On March 17, Vingroup’s Board of Directors (stock code: VIC) signed an agreement to sell up to 100% of the charter capital in SDI Company – the unit currently owning over 99% of the charter capital of Vincom Retail Trading Company, a major shareholder of Vincom Retail. After this transaction is completed, SDI Company, Sado Company, and Vincom Retail Company will no longer be subsidiaries of Vingroup.

SDI Trading Company is currently the largest shareholder of this company, owning 943.2 million VRE shares, equivalent to 40.5% of the charter capital and 41.51% of the voting rights of the company.

Sharing about this deal, Mr. Nguyen Viet Quang, CEO of Vingroup, said that this is the time to focus all resources on developing this conglomerate and its key brands, which have high growth potential. And to accomplish this mission, the company will devote all its resources, especially its financial resources, to create a breakthrough development in the next turning point.

A Vincom Retail shopping center.

This is not the first “high-profile” divestment deal of Vingroup in recent years. Especially, in the context of VinFast still being a “money-burning” business area, which requires a lot of capital but has not brought profit yet, the real estate “cash cow” named Vincom Retail is still facing difficulties due to the general market.

In late 2018, Vingroup announced its desire to become a world-class Technology – Industry – Service group, in which Technology accounted for the majority. Therefore, divesting from subsidiaries that do not belong to the above direction or closing inefficient business areas is almost mandatory for the conglomerate of billionaire Pham Nhat Vuong to be able to mobilize capital.

Vingroup’s high-profile divestment deals

The first “high-profile” divestment deal of Vingroup was the complete sale of shares of Vincom Securities (VincomSC). Specifically, in the period from 2007 to 2008, when the Vietnamese stock market was at its peak, with VN-Index continuously exceeding 1,000 points, Vingroup had the ambition to join the market with Vincom Financial Group (VFG) with the establishment of Vincom Securities Company in 2007.

However, the global economic crisis in 2008 led Vingroup to cancel its plan to participate in the financial sector. As a result, billionaire Pham Nhat Vuong had to abandon the plan to establish a financial group. In 2011, Vingroup sold all of its capital in VincomSC.

Currently, the company is still operating on the Vietnamese stock market under the name VIX Securities.

From 2009 to the present, Vingroup has opened and closed countless projects: VinDS (clothing and footwear stores in Vincom shopping centers), Vinlink, VinExpress (logistics), Emigo (VinFashion fashion company), Vinpearl Air (aviation), etc.

Another notable divestment deal that Vingroup carried out is divesting from the retail – e-commerce sector. At the end of 2019, the market was “shaken” by the news that Vingroup was withdrawing from the retail sector after a period of investment and development.

Specifically, Vingroup announced its decision to exchange shares of VinCommerce Company, the unit owning the VinMart supermarket chain and VinMart+ convenience stores, for Masan Group (stock code: MSN), officially bidding farewell to the retail sector. Additionally, Vingroup also sold VinEco to Masan Group in this deal. At the time of departure, VinCommerce had experienced consecutive years of losses and was struggling to gain market share.

In addition to selling VinCommerce and VinEco to Masan Group, Vingroup also decided to close the VinPro electronics and technology stores and the Adayroi e-commerce platform.

However, not all of Vingroup’s deals have been well received. In particular, the decision to stop producing Vsmart phones and televisions has received mixed reactions from consumers.

At the time of its launch, Vsmart was favored by many consumers. From zero to the end of 2020, Vsmart phones ranked third in the domestic market with a 12.7% market share. At the beginning of 2021, three phones produced by VinSmart under the AT&T brand were officially launched in the U.S.

However, in May 2021, Vingroup announced the discontinuation of the Vsmart phone and television brand. Mr. Nguyen Viet Quang, CEO of Vingroup, shared, “Producing smartphones or smart TVs no longer brings breakthrough capabilities or creates different value for users.” In addition, the unsuccessful acquisition of LG’s factory also played a role in Vingroup’s withdrawal from this sector.

However, VinSmart is still operating. The company has shifted its focus to developing smart features for VinFast vehicles and homes. The goal of the conglomerate is to develop smart – entertainment – service features for VinFast cars.

The most recent “notable” divestment deal is Vingroup’s divestment from One Mount Group.

In mid-2022, Vingroup transferred all of its shares in One Mount Group Joint Stock Company – a company established by the largest corporations in Vietnam, including “Masan Group, Techcombank, and Vingroup.”

The main business of this company is Agency, Brokerage, and Auction of goods. In addition, One Mount Group is also involved in transportation, support services, real estate business, management consulting, advertising, etc. Famous brands under One Mount include Vin ID, VinShop, and One Housing.

Specifically, Vin ID aims to become a super personal assistant application, integrating various functions such as payment, home management, and shopping. One Housing is a platform that caters to buying, selling, leasing, and other real estate-related services.

VinShop is a platform that serves grocery stores at all stages, from purchasing, transportation, store management, payment, to financial support and suppliers, with the potential to become a distribution channel for financial products and other services.

The One Mount ecosystem.

Although Vingroup has divested from many business areas, as of December 31, 2023, it still owns a huge number of subsidiaries, totaling 110 companies. Among them, the group still owns famous brands such as Vinhomes (real estate), VinPearl (resorts), VinFast (industry), Vinmec (hospitals), Vinschool (education), VinBrain (artificial intelligence), etc.

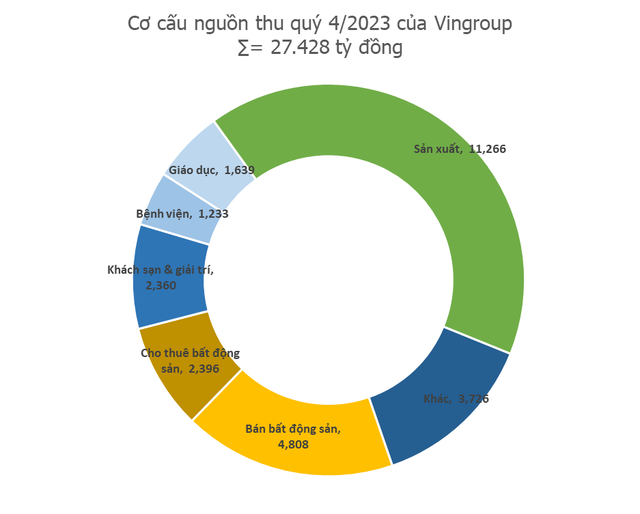

Investing heavily in the industry may cost a lot of money, but it has begun to pay off for Vingroup. Specifically, the group recorded a net revenue of VND 27,428 billion in the fourth quarter, a decrease of 34% compared to the same period.

In the net revenue structure, revenue from production activities brought in the majority, contributing VND 11,266 billion, an increase of 2.8 times compared to the same period. Meanwhile, revenue from real estate transfers decreased sharply by 84% to VND 4,808 billion. Revenue from real estate leasing brought in the third largest revenue with VND 2,396 billion.

This is the first quarter since VinFast began commercial operations that the production activities of Vingroup have surpassed the real estate business activities and become the main source of revenue for Vingroup.