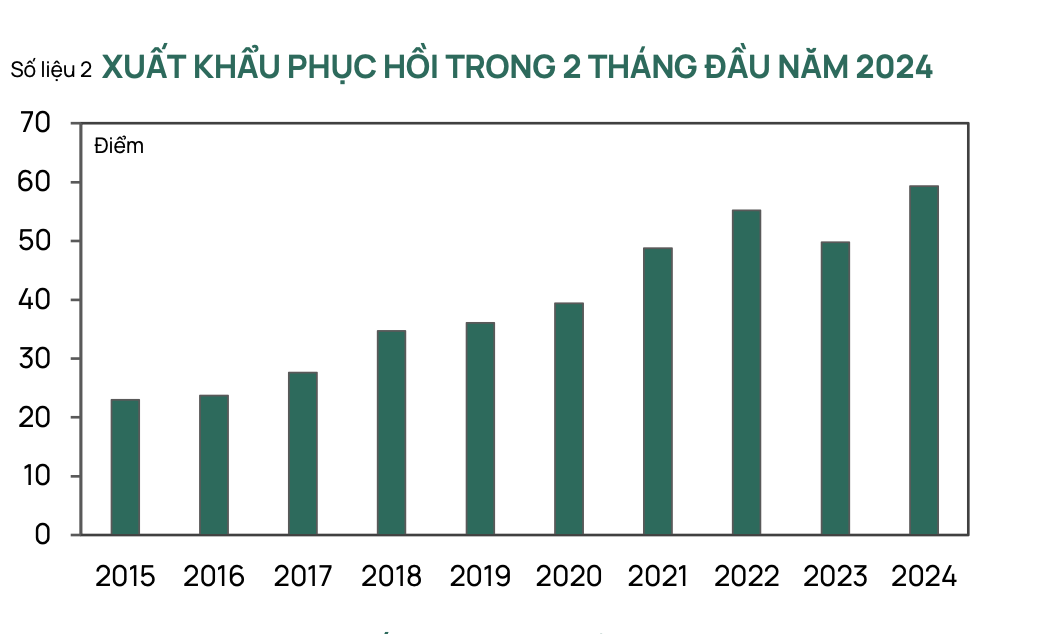

In a recent report, Dragon Capital evaluates the macro context with many bright spots. Exports in the first 2 months of the year reached $59.3 billion, up 19.2% compared to the same period, while imports reached $54.5 billion, up 18%. Especially, trade activities with countries that Vietnam upgraded its diplomatic relationship with in recent times have recorded significant growth.

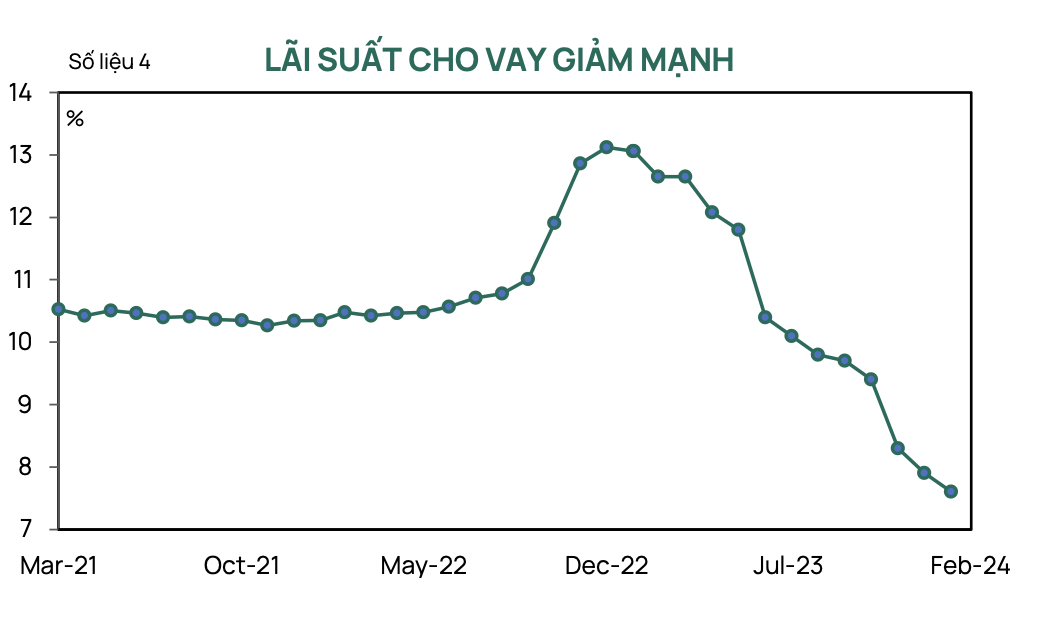

The export growth reflects the effectiveness of loose monetary policy in supporting the economy. Fixed interest rates for new loans currently stand at about 6-8% per year, nearly half of the previous year’s level at 12-14%.

Another positive trend is that domestic businesses’ exports are growing faster than FDI enterprises (33.3% compared to 14.7%), including oil exports. This demonstrates clear improvement in the competitiveness and market adaptability of Vietnamese enterprises.

As for the stock market, after a positive recovery in both indexes and liquidity, Dragon Capital believes that stocks remain an attractive investment channel to replace time deposits when the average interest rate for 12-month deposits has dropped to 4.7%, compared to the peak above 10%.

Money has flowed into the Information Technology (+13.1%), Import-Export (+10.9%), Raw Materials (+9.6%), and Banking (+9.1%) sectors. Export companies such as TNG Garment Company report that they are starting to recruit again as order volumes are full until the third quarter of 2024, while Vinh Hoan Seafood Company (VHC) benefits from news related to increased fish prices as well as the unstable situation in maritime transportation, which does not significantly affect the company.

The Raw Materials sector, led by Hoa Phat Group, has been strongly promoted after the Ministry of Finance reported that domestic investment and development targets increased by 21.8% compared to the same period last year, reaching $2.4 billion in the first two months of 2024. This government-driven push is expected to create momentum for the raw materials sector and stimulate demand for infrastructure-based projects.

However, foreign net selling has halted market growth. Continuous foreign net selling of over a billion USD since April 2023 shows that global economic instability is affecting investor sentiment and market stability. However, the recent trend of foreign net selling shows signs of improvement as it has decreased to around $100 million compared to the peak in December 2023, with over $400 million exiting the market.

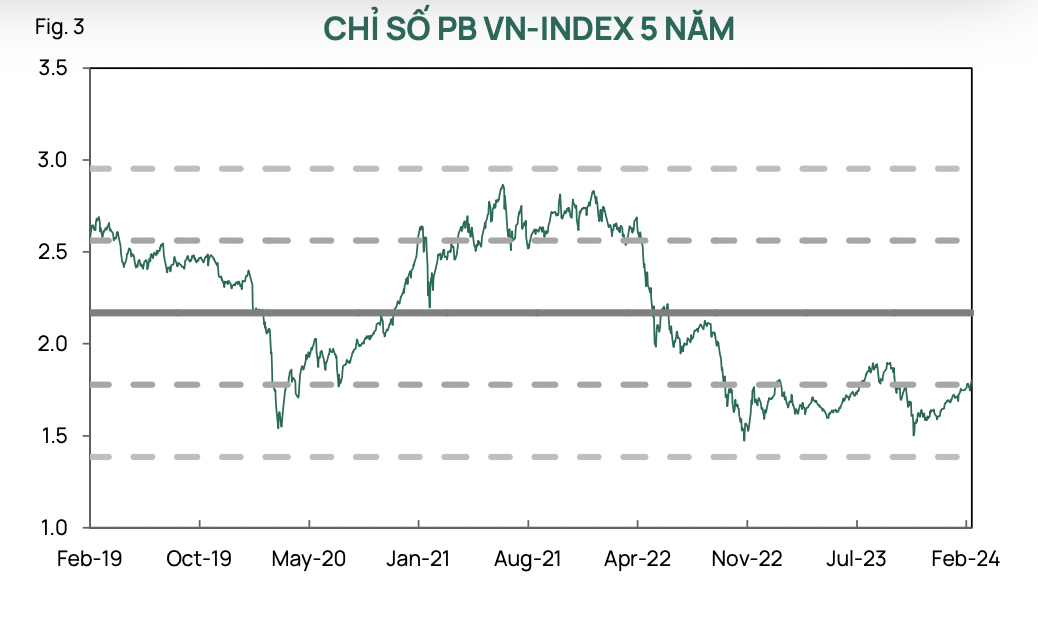

“The valuation of VN-Index remains attractive with an expected PE ratio for 2024 of 10.6 times for 80 leading companies, compared to other ASEAN countries such as Thailand (16.0 times), Malaysia (14.1 times), Indonesia (13 times), and Philippines (12.6 times),” Dragon Capital’s report stated.

According to Dragon Capital, market upgrade is just the beginning. At the recent conference on implementing the development of the stock market in 2024, the upgrade of the Vietnamese stock market to a new emerging market of FTSE was intensively discussed. Dragon Capital’s analysis shows that there are currently around $700-$800 billion being invested in this market segment.

“If Vietnam can upgrade the market, the proportion of investment can account for 0.2-0.24%, equivalent to $1.3 -1.9 billion,” the research group said.