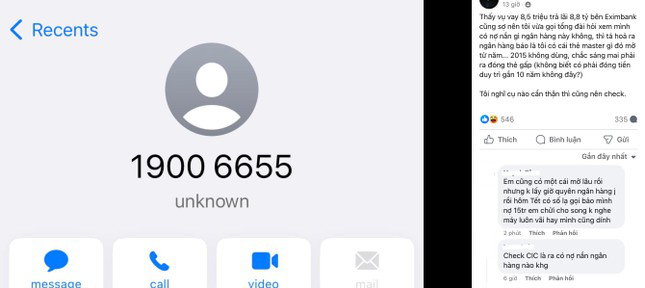

Mr. Ngo Linh (in Hanoi) shared that after contacting the bank hotline, he was shocked to discover a credit card opened since 2015 but unused, and he’s concerned about having to pay for maintaining the card for nearly 10 years. Mr. Linh decided to go to the bank branch the next day to cancel the card.

Many credit card users share how to check bad debts.

Not only credit cards, but ATM card holders also discovered maintenance fees for unused cards. Ms. Vu Hong Hanh (in Hanoi) said that through the bank hotline, she recently checked and found that her ATM card, which hasn’t been used for 6-7 years, has a negative balance of VND 712,000 for card maintenance fees. Ms. Hanh hurriedly went to the nearest bank branch to pay the missing amount and cancel the card.

Many credit card users share with each other how to check bad debts, from the website of the Credit Information Center (CIC) of the State Bank. The CIC performs the following main functions: Collecting credit information database from 100% of credit institutions in the banking system; providing credit information reports to the credit institution system, credit scoring reports for individual customers, credit rating reports for business customers.

CIC website.

With the query on the CIC, borrowers can freely exploit their own credit report once a year. From the second query in the year, customers must pay a fee of VND 20,000 per personal credit information report, VND 50,000 per business credit information report (excluding VAT).

Borrowers can refer to the guide for using the credit information report on the website https://cic.gov.vn, section “Quick guide to using the Mobile App” or the Facebook page “National Credit Information Center – CIC”.

A credit card is a type of bank card that allows the owner to use it for payment within the credit limit agreed with the card issuer. This means you will “borrow” the bank a certain amount of money to make purchases and expenses, and at the end of the period, you will have to fully or partially repay the borrowed amount to the bank.

With post-payment by credit card, customers can easily make payments anytime, anywhere without cash. In addition, credit cards are also a reasonable solution for timely payment of personal fees, easy expense control, and help cardholders reduce financial pressure. However, using cards also has some points to note, customers are advised to learn from the issuing unit, the content stated in the card issuance contract.

According to Mr. Quan, each person should only use a maximum of 2 credit cards to prevent the case when one card has issues, there will still be another card. When opening a card, customers should pay attention to the purpose of using the card and the accompanying benefits.