The Aviation Sector’s Positive Outlook in 2024

In stark contrast to the broader market’s unfavorable trajectory in 2023, the aviation sector has shown resilience. While Warehouse, Logistics, and Maintenance stocks have performed in line with the market since the beginning of 2024, Aviation Services have outperformed after news of a price ceiling increase for domestic flights from March 1, 2024.

Yuanta Securities believes the aviation industry has overcome its challenges, citing four key reasons:

1. Stable Oil Prices

Oil prices are expected to remain stable in 2024 as supply-demand imbalances persist, with a current deficit of 1.11 million barrels as per February 2024 data. Historically, oil prices tend to rise during supply-demand shortages.

Oil inventories in both the OECD and the US are projected to remain flat in 2024, with total inventories currently at 3.9 billion barrels, 2% lower than the 2023 average. This will help stabilize oil prices throughout the year.

According to the EIA’s April 2024 forecast, the average oil price will be $90 per barrel in Q2/2024 and $89 per barrel for the entire year. Fuel costs represent approximately 25%-28% of airlines’ operating expenses. With oil prices stabilizing around $90 per barrel, higher than the 2023 average but not overly burdensome, the aviation industry’s profit margins will not be significantly impacted. However, geopolitical factors that could potentially drive up oil prices should be monitored.

2. Rebounding Demand for Travel and Cargo

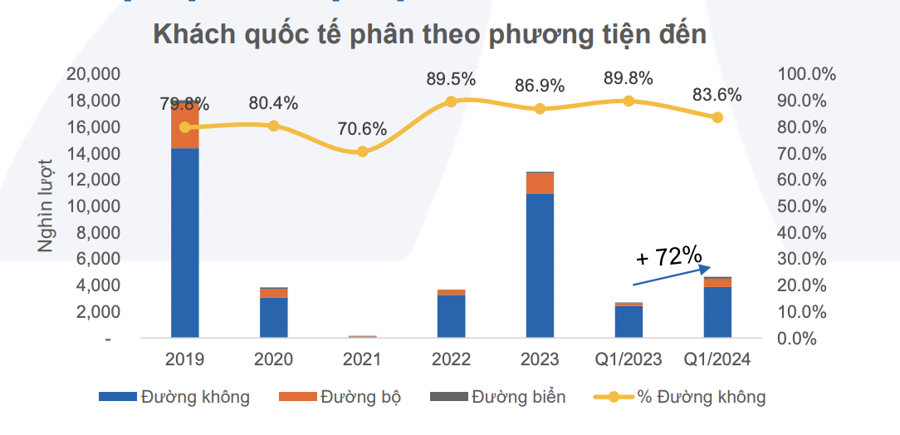

Travel and freight demands continue to recover, with international passenger traffic increasing. In 2023, international visitors to Vietnam increased threefold compared to 2022, reaching 70% of pre-COVID levels.

The first three months of 2024 saw a strong 72% increase in international arrivals compared to the same period last year, to 4 million passengers. Furthermore, air travel is becoming more popular than before the pandemic, with 87%-89% of travel occurring via air in 2022-2023, compared to 80% in 2019.

Chinese tourists are expected to return to pre-pandemic levels by the end of 2024. In 2023, tourism from China recovered more slowly than from other regions, accounting for 13.8% of international arrivals compared to over 30% pre-pandemic. However, Chinese visitors to Vietnam have increased significantly since the beginning of 2023, reaching 19.2% in the first three quarters of 2024.

The new visa policy implemented in September 2023 is further boosting tourism growth in 2024. International arrivals have increased significantly since October 2023, following the introduction of the new policy: visa exemptions for 25 countries extended from 15 to 45 days; electronic visas for all countries; and longer validity periods for electronic visas.

Domestic tourism has also rebounded, growing by 7% in 2023, aligning with pre-pandemic annual growth rates of 6%-9%.

In Q1/2024, domestic tourism reached 30 million passengers, a 9% increase. Yuanta expects domestic tourism to continue growing strongly in Q2 and Q3/2024 before cooling off towards the end of the year, driven by increased summer travel. Domestic tourism grew by 33% in both Q2/2022 and Q2/2023 compared to the previous quarter.

Air cargo volume declined by 9.3% in 2023 compared to 2022, reaching 87.3% of pre-pandemic levels. Cargo volume is expected to recover more robustly in 2024 as demand improves in line with the recovery of major economies.

3. Domestic Flight Price Ceiling Increase

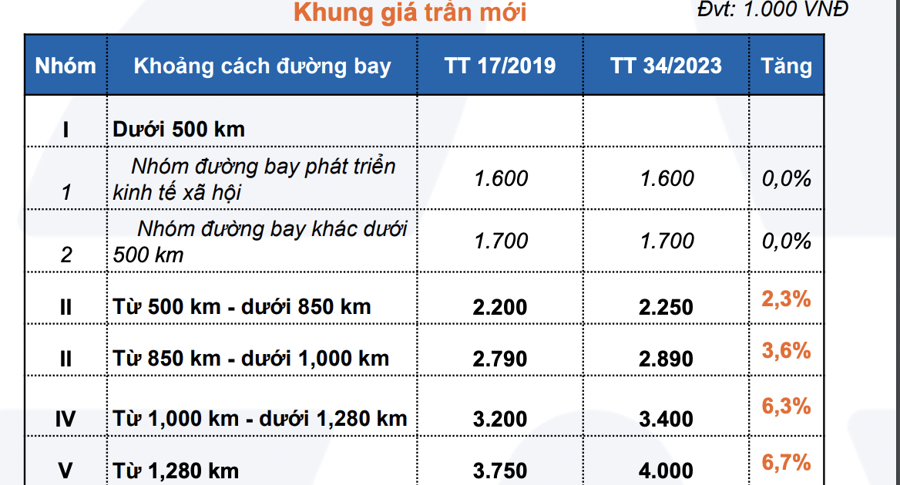

Circular 34 of the Ministry of Transport, which supplements Circular 17, allows for an increase in the price ceiling for domestic flights, effective March 1, 2024.

The price ceiling applies to economy class passengers and excludes VAT; charges for passenger terminal services and security, such as passenger service charges, security charges, and baggage fees; and additional service charges for other features.

The circular permits airlines to offset input costs, particularly fuel prices. It also provides airlines with flexibility to adjust prices on domestic routes. However, airlines will need to balance ticket prices to ensure operational efficiency and customer satisfaction. As such, prices will continue to be subject to market forces.

4. Long-Term Prospects with Long Thanh International Airport

Long Thanh International Airport will have a total capacity of 100 million passengers and 5 million tons of cargo per year. This will alleviate congestion at Tan Son Nhat International Airport, with 80% of international flights and 12% of domestic flights expected to be transferred to LTA, benefiting both airlines and ACV in the long run.

The project is divided into three phases. Phase 1 will have a capacity of 25 million passengers per year and two cargo terminals with a capacity of 1.2 million tons of cargo per year.

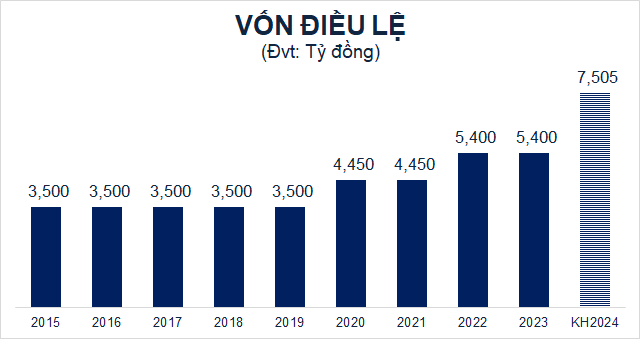

Phase 1 Progress: As per the Prime Minister’s directive, tenders are being accelerated and work is progressing as scheduled. In Q1 and QII/2024, ACV will continue to tender multiple packages for component project 3. Three state-owned commercial banks, Vietcombank, Vietinbank, and BIDV, will sign a financing contract for the project in 2024, amounting to $1.8 billion. The airport is expected to become operational in late 2026, with airlines benefiting from 2027 onwards.

In terms of valuation, the Aviation Services sector is currently trading at an EV/EBITDA of 39.x, significantly higher than the 2018-2019 period, while Warehouse, Logistics, and Maintenance are trading at pre-pandemic levels of around 15.x.

With the expectation of recovering travel demand, Yuanta Securities believes that Warehouse, Logistics, and Maintenance companies are currently undervalued, while Aviation companies require more time to recover.