At the scientific workshop themed “Solutions to Upgrade Vietnam’s Stock Market” co-organized by the Ministry of Finance and the World Bank at the beginning of the week, international experts emphasized the attractiveness of the Vietnamese stock market if it is upgraded to emerging market status.

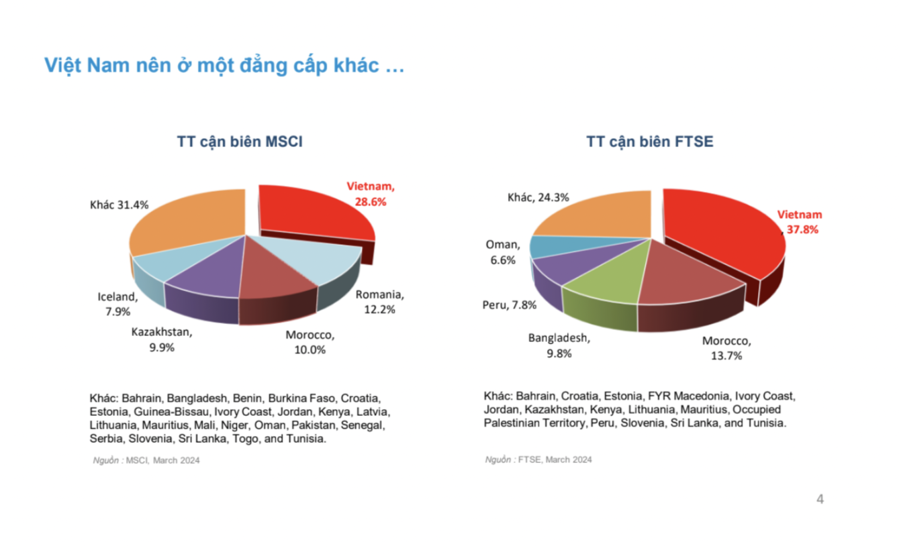

Mr. Ketut Kusuma, Senior Financial Specialist, Program Coordinator of the World Bank’s Financial Sector Program in Vietnam emphasized that “Vietnam should be in a different class”.

The expert assessed the impressive growth of Vietnam’s capital market as it has caught up with peer countries. The size of the financial market including government bonds, corporate bonds, and stocks is currently equivalent to 90% of GDP. Vietnam’s market capitalization has surpassed that of Indonesia, but remains below that of Thailand, China, Malaysia, and Singapore.

The stock market has yet to develop into a significant source of funding despite its strong potential. The market capitalization of Vietnamese stocks is currently equivalent to 58.1% of GDP; equity capital mobilization on stock exchanges has been decreasing. In 2018, a record of 105 trillion VND was reached through IPOs and secondary public offerings; in 2021, it was 73,000 billion VND, however, this number in 2023 only reached 16.5 trillion VND.

“Vietnam should be in a different class”, he emphasized. Funds recommended by MSCI allocate around 30% to the Vietnamese market in the frontier market. If Vietnam is upgraded to emerging market status, the size of this category will be 6.800 billion USD and with just 1% Vietnam will have 68 billion USD in the market. Typically, the capital flow will enter the market before the upgrade announcement, similar to the situations that occurred in Pakistan, Saudi Arabia, or Kuwait. If meeting the standards of FTSE Russell, Vietnam could receive a capital inflow of 25 billion USD.

Mr. Andrea Coppola – Lead Economist of the World Bank in Vietnam also said that international organizations have assessed Vietnam as a frontier market. Since September 2018, Vietnam has been on the watchlist for stock market upgrade. The upgrade will boost the position of the Vietnamese market, helping to attract foreign investors.

According to the World Bank’s estimate, if Vietnam’s stock market is upgraded, it will attract 25 billion USD by 2030. However, to attract 25 billion USD by 2030 as predicted, it is necessary to ensure certain conditions, including raising the foreign ownership limit and meeting other criteria set by the two rating agencies.

Regarding the issue of technical requirements, Vietnam can refer to the lessons learned from Saudi Arabia. Before 2015, they also required pre-trade margin trading, settlement day on T+0, and assets held by local brokerage firms. Later, they reformed by establishing a central securities depository, applying T+2 for transferring cash and securities 2 working days after the transaction. In 2021, the trading value in the market was more than 20 times higher than in 2018 when the upgrade to emerging market status was announced.

Ms. Arabella Bennett – Second Secretary, Australian Embassy in Vietnam believes that despite the challenges, Vietnam has made significant progress in its efforts towards the goal of upgrading to emerging market status. Ms. Arabella Bennett also emphasized that upgrading the stock market will make Vietnam a bright spot in the region and the Australian Embassy will cooperate with the Worldbank in supporting Vietnam to attract foreign investors to the Vietnamese stock market.