HoSE Updates Index Constituents, Impacting ETF Portfolios

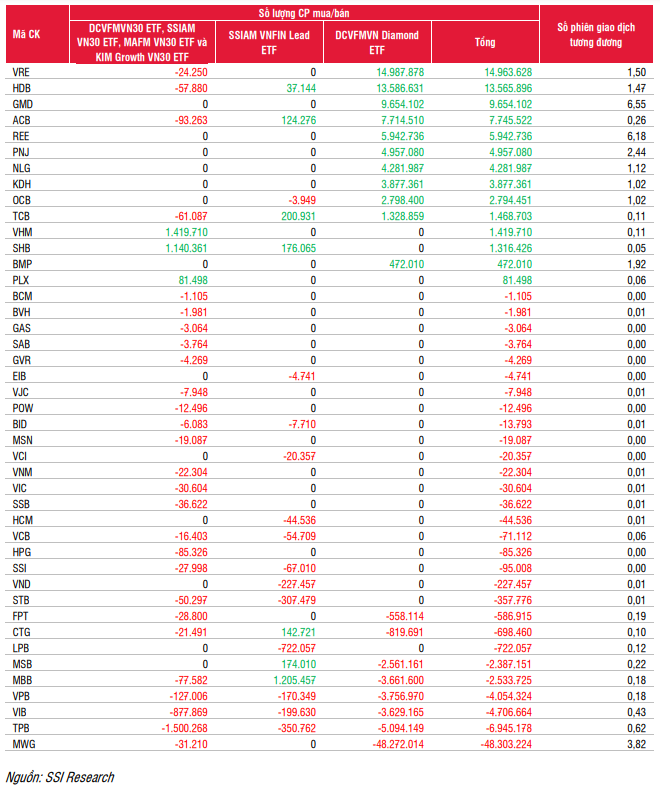

HoSE (Ho Chi Minh Stock Exchange) has recently announced the revised index constituents for Q1 2024. These changes will take effect on May 6th, and affected ETFs are expected to restructure their portfolios by May 3rd. SSI Securities has forecasted the estimated quantity of shares to be bought and sold by ETFs tracking the three major indices on the Vietnamese stock market.

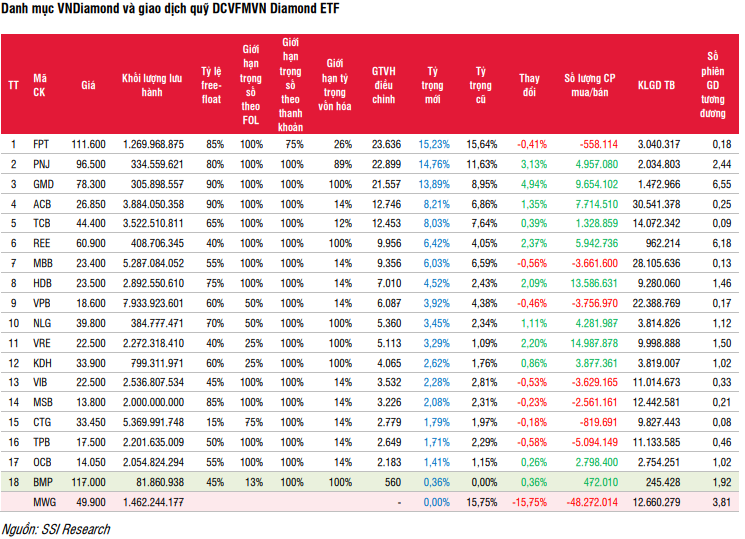

VNDiamond Index

MWG has been excluded from the VNDiamond index, while BMP has been included. The revised index will comprise 18 stocks, including 10 from the financial sector and 8 non-financial stocks. Additionally, the 10 financial stocks will be subject to a 40% market capitalization limit (as per HOSE regulations).

Currently, there are three ETFs on the market that track the VNDiamond index: DCVFMVN DIAMOND, MAFM VNDIAMOND, and BVFVN DIAMOND. These ETFs collectively manage approximately VND 15,748 billion in assets under management (AUM), with DCVFMVN Diamond accounting for approximately VND 15,294 billion.

SSI Securities estimates that DCVFMVN Diamond will sell approximately 48.2 million MWG shares and acquire approximately 472,000 BMP shares. Other stocks expected to be purchased in significant quantities by the fund include VRE (15 million shares), HDB (13.6 million shares), and GMD (9.6 million shares).

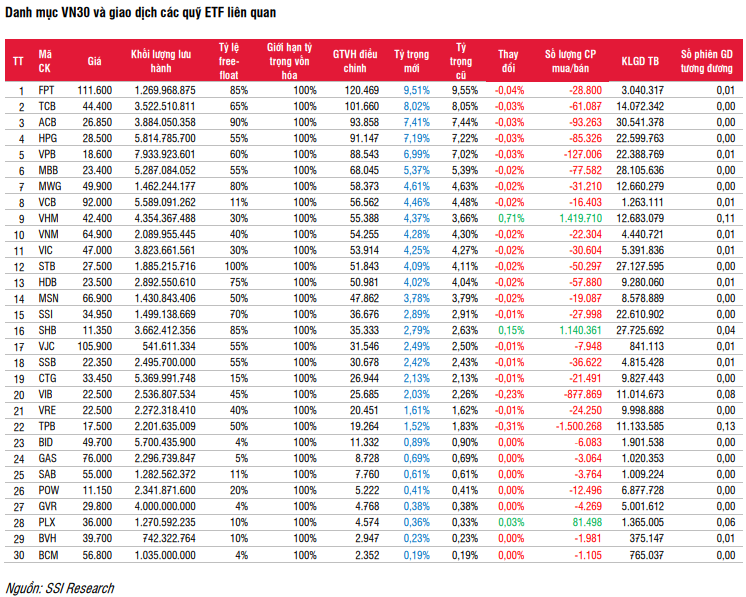

VN30 Index

There are no changes to the VN30 index constituents this period. Four ETFs currently track the index: DCVFMVN30, SSIAM VN30, MAFM VN30, and KIM Growth VN30. These ETFs have an estimated combined AUM of VND 8,432 billion.

DCVFMVN30, with an AUM of approximately VND 7,253 billion, has experienced a decline of nearly 4% in AUM since the beginning of 2024. However, the fund’s NAV has increased by 8.5%, while net redemptions have totalled VND 968 billion since the start of the year.

SSI Securities estimates that DCVFMVN30 will purchase an additional 1.4 million VHM shares, 1.1 million SHB shares, and 81,000 PLX shares, while selling 1.5 million TPB shares, 878,000 VIB shares, and 127,000 VPB shares, among others.

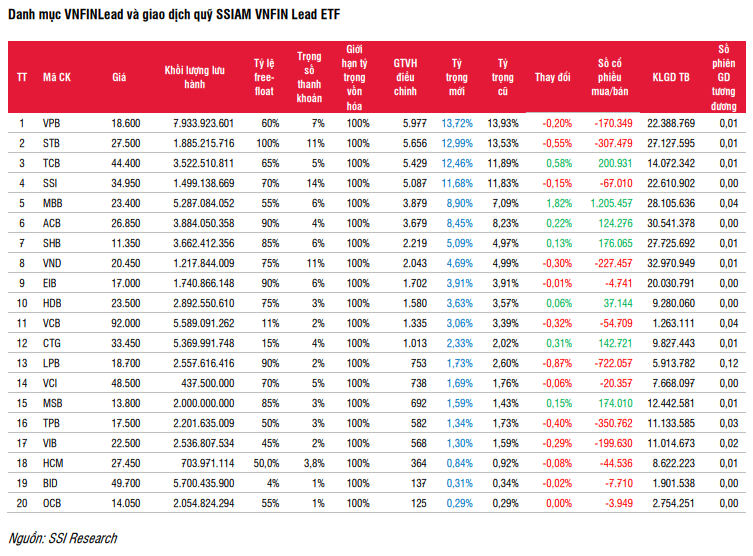

VNFIN Lead Index

The VNFIN Lead index constituents remain unchanged for this period, with the index continuing to include 20 stocks. As of April 15th, 2024, the SSIAM VNFIN Lead ETF had an AUM of approximately VND 1,534 billion and tracks the VNFIN Lead index. The fund’s AUM has decreased by 33% since the beginning of 2024, while NAV has increased by 14%. Over the past three months, the fund has experienced net redemptions of approximately VND 1,050 billion.

SSI Securities estimates that SSIAM VNFIN Lead ETF will acquire 1.2 million MBB shares, 201,000 TCB shares, and 176,000 SHB shares, while reducing its holdings of 722,000 LPB shares, 351,000 TPB shares, and 307,000 STB shares, among others.

Summary

Based on the changes to the VN30, VNFIN Lead, and VN Diamond indices, SSI Securities anticipates that ETFs tracking these indices will sell significant quantities of MWG, TPB, VIB, VPB, and MBB shares during the portfolio rebalancing.

Conversely, the firm predicts that the three domestic ETFs may make substantial purchases of VRE, HDB, GMD, ACB, and REE shares, among others.