Vn-Index peacefully ended its trading week before the holiday, disregarding less than positive news such as another postponement of the KRX system due to the State Securities Commission’s disapproval of HoSE’s process. The index fluctuated widely from the trading session’s opening until close, but recovered, rising 4.55% to 1,209 points.

The market breadth remained negative, with 227 stocks declining against 209 gainers. Notably, the retail sector led the gainers, increasing by 2.06%; Chemicals rose by 1.52%, and Real Estate climbed by 1.17%. VIC experienced a substantial spike at one point during the session, thanks to its business performance doubling year-over-year, predominantly due to increased financial activities. Banking stocks also contributed with a 0.17% increase, while Construction stocks rose by 0.71%.

Stocks driving the market upward today included VIC, surging by 2.28 points; HDB, up by 0.78 points; GVR, climbing 0.58 points; MWG, gaining 0.39 points. Additional contributors included TCB, SHB, VCB, and FRT. Conversely, the Securities group underperformed expectations with a 0.97% decline following the KRX postponement; Building Materials fell by 0.50%; and Seafood stocks dipped by 0.25%. Stocks weighing down the index included BID, MSN, GAS, CTG, and HPG.

With the market observing a five-day holiday period, investors remained cautious, resulting in subdued inflows. The three exchanges recorded combined trading value of 17,400 billion VND, with foreign investors unexpectedly turning net buyers to the tune of 220.8 billion VND; specifically in matching orders, they bought 102.8 billion VND worth of stocks.

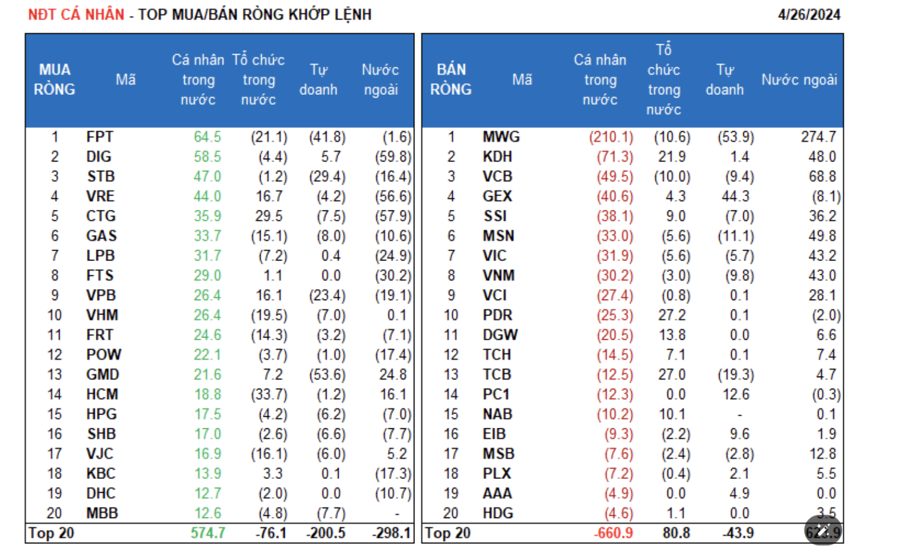

Foreigners’ primary focus for matched-order net purchases was the Retail sector, along with Food and Beverage. Their top matched-order purchases included MWG, VCB, MSN, KDH, VIC, VNM, SSI, VCI, GMD, and HCM.

On the net selling side, foreigners targeted the Financial Services sector. Their top matched-order sales included FUEVFVND, DIG, CTG, VRE, FTS, VPB, POW, NLG, and KBC.

Domestic individual investors bought a net 22.9 billion VND worth of stocks, with 53.4 billion VND in net matched-order purchases. Analyzing matched orders alone, they purchased stocks from 11 out of 18 sectors, primarily concentrated in Banking. Their top purchases were FPT, DIG, STB, VRE, CTG, GAS, LPB, FTS, VPB, and VHM.

They sold stocks in 7 out of 18 sectors, primarily within Retail and Food and Beverage. Their top sales included MWG, KDH, VCB, GEX, SSI, MSN, VNM, VCI, and PDR.

Proprietary traders sold a net 177.6 billion VND, with 170.2 billion VND coming from matched-order sales. In matched orders alone, they bought stocks in 6 out of 18 sectors, focusing primarily on Financial Services, Construction, and Materials. Their top matched-order purchases were FUEVFVND, GEX, PC1, NLG, EIB, DIG, AAA, FUESSVFL, GVR, and PLX.

Net sales were largely in the Banking sector. Top stocks sold by proprietary traders included MWG, GMD, PNJ, FPT, STB, VPB, HDB, TCB, REE, and ACB.

Domestic institutions bought a net 44.6 billion VND worth of stocks, with 14.0 billion VND in matched-order purchases. In matched orders, they sold in 11 out of 18 sectors, with the largest value coming from Financial Services. Their top sales were FUEVFVND, HCM, FPT, VHM, VJC, GAS, FRT, MWG, VCB, and BWE.

Their largest net purchases were in Banking stocks, with PNJ, CTG, PDR, TCB, KDH, REE, VRE, VPB, HDB, and DGW among their top buys.

Block trades today reached 1,687.1 billion VND, a 24.3% decrease from the previous session and representing 9.8% of the total trading value.

Foreign institutions continued to execute sizable block trades today, including the exchange of approximately 2.66 million FPT shares (equivalent to 350.1 billion VND). Domestic individual investors also participated in significant block trades, particularly in EIB and TCB.

The distribution of cash flow increased in Real Estate, Steel, Chemicals, Aquaculture and Seafood, Oil and Gas Equipment, Warehousing Logistics and Maintenance, Industrial Machinery, while decreasing in Banking, Securities, Food, Retail, Information Technology, and Construction Materials.

Analyzing matched orders alone, the proportion of trading value increased in the mid-cap VNMID and small-cap VNSML groups, but declined in the large-cap VN30 group.