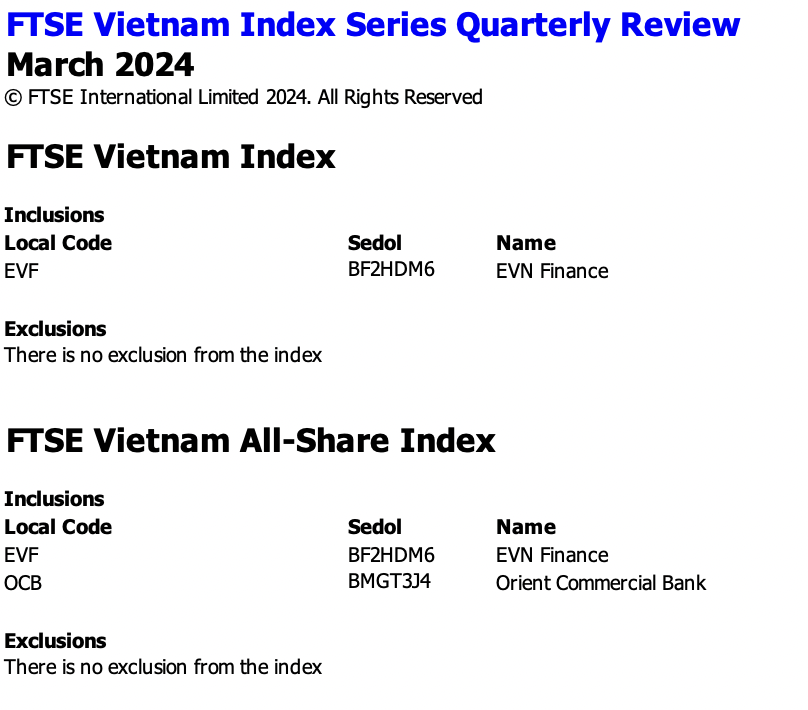

In the Q1 2024 review, FTSE Russell added Electric Financial Corporation (EVF) stock to the FTSE Vietnam Index without removing any stocks.

Additionally, EVF and Oriental Commercial Bank (OCB) stock were added to the FTSE Vietnam All-Share Index, while no stocks were removed from the index.

After the Q1 2023 review, the number of stocks in the FTSE Vietnam Index increased to 27. The new portfolio will take effect after the close of trading on Friday (March 15) and officially start trading on the following Monday (March 18).

The FTSE Vietnam Index is the reference index for the FTSE Vietnam ETF. As of February 29, the total net asset value of foreign funds reached $360 million (about VND 8.9 trillion). The investment performance of this ETF from the beginning of 2024 to date is nearly 5.5%.

As of the end of January 2024, the FTSE ETF portfolio primarily focuses on financial, real estate, consumer goods, and industrial sectors. The most heavily held stocks include HPG, VHM, VIC, VNM, VCB, MSN, SSI,…

Prior to this, SSI Securities accurately predicted that the FTSE Vietnam Index would add financial sector stock EVF as it met all the requirements. EVF is currently a rare listed financial company on the stock exchange.

According to SSI, approximately 5.5 million EVF shares will be purchased by the FTSE ETF to add to the portfolio.

In the early morning of March 8 (Vietnam time), MarketVector Indexes will announce the portfolio of the MarketVector Vietnam Local Index – the benchmark index of the VNM ETF.