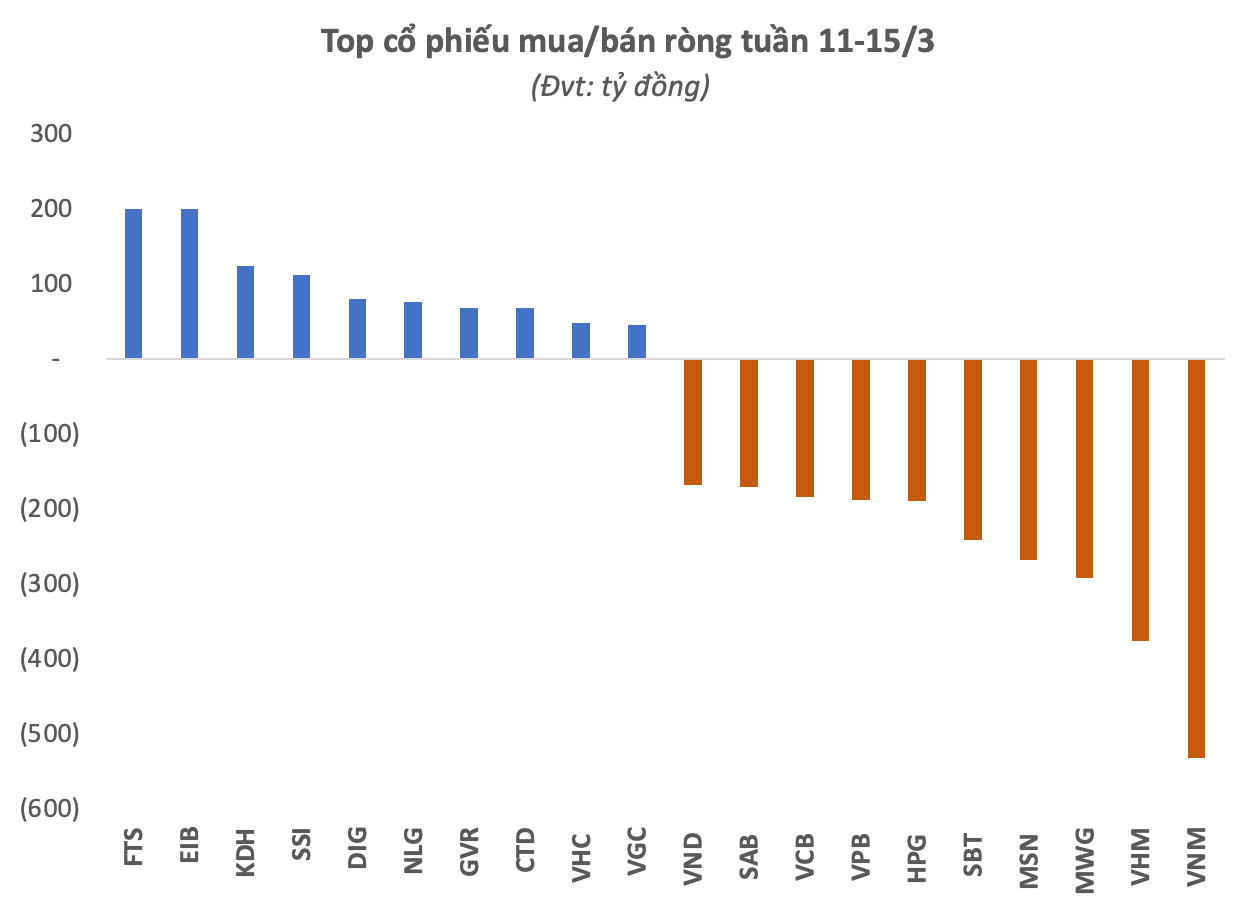

According to the securities codes, the net selling focus was on VNM stock with a net selling value of nearly 532 billion dong. Following that, the two bluechips VHM and MWG were also net sold for 375 billion dong and 291 billion dong respectively. MSN stock was also net sold for 268 billion dong.

The net selling list also includes SBT and HPG stocks, with net selling values of 241 billion dong and 189 billion dong respectively. VPB and VCB banking stocks were also net sold by foreign investors for over 188 billion dong each. The net selling list of foreign investors in the past week also includes SAB, VND,…

In contrast, FTS securities were the strongest net bought by foreign investors with 201 billion dong, all on the trading floor. This is a stock that was recently added to the portfolio of MVIS Vietnam Local Index – the underlying index of Vaneck Vectors Vietnam ETF (VNM ETF) in the Q1/2024 review period.