According to preliminary statistics from the General Department of Customs, in March 2024, the country imported 428,853 tons of fertilizer, equivalent to USD 123.33 million, with an average price of USD 287.6/ton, up 52.3% in volume and 34.7% in value compared to February 2024. Compared to March 2023, it increased by 47.2% in volume and 9% in value.

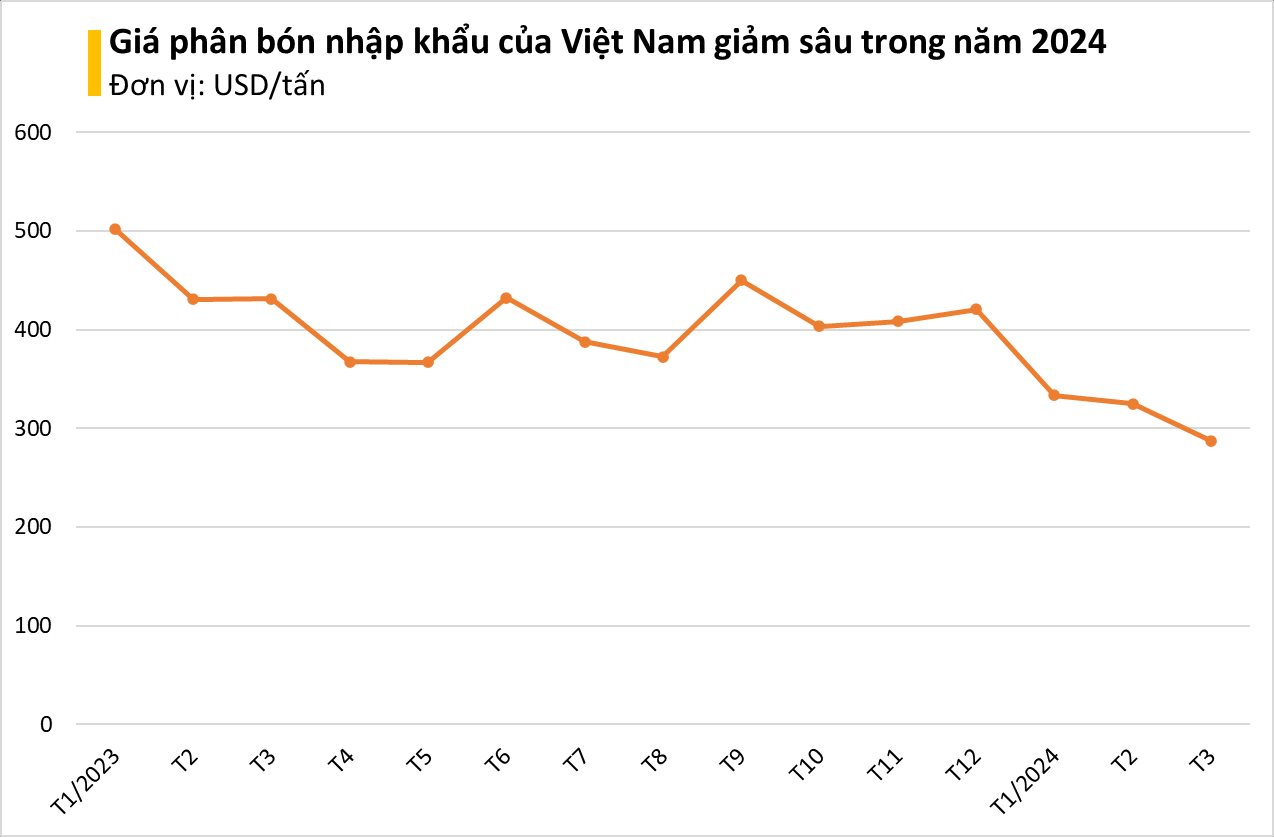

In the first three months of 2024, the total volume of fertilizer imported by the country reached over 1.12 million tons, valued at nearly USD 351.9 million, with an average price of USD 314.2/ton, up 82.8% in volume, 48.2% in value but decreased by 18.9% in price compared to the first three months of 2023.

China continued to lead the market in supplying fertilizer to Vietnam in the first quarter of 2024, accounting for 41.6% of the total volume and 29.6% of the total fertilizer import value of the country, reaching 466,409 tons, equivalent to USD 104.16 million, with an average price of USD 223.3/ton, up 54.5% in volume, but down 3.1% in value and down 37.3% in price compared to the first three months of 2023.

Next, the Russian market ranked second, accounting for 12.5% of the total volume and 23.8% of the total value, with 140,435 tons, equivalent to USD 83.81 million, with an average price of USD 596.8/ton, increasing 573% in volume, 574.6% in value, and 0.2% in price compared to the first three months of 2023.

Laos is the third import market for Vietnam, reaching 83,7 thousand tons, equivalent to USD 22.7 million, increasing by 105.73% in volume and 32.06% in value compared to the first quarter of 2023.

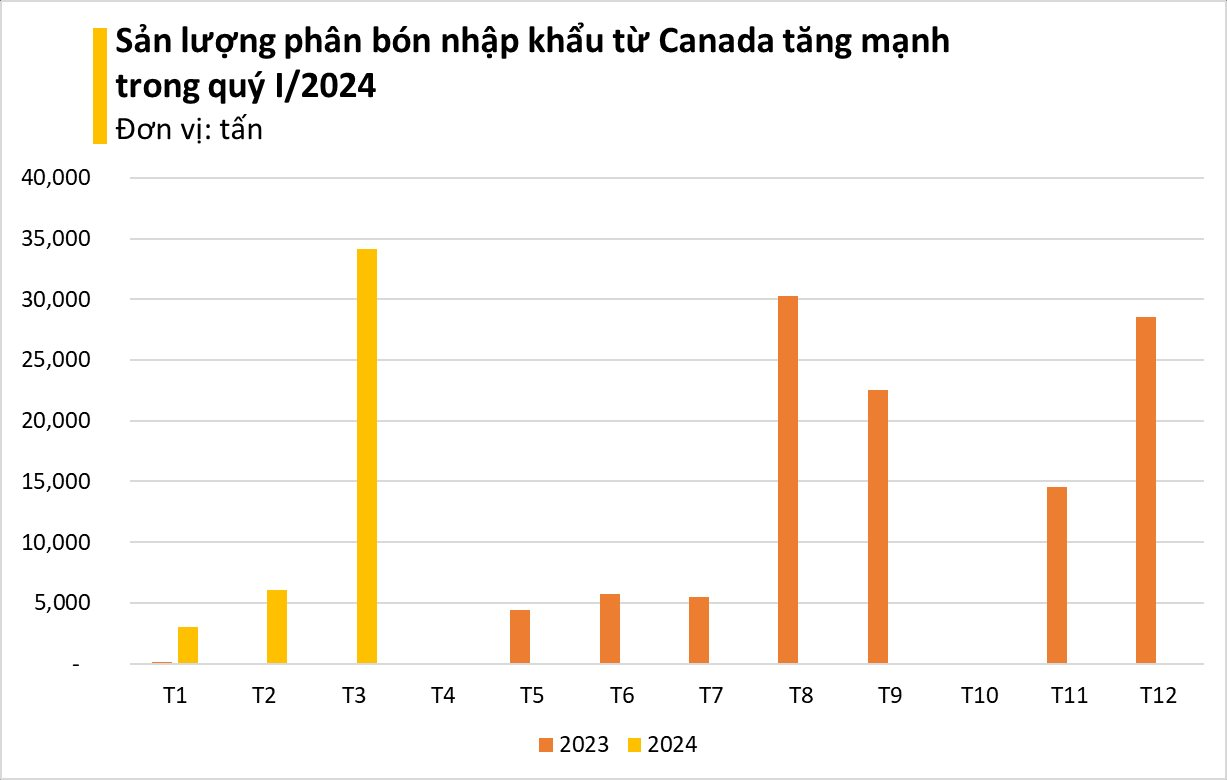

Overall, in the first three months of 2024, fertilizer imports from most markets increased in volume but decreased in value compared to the first three months of 2023. The highlight is Canada with a sharp increase in imports.

Specifically, in March 2024, Vietnam imported 34,147 tons of fertilizer from Canada, valued at USD 11.7 million, representing a dramatic increase of 81,202% in volume and 8,099% in value compared to March 2023.

In the first three months of the year, the country supplied Vietnam with over 40,000 tons of fertilizer, equivalent to USD 13.6 million, up 28,386% in volume and 5,170% in value compared to the same period last year. The average import price from Canada was USD 338.2/ton, down by 81.5% compared to the same period last year.

Vietnam currently imports types of fertilizer that are scarce or cannot be produced domestically. For example, DAP, Vietnam can only produce from 400,000 – 500,000 tons, but the demand for use is up to nearly 1 million tons, so it has to be imported; or ammonium sulfate (SA), Vietnam imports from 900,000 – 1 million tons each year. In addition, potash fertilizer (MOP), Vietnam also has to import the entire amount, fluctuating at 1 million tons/year.

The domestic fertilizer supply does not depend entirely on foreign markets. Some types of fertilizers that Vietnam both produces for domestic use and exports are UREA or Super Phosphate…

China is the world’s largest exporter of phosphate and a major supplier of urea, but since 2021, it has implemented measures including export quotas and lengthy inspections of fertilizer components to lower domestic prices. In September 2023, the government continued to request some of the country’s top urea producers to temporarily halt exports.

This has caused the global fertilizer market to be chaotic, especially in countries that have to rely on imported fertilizers to ensure food production for domestic demand. Uncertainties in the Red Sea and the prospect of tighter Chinese exports could cause fertilizer prices to rise slightly in 2024 compared to previous years.