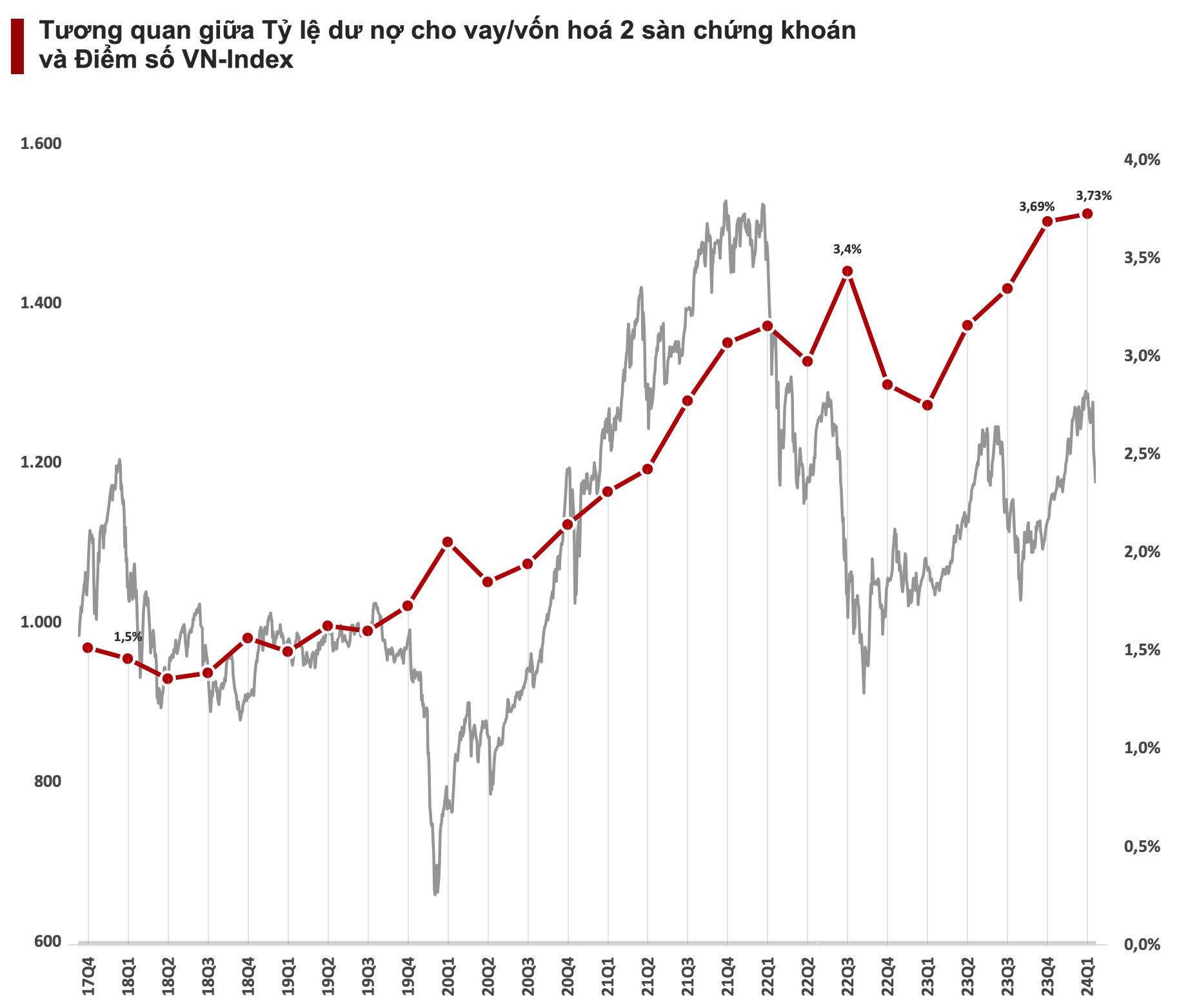

Brokers’ loan balance continued to witness an impressive increase of VND 27,000 billion to approximately VND 207,000 billion at the end of Q1/2024, the highest level in history. Of this amount, loans for margin trading accounted for approximately VND 195,000 billion, while the remainder was for advances to investors for stock sales. The majority of outstanding loans in the market are currently margin loans, and the balance does not include three-party loans or “warehouses”.

As of March 31, 2024, the market capitalization of listed stocks on the HoSE and HNX exchanges reached nearly VND 5.6 million billion. Thus, the ratio of Loan balance/Market capitalization of the two listed stock exchanges is estimated to be around 3.73%. This figure rose by another 0.04 percentage points compared to the record high of 3.69% at the end of 2023, setting a new milestone in the history of the stock market.

Using leverage (margin) is one of the effective tools that help investors increase their account size rapidly if used reasonably. It boosts liquidity abundantly and motivates the upward momentum of the overall market. Notably, the context of low interest rates and a positive market outlook has spurred investors to participate more vigorously. The VN-Index gained 14% in the first three months of the year, while the margin balance increased by approximately 15% compared to the end of last year.

However, it should be noted that excessive margin increases can also lead to risks. A sharp correction can easily trigger a “margin call” phenomenon, putting pressure back on the market and causing it to fall deeper.

Furthermore, looking at a broader perspective, with the same 1,300-point mark, more than a year ago, in around Q3/2022, the loan balance/capitalization ratio was only about 3.4%. Going further back, the figure for Q2/2021 was significantly lower at 2.4%, even though the VN-Index was at a similar level. This indicates that investors in the Vietnamese stock market are more aggressive in borrowing to invest while the VN-Index has not really broken out.

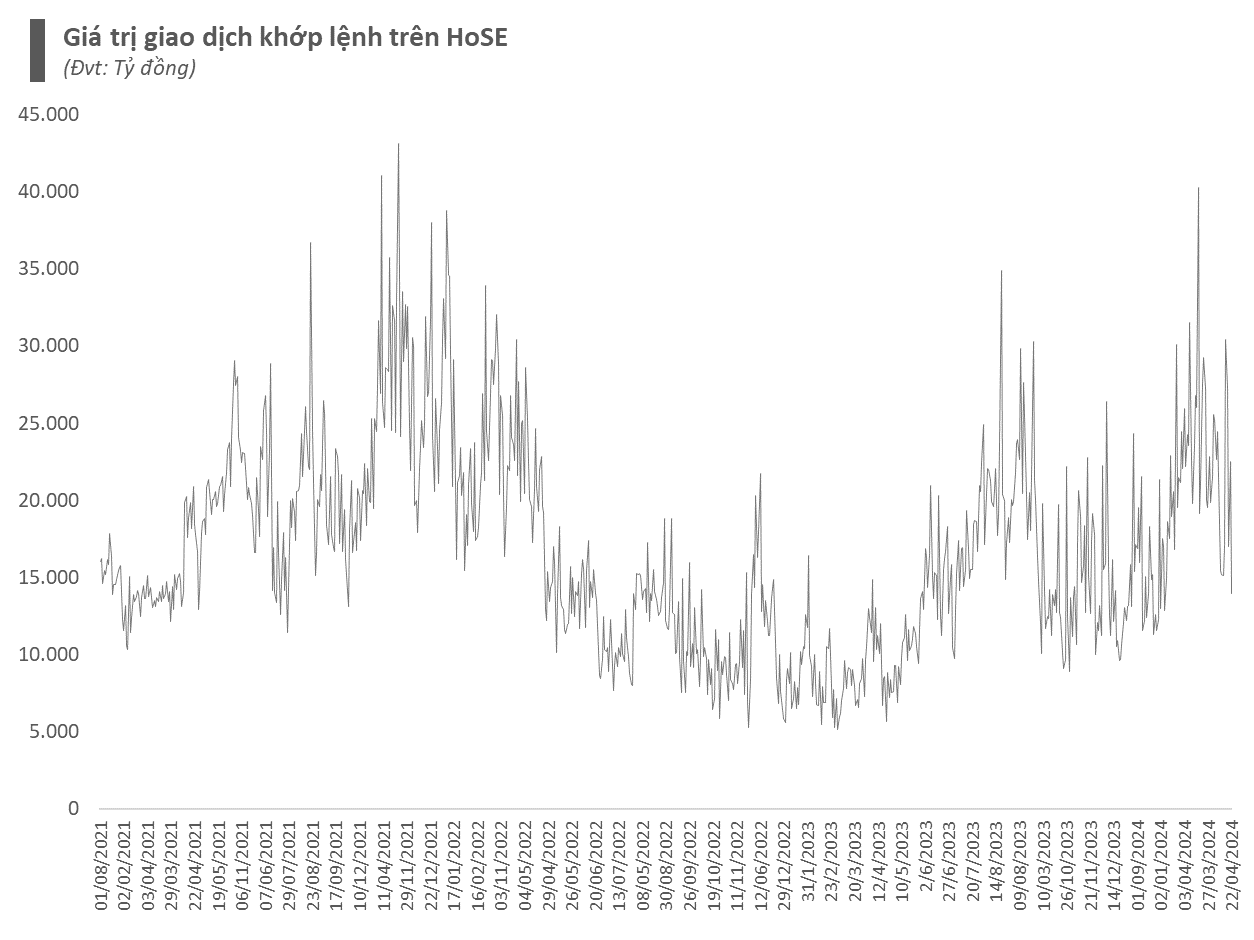

According to Mr. Bui Van Huy – Director of DSC Securities, Ho Chi Minh City Branch, the sharp increase in loan balance shows that margin risks across the market remain latent, but have not increased much compared to Q4/2023. Statistics in the first quarter of 2024 alone show that average trading liquidity on the HoSE exchange was nearly VND 20,000 billion per session, an increase of about 40% compared to the previous weak Q4. The growth is consistent with the index points and occurs amidst improving liquidity.

Another positive factor during this period is the significant improvement in the lending capacity of securities companies after the recent period of active capital mobilization, in contrast to the tight “room” in previous periods. The total equity of the securities companies group is around VND 235,000 billion, an increase of VND 16,000 billion compared to the beginning of the year. Therefore, despite the strong increase in loan balance, the Margin/VCSH ratio is about 83%. A simple calculation based on the regulation that “a securities company is not allowed to provide margin loans exceeding twice its equity at any one time” indicates that securities companies still have VND 277,000 billion available to lend to investors for margin trading in the near future.

According to Mr. Huy, the margin/capitalization ratio of the Vietnamese stock market is currently very high compared to other markets; however, what sets it apart is that outstanding loans in the market have long been considered a partial substitute for bank loans, serving large shareholders who borrow capital by pledging stocks instead of being used solely as leverage for stock investors. Therefore, the increase in outstanding loans among individual investors accounts for only a portion, while the rest comes from institutions and major players in the market. The current context does not yet indicate significant risks affecting these groups of investors, and international and domestic factors need to be monitored further.

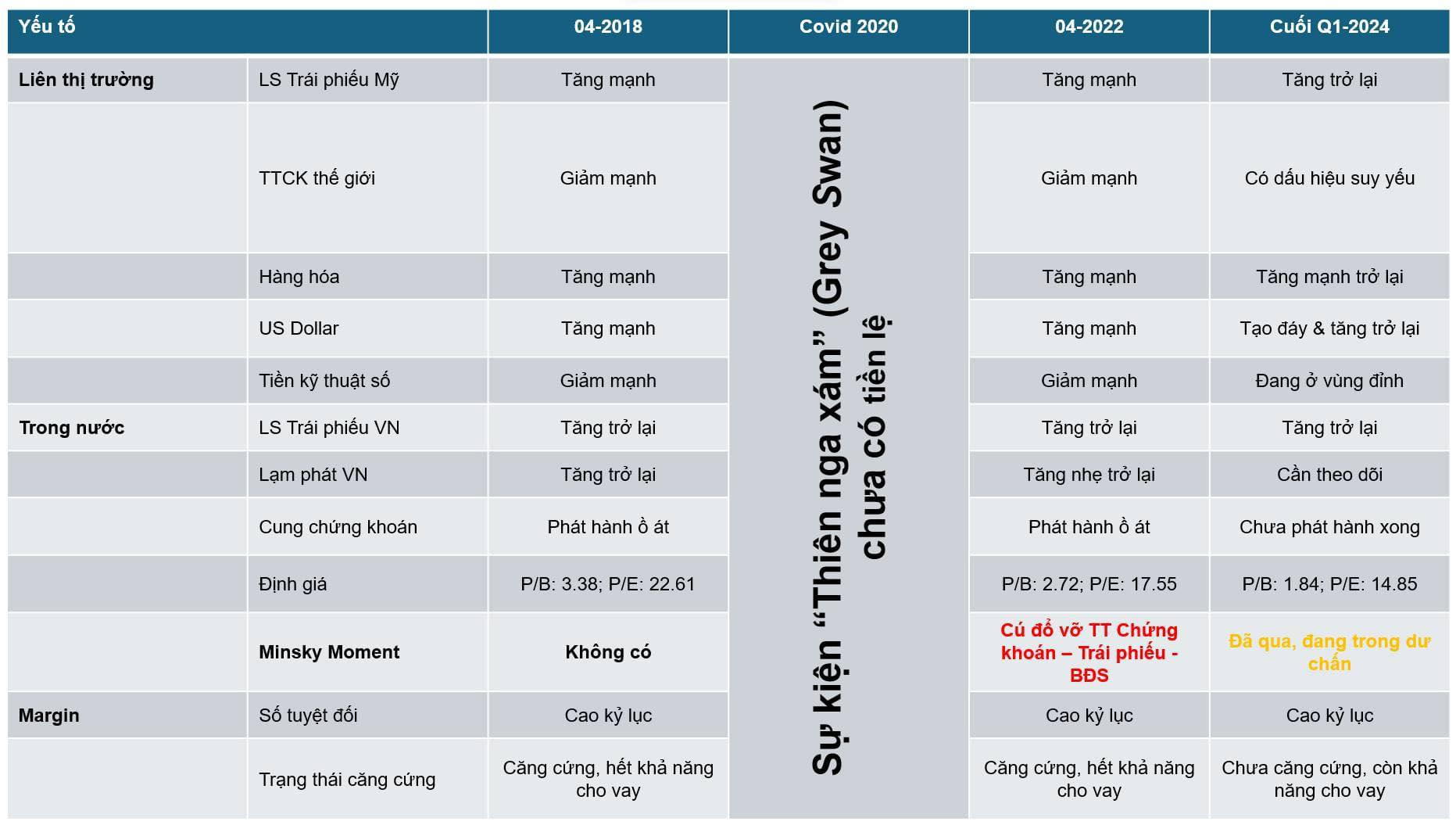

Comparison of time periods when the market peaked and corrected sharply

Commenting on recent developments, the Director of DSC assessed that in the short term, the market may face considerable pressure related to loan balance and is likely to “pay the price” for the historically high margin, with the possibility of “margin calls” occurring. Nevertheless, the probability of the VN-Index falling by 15-20% is highly unlikely. The threshold around 1,170 points will provide strong support during this period of decline. The market can only “break” the above threshold when domestic growth pillars are clearly breached, and the global stock market experiences a sharp downturn.