DAT XANH Group Corporation (code DXG) has just updated the annual General Meeting of Shareholders 2024 documents with a presentation on the 2 equity capital raising plans.

Accordingly, DAT XANH plans to offer more than 150 million shares to existing shareholders at a minimum offering price of VND 12,000/share. The offering ratio is 24:5, meaning that shareholders owning 24 shares are entitled to buy 5 new shares. The shares offered are not subject to transfer restrictions. The expected issuance time is in 2024 or as decided by the Board of Directors after approval by the State Securities Commission (SSC).

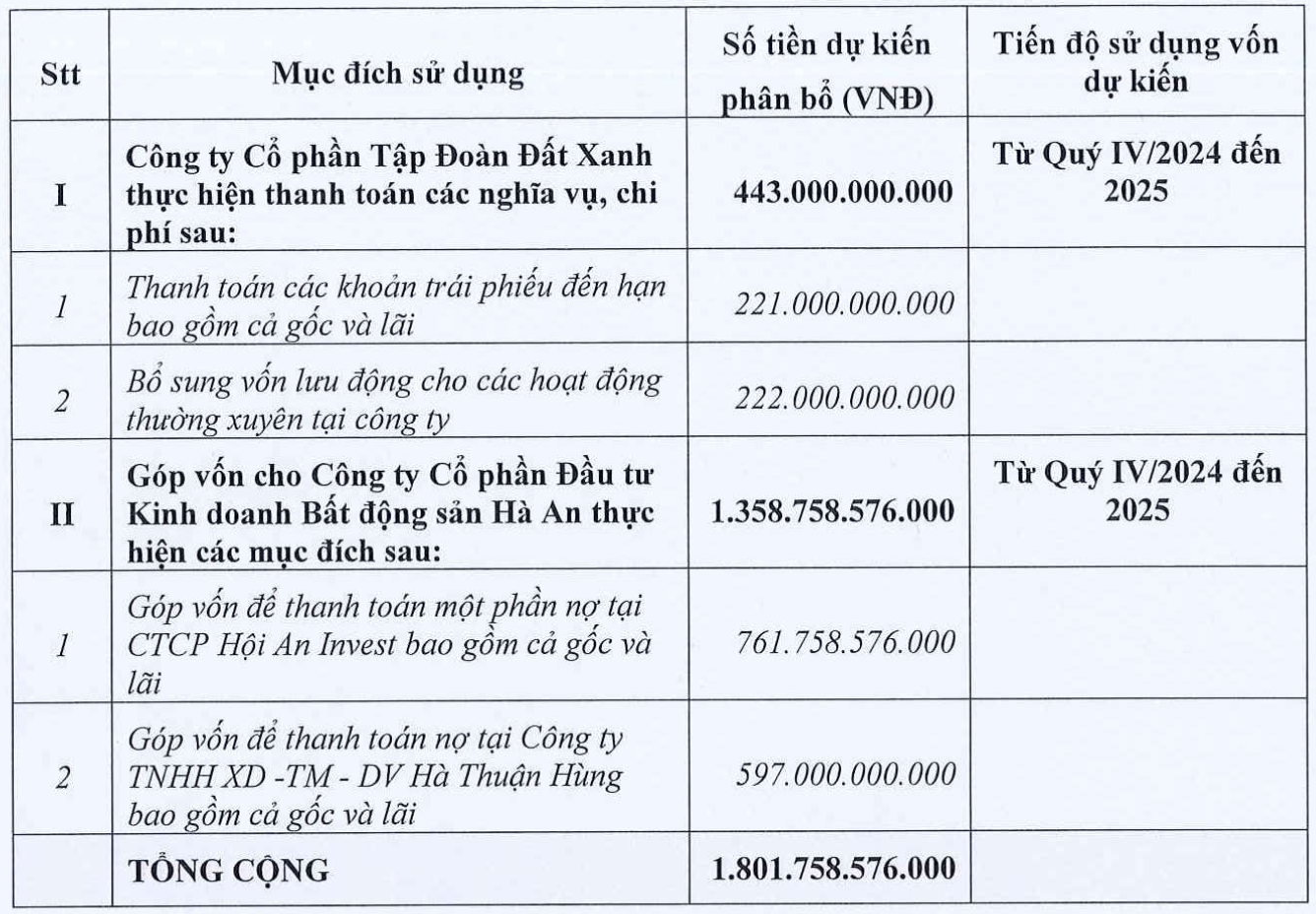

The expected mobilization amount of VND 1,800 billion will be used mostly by DAT XANH to contribute to its subsidiary – Ha An Real Estate Trading and Investment JSC, for the following purposes: Repaying part of the debt at Hoi An Invest JSC (VND 762 billion), repaying debt at Ha Thuan Hung Trading Construction Service Company Limited (VND 597 billion). The remainder is used to repay maturing bonds (VND 221 billion), and supplement working capital (VND 222 billion).

In addition, DAT XANH also plans to offer 93.4 million shares to professional securities investors at a minimum price of VND 18,600/share. The issued shares will be subject to a one-year transfer restriction. The expected issuance time is in 2024 or as decided by the Board of Directors after approval by the SSC. The mobilized amount of more than VND 1,700 billion is expected to be used to contribute additional capital and increase ownership in the subsidiary.

If both of the above options are fully issued with a total volume of nearly 244 million shares, DAT XANH will mobilize more than VND 3,500 billion, and at the same time increase its charter capital from more than VND 7,200 billion to nearly VND 9,650 billion.

In the meeting document, DAT XANH also reported to shareholders the results of the 2023 capital increase issuance. With the plan to issue 9 million shares to employees under the Employee Stock Option Program (ESOP), the company completed on February 2, 2024, thereby raising its charter capital to nearly VND 6,208 billion. With the plan to issue 101.6 million shares to existing shareholders at a price of VND 12,000/share, the company also completed at the end of January 2024, thereby raising its charter capital to nearly VND 7,225 billion.

In addition to the 2 above ESOP share and share issues for existing shareholders, the DAT XANH Annual General Meeting of Shareholders in 2023 also approved a private share issuance plan for professional securities investors with the purpose of raising capital to increase DAT XANH’s ownership in DAT XANH Real Estate Service JSC (DAT XANH Service – code DXS).

However, according to DAT XANH, during the process of applying for a license for the issuance, DAT XANH Service has completed a share issuance to increase share capital from its own capital source at a ratio of 1000:267. Accordingly, the number of shares that DAT XANH plans to repurchase to increase its ownership in DAT XANH Service has changed compared to the original plan. Therefore, DAT XANH has not yet issued private shares to professional investors according to the approved plan.

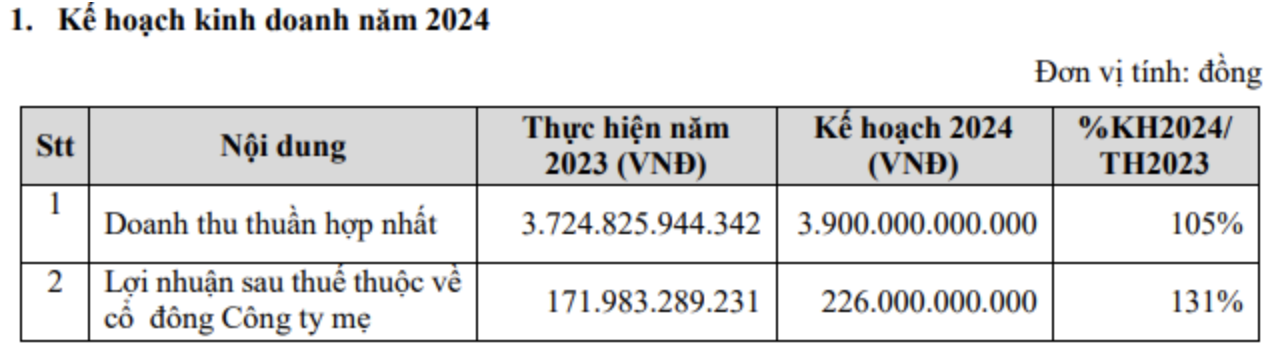

DAT XANH’s 2024 Annual General Meeting of Shareholders is scheduled to be held on the morning of April 19 via online platform. Regarding the 2024 business plan, DAT XANH sets a target of VND 3,900 billion in net revenue, and VND 226 billion in after-tax profit, respectively increasing by 5% and 31% compared to 2023’s performance. Expected dividend is 20% of par value, but it is not yet clear whether it will be in cash or shares. The company did not distribute dividends in 2023.