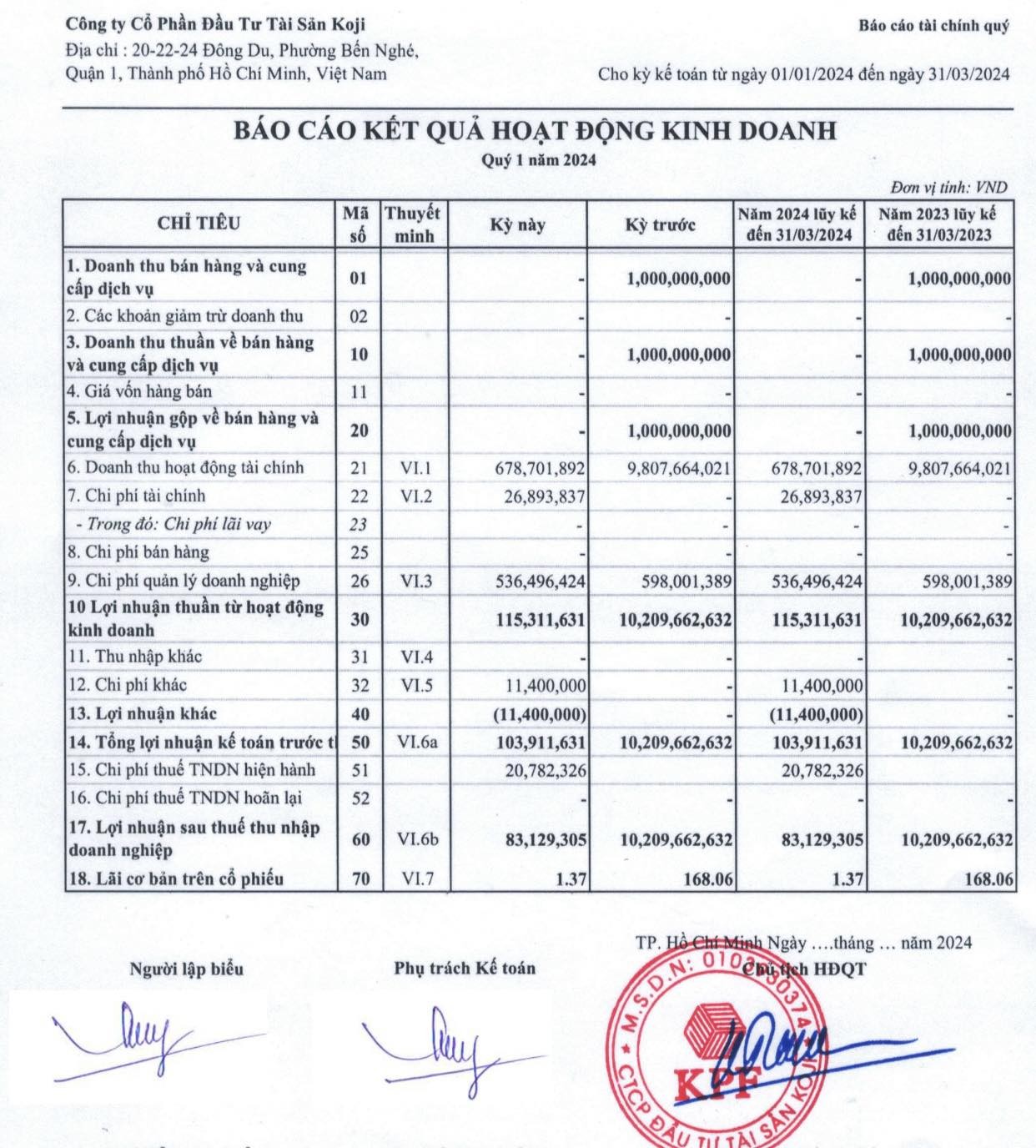

Koji Asset Investment JSC (stock code: KPF) has just announced its financial report for the first quarter of 2024 with not much optimistic results.

Specifically, KPF recorded a “zero” in net revenue from sales and service provision in the first quarter of 2024, while in the same period last year it still recorded 1 billion VND in revenue.

KPF’s business results in the first quarter of 2024. Screenshot.

During this period, KPF’s financial revenue also decreased by 93% compared to the same period last year, down to 678.7 million VND. During the period, KPF incurred over 26 million VND in financial expenses, while business management expenses fluctuated insignificantly at 536 million VND.

As a result, KPF reported after-tax profit of over 83 million VND in the first quarter of 2024, while in the same period last year it made a profit of 10.2 billion VND, a decrease of over 99%.

KPF’s total assets at the end of the first quarter of 2024 were 806.7 billion VND, a slight increase compared to the beginning of the year. Among them, the main assets are long-term financial investments at 483.4 billion VND, accounting for 60% of total assets.

KPF’s accounts receivable for loans as of March 31, 2024 decreased to over 207 billion VND. The largest loans were to Cam Lam Investment Co., Ltd. with 79.875 billion VND; Phuc Hau Investment Co., Ltd. with 76.06 billion VND; Binh Duong Service and Industrial JSC with 51.22 billion VND.

KPF’s liabilities at the end of the period were nearly 14 billion VND. The company has no financial debt.

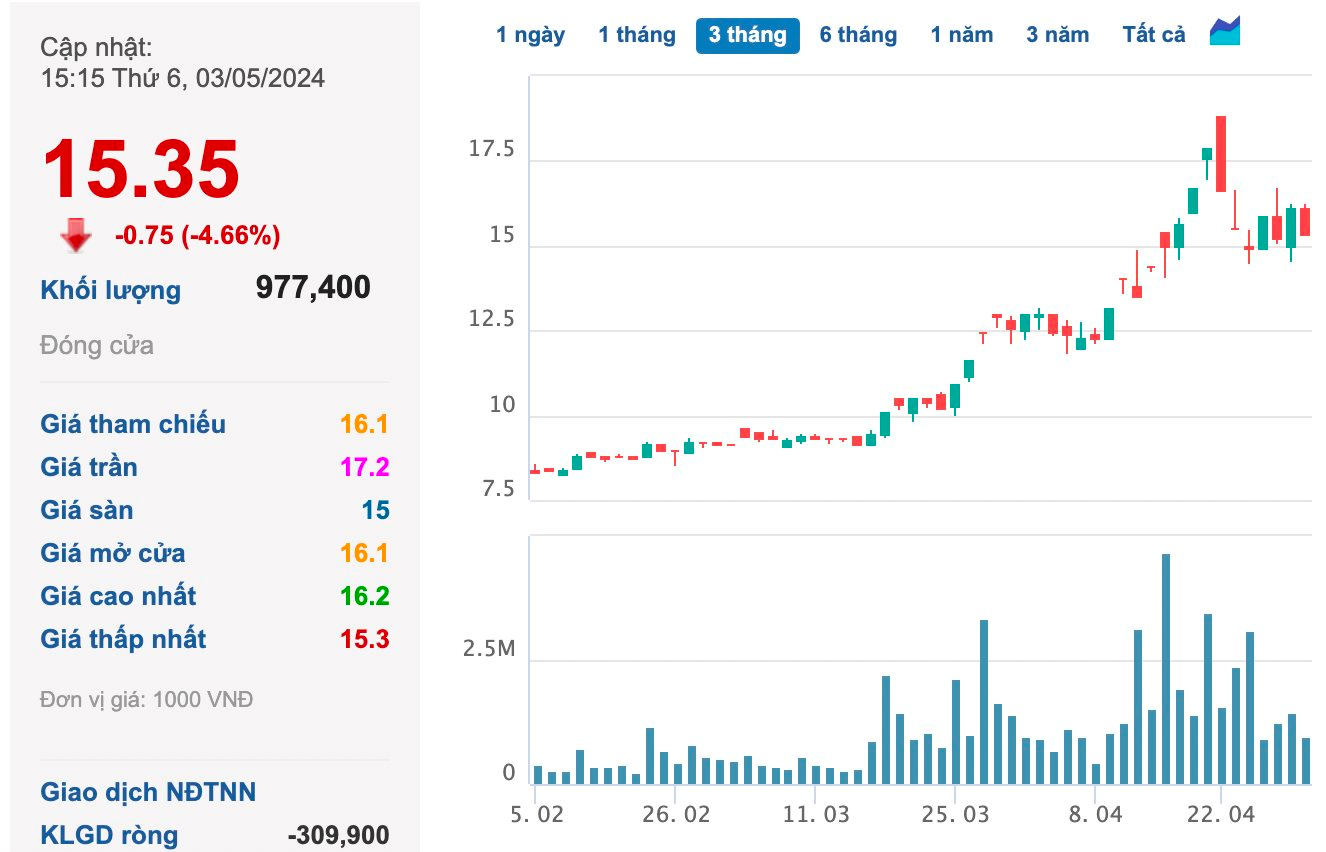

In other developments, Koji Asset Investment has received a notice from the Ho Chi Minh City Stock Exchange that KPF shares will be put on the warning list from April 11, 2024 due to the auditing organization having an exception opinion on the financial statements audited in 2023 of this enterprise.