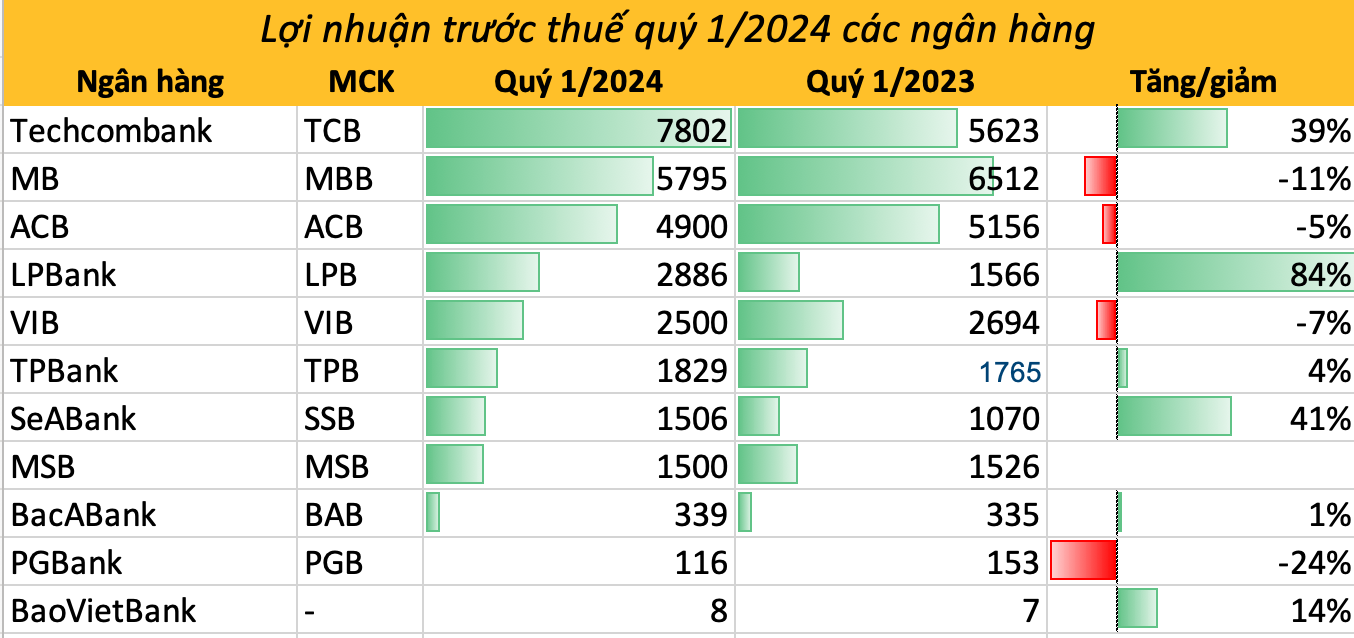

Profit before tax. Unit: Billion VND

On April 23, the two banks MSB and TPBank held their Annual General Meeting of Shareholders for 2024. At the General Meeting, the bank’s leaders disclosed the business results of the first quarter of 2024.

MSB: Pre-tax profit of more than VND 1,500 billion

MSB’s CEO, Mr. Nguyen Hoang Linh, said that at the end of the first quarter, total assets reached over VND 280,000 billion, an increase of more than 4%. Despite the slowdown in overall credit growth in the banking industry, MSB’s credit growth in the first quarter of 2024 is estimated to have reached over 5%. Loans to customers reached VND 158,000 billion, an increase of 4.7%. Deposits reached VND 138,000 billion, up 4.1%.

At the end of the first quarter of 2024, the bank recorded an interest income of more than VND 550 billion from foreign exchange trading, equivalent to 54% of the net interest income for the whole year of 2023. Pre-tax profit for the first quarter reached over VND 1,500 billion, a slight increase compared to the previous year. CIR decreased to 33%, overall NIM 3.87%; CASA increased by 14.64% and accounted for 29% of total deposits, an increase compared to the same period last year.

TPBank: Pre-tax profit reaches over VND 1,800 billion

Mr. Nguyen Hung, General Director of TPBank, said that this year the bank’s target is to achieve a pre-tax profit of VND 7,500 billion, an increase of 34%. The positive results in the first quarter show that the business plan submitted to the GMS is feasible. Specifically, in the first 3 months of the year, TPBank’s profit reached VND 1,829 billion and is expected to reach over VND 2,500 billion by the end of April. The bad debt ratio is also gradually decreasing.

Last year, TPBank increased its risk provisions, which was the main reason for the decline in profit, as it failed to meet the plan. It is expected that in 2024, the burden of provisions will be reduced, and the strict control of asset quality will create more favorable conditions for profit growth.

As of the afternoon of April 23, 11 banks had announced their business results. Six banks have published their financial reports: Techcombank, MB, LPBank, PGBank, BacABank, BaoVietBank. Besides, many banks have announced their preliminary business results, such as SeABank, ACB, VIB, TPBank, and MSB.

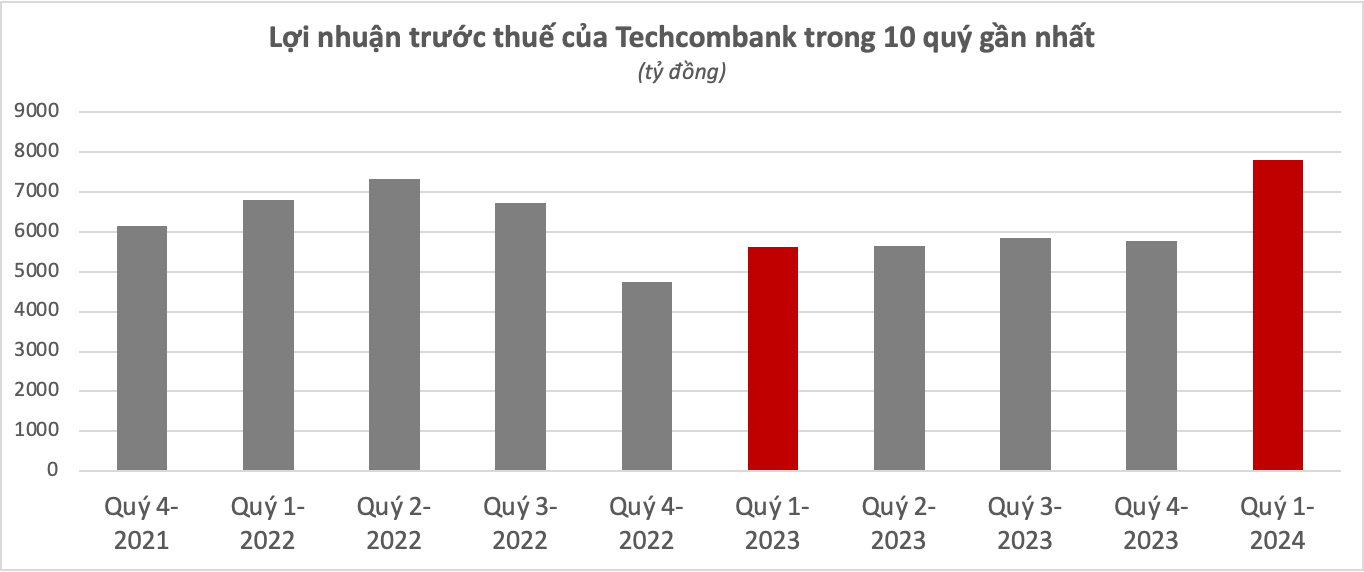

Techcombank: Pre-tax profit reached VND 7,802 billion, up 38.7%

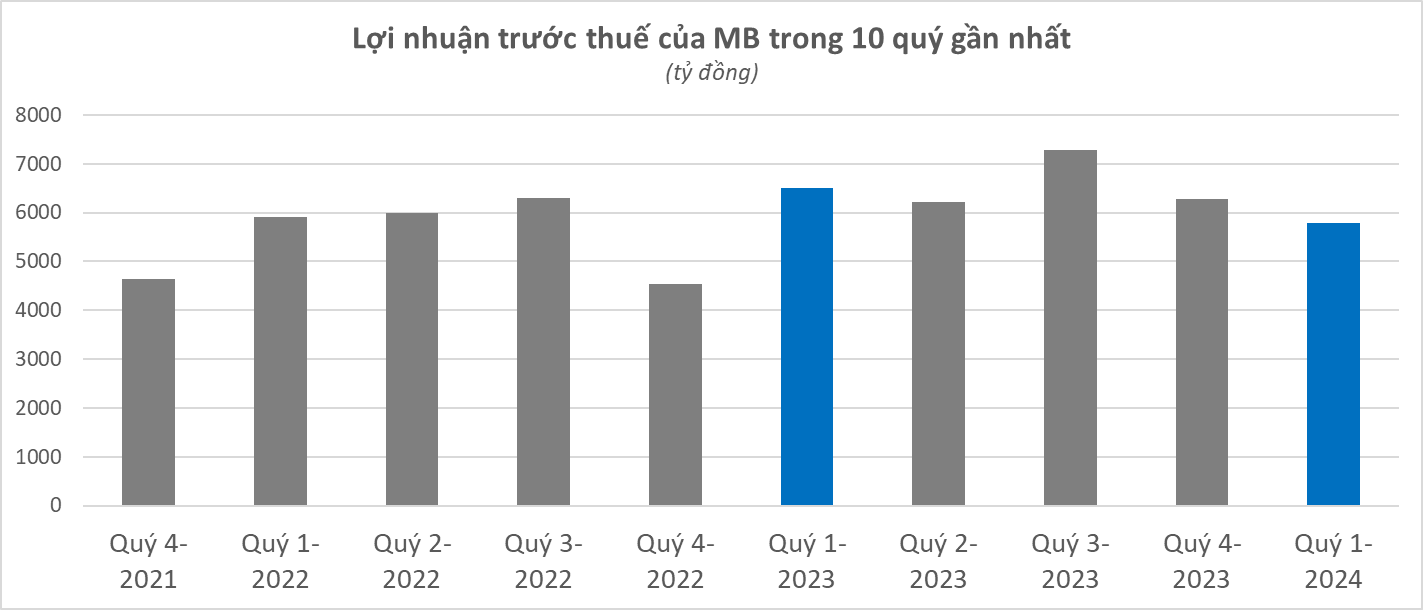

MB: Pre-tax profit of nearly VND 5,800 billion, down 11%

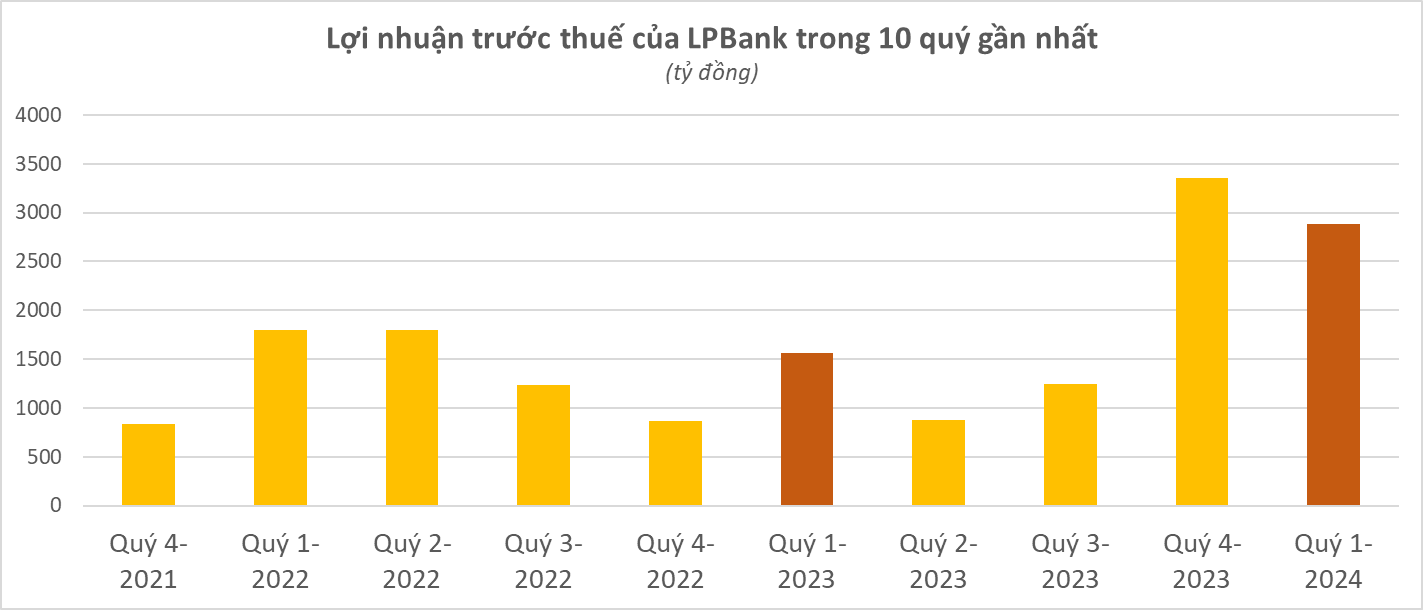

LPBank: Pre-tax profit of nearly VND 2,900 billion, up 84%

BacABank: Pre-tax profit of VND 339 billion, up 1%

PGBank: Pre-tax profit of VND 116 billion, down 24%

VIB: Pre-tax profit of over VND 2,500 billion

SeABank: Pre-tax profit of over VND 1,500 billion, up 41%

ACB: Pre-tax profit is expected to reach VND 4,900 billion