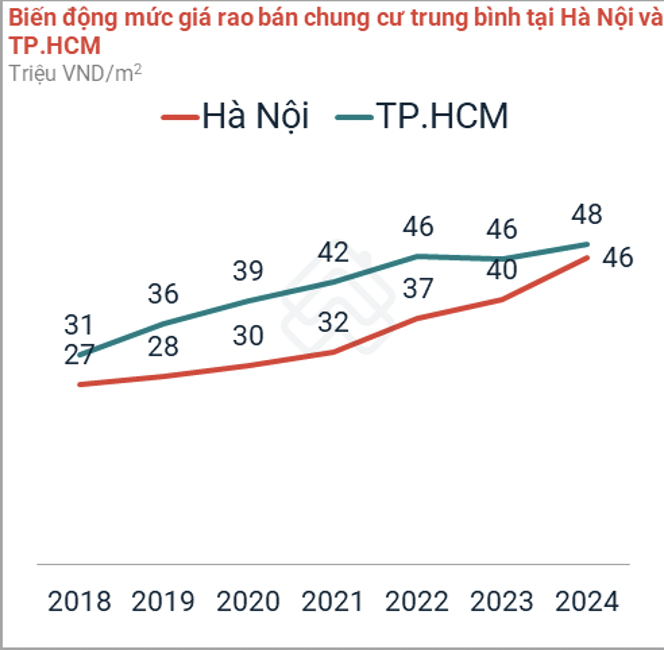

Currently, according to the real estate report of Quarter I/2024 conducted by PropertyGuru Vietnam, apartment prices in Hanoi witnessed an average increase of 70% over the past six years. Specifically, the average price of an apartment in Hanoi is VND 46 million/ sq.m, while in Ho Chi Minh City, it is VND 48 million/ sq.m.

At the beginning of 2018, apartments in Hanoi were priced at VND 27 million/ sq.m and VND 31 million/ sq.m for HCM counterpart.

Real estate prices in Hanoi and Ho Chi Minh City have been on the increase throughout the years. (Source: PropertyGuru Vietnam).

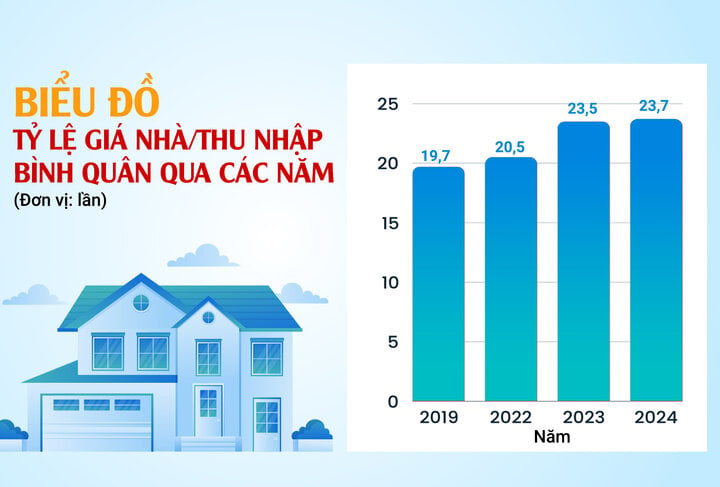

Housing price is almost 24 times higher than average income

The latest report of Numbeo.com (a website providing statistics on quality of living in cities and countries around the world through surveys) shows that, on average, housing prices in Vietnam in 2024 are 24 times higher than annual average household income.

Graphics: Huy Manh. (Source: Numbeo)

In Ho Chi Minh City, according to Ms. Giang Huynh, Deputy Director of Research & S22M, Savills HCMC, the current housing price is approximately 30 times higher than average income of local people.

Specifically, an average household in Ho Chi Minh City has an income of only about VND 15 million/month, while housing for new projects is currently priced at around VND 5.5 – 6 billion. If families manage to save 40 – 50% of income per month, it will still take them decades to afford a house, assuming no financial leverage or support from relatives is utilized.

“

It’s very difficult for families to afford housing in Ho Chi Minh City relying solely on income at present. They have to be in high-income brackets or use financial leverage to be able to purchase an average apartment

”, said Ms. Giang.

Several studies also reveal that housing price growth has outpaced income growth over the past few years. Savills Vietnam reported that Hanoi is aiming for a per capita income of VND 150 million/person/year by 2023, with an annual average income growth of 6%, compared to 2019.

Meanwhile, apartment price growth from 2019 to the first half of 2023 was as high as 13% per year.

“

This figure proves that income growth in Hanoi is less than half that of apartment prices

”, commented Ms. Do Thu Hang, Senior Director, Consulting & Research, Savills Hanoi.

Ms. Hang warned that it will become even more difficult for people to own houses if this gap continues to grow.

Financial and banking expert Mr. Le Xuan Nghia has provided an example of the excessive gap between housing prices and people’s income.

Specifically, an average worker below the age of 30 earns about VND 15 million/month, with living expenses in major cities like Ho Chi Minh city and Hanoi around 6 million, resulting in a surplus of VND 6 million. Therefore, it will take them at least 20 years to save up VND 1.5 billion. Even with an income of VND 20 – 30 million/month, they will have to save for 10 – 15 years to purchase a VND 1.5 billion apartment.

According to PropertyGuru Vietnam, houses in Hanoi are priced at around VND 22.8 billion per unit for shophouses; VND 17.8 billion per unit for villas; VND 6.3 billion per unit for single houses; and VND 3.1 billion per unit for apartments. While the estimated average annual income of Hanoi residents in 2023 will be VND 135 million.

Thus, to be able to buy a shophouse in Hanoi, residents will have to “work hard” for 169 years, 132 years for a singlehouse, and 23 years for an apartment (assuming they use all their income to buy a house).

Why do housing prices only increase but not decrease?

According to experts, housing prices increase because of high demand, while supply is scarce. Explaining the limited supply, the Ministry of Construction stated that many real estate projects have faced various difficulties in implementation (such as delays, extensions, and postponements, coupled with difficulties in accessing credit loans, issuing bonds, and mobilizing capital).

Housing costs keep rising due to limited supply and high construction prices. (Photo: Cong Hieu).

Another factor, according to Mr. Giang Anh Tuan, Director of Tuan Anh real estate, is that real estate prices depend on factors like land price, construction cost, legal issues, etc. If these factors overlap, it will be difficult for companies to lower housing prices.

Specifically, for a real estate project, land cost is an important input cost that affects final price. In urban areas, land use fees account for more than 10% of the cost of apartment units, 20 – 30% of the cost of low-rise terraced houses, and around 50% of the cost of villas.

Recently, land prices have increased by 15 – 30%, leading to a 2 – 8% increase in housing prices.

Not only land prices, construction materials like steel, iron, and sand have also witnessed significant increases. For example, steel and iron prices have climbed by around 15 – 20%, while raw material costs account for 65 – 70% of construction project estimates.

Legal issues prolong construction time, contributing to an increase in project implementation costs. Mr. Tuan indicated that some projects can take up to 4 – 5 years to complete all legal procedures.

Mr. Tuan elaborated that if a company purchases a VND 500 billion land plot, they will incur an annual expense of 10% interest, resulting in VND 50 billion. This cost must be factored into the price of homes.

Agreeing with the above, Mr. Tran Khanh Quang, CEO of Binh Duong-based real estate company Viet An Hoa, believes that high investment costs are a huge obstacle in the way of decreasing real estate prices.

“

In the current composition of project costs, construction costs have almost doubled compared to 4 – 5 years ago, climbing from VND 7 – 7.5 million/m3 to over VND 12 million/m2

”, said Mr. Quang.

According to Mr. Nguyen Duy Phuong, Investment Director of DGCapital, when implementing a project, investors must mortgage both land and future assets to