Illustrative photo

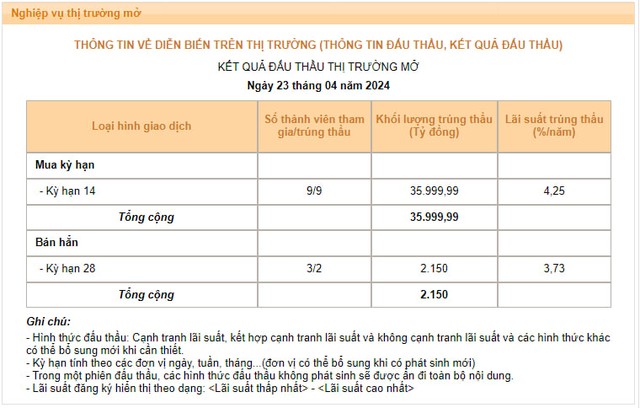

The trading session yesterday, April 23, witnessed a significant development in the open market when the State Bank of Vietnam (SBV) lent nearly VND 36,000 billion to 9 credit institutions through the government securities repo (OMO) channel with a term of 14 days and an interest rate of 4.25%/year. This is the strongest OMO liquidity support session in many years, only behind the record high of over VND 42,000 billion set on January 24, 2017.

Compared to the previous session, the SBV’s lending scale has increased more than 4 times, while the term has also increased from 7 days to 14 days. Notably, the OMO lending interest rate has increased to 4.25%/year from 4%/year in previous trading sessions.

On the other hand, the OMO loan with a term of 7 days that took place on April 16 with a total value of nearly VND 12,000 billion has matured. After netting, the SBV injected nearly VND 24,000 billion through the OMO channel in the session on April 23.

On the other hand, the Central Bank continues to maintain the issuance of new Treasury bills with a winning volume of VND 2,150 billion, a term of 28 days, and an interest rate kept at 3.73%/year, the highest since the reopening of this channel. Also in the session on April 23, the Treasury bill issued on March 26 matured, returning VND 3,700 billion of liquidity to the market.

In both OMO and Treasury bills, the SBV has injected a net total of VND 25,550 billion into the banking system in the session on April 23.

Source: SBV

Analysts say that the SBV’s increased OMO lending and the adjustment of the term to 14 days are aimed at supporting system liquidity in the context of the peak period of payments and balances at the end of April approaching, especially when the break for the holidays of April 30 – May 1 this year will last up to 5 days. In addition, the increase in the OMO interest rate is also a reasonable move because the loan term has increased from 7 days to 14 days, and this will help establish a higher interbank interest rate level, thereby indirectly supporting the exchange rate.

According to Mr. Tran Ngoc Bau, CEO of WiGroup, the SBV’s 7-day OMO lending interest rate has always been 4% so far, so the 14-day term interest rate is 4.25% (as in the session on April 23), while the 22/04 session is not stable. “The longer term should have a better yield,” said Mr. Bau.

In addition, the VND 36,000 billion OMO winning level with a term of 14 days is also reasonable because partly to “cover” for the OMO loans maturing last week, and a large part is to “cover” for a long holiday period. in the end of the month.

The Wigroup CEO said that the high demand for OMO loans from banks is seasonal, not due to the impact of gold and USD intervention sales, because the scale of VND counterpart absorption through this activity is quite small, not enough to make system liquidity tight.

Sharing with the author, an expert with many years of experience in the bond business – the capital source at the bank also said that the banks’ need for large support from the SBV in the session on April 23 was mainly due to the demand for liquidity of large banks increased at the end of the month. At the same time, raising the OMO winning interest rate is also a way for the SBV to coordinate tools to narrow the USD – VND interest rate gap, combined with selling USD at a certain price level to stabilize the exchange rate.

“The swaps gap increases, or positive, combined with a good inflow of foreign currency, the SBV may not need to sell reserves, or sell less,” he said.

Previously, as we reported, from April 19, the SBV has publicly announced the intervention sale of foreign currencies to banks with negative foreign currency status to transfer foreign currency status to 0, with the intervention exchange rate being VND 25,450.

“This is a very strong measure of the SBV to ease market sentiment, ensure market supply, smooth supply of foreign currency, and fully meet the legitimate foreign currency needs of the economy,” said Mr. Pham Chi Quang at a press conference. Information on the banking operations results in the first quarter of 2024 took place on April 19.

In addition to being ready to meet the demand for foreign currency for the banking system, the SBV also continues to maintain regular Treasury bill auctions with increasing interest rates to control and raise the price level of VND interest rates on the interbank market. For banks in need of support, the SBV is ready to lend through the OMO channel, but these banks must accept an interest rate that is not cheap (from 4% or more)

The parallel use of two instruments, Treasury bills, and OMO is assessed to serve the dual goal of both ensuring liquidity for the banking system to maintain a low interest rate level in the market and at the same time reduce pressure on the exchange rate. through narrowing the USD – VND interest rate gap in the interbank market.