Late afternoon March 18, according to VTC News, lawyer Ta Anh Tuan, Director of Emme Law Limited Company (Hanoi Bar Association) – who is the representative of Mr. P.H.A (Quang Ninh) confirmed that on the morning of March 19, Mr. Tuan will work with the Export-Import Bank of Vietnam (Eximbank) branch in Quang Ninh in the case where Mr. H.A. was sent a notice by Eximbank to reclaim a bad debt of nearly 8.5 million VND due to credit card spending since 2013, with accumulated interest now amounting to 8.84 billion VND.

Last week, Mr. Tuan said he received information and documents from Mr. H.A. but they were not complete and comprehensive. “We will have to meet with Eximbank to get multidimensional and comprehensive information. I will complete the necessary procedures as required this week. Next week, I will work with Eximbank,” he said.

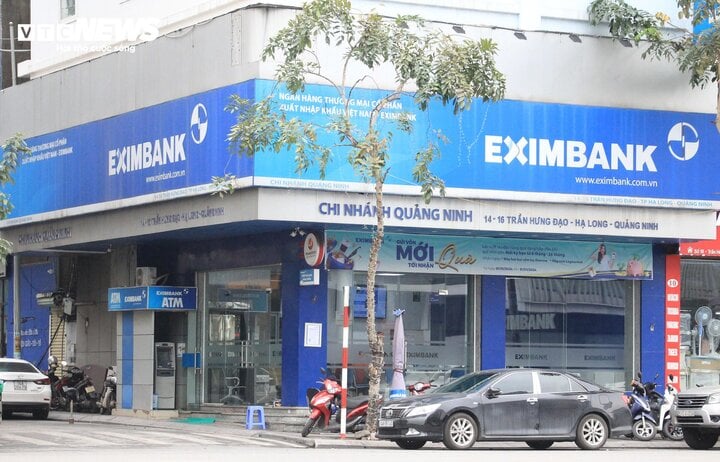

Headquarters of Eximbank branch in Quang Ninh.

According to information from Eximbank, Mr. H.A. opened a Master Card at Eximbank branch in Quang Ninh on March 23, 2013, with a credit limit of 10 million VND.

The customer then made two payment transactions on April 23, 2013, and July 26, 2013, at an accepting point. Since September 14, 2013, the above credit debt has turned into bad debt, and the overdue period has lasted nearly 11 years. Immediately after that, the bank took steps to recover Mr. H.A.’s debt.

“This is an overdue debt that has lasted nearly 11 years. The bank has notified and worked directly with the customer multiple times. However, the customer still has not come up with a plan to handle the debt,” Eximbank informed.

The bank also affirmed that sending debt obligation notices to customers is a routine activity during the process of handling and recovering debts. Up to now, the bank has not received any payment from the customer.

According to Eximbank, the method of calculating interest and fees in the above-mentioned debt is “completely in accordance with the agreement between Eximbank and the customer based on the card application file dated March 15, 2013, with the customer’s signature. The regulations on fees and interest are clearly stipulated in the issuing and using card fee schedule, which has also been publicly posted on Eximbank’s website.”

“Currently, Eximbank is continuing to work and cooperate with the customer to have a plan to support the customer in handling the debt,” the bank further affirmed.

However, the customer himself claims to be a victim since he did not spend 8.5 million VND on the credit card and was also not notified early when it turned into bad debt. In March 2013, he asked an employee at Eximbank branch in Quang Ninh to issue a credit card, but in reality, he did not receive this credit card.

In the last meeting in mid-2022 at his house with the bank representatives, Mr. A. also requested clarification on signs of customer deception by that employee.

Providing initial comments on this detail, lawyer Ta Anh Tuan said that if it is true as Mr. H.A. described, this case has issues with the card issuance process, especially the card delivery process to customers.

“It is highly possible that the customer due to some negligence did not thoroughly check the card. In the case of Mr. H.A., upon receiving it, it was not a credit card but a regular ATM card. In principle, when receiving the card, Mr. H.A. himself needs to carefully check, but why he did not do so, the truth needs to be clarified,” Mr. Tuan said.

On March 14, the State Bank of Vietnam branch in Quang Ninh issued a letter requesting Eximbank Head Office in Ho Chi Minh City and Eximbank branch in Quang Ninh to verify and clarify the information regarding this case and provide information to the media.

According to VTC News sources on March 19, the State Bank branch in Quang Ninh has received and is reviewing the detailed report on the incident from Eximbank.