On April 26, PAN Group Corporation (HSX: PAN) held its 2024 Annual General Meeting of Shareholders (AGM) to assess business results for 2023 and approve its 2024 plan with projected continuous increase in revenue and profit targets.

Overview of PAN Group AGM

Parent company’s profit for shareholders skyrockets by 109%

The 2024 AGM approved the business plan with net revenue of VND 14,780 billion and after-tax profit of VND 882 billion, representing a respective 12% and 8% growth compared to 2023. The target after-tax profit for the parent company’s shareholders is VND 447 billion, an increase of 10% compared to last year.

The revenue growth plan is relatively positive for several companies in the agriculture sector, increasing by 16% with the main driver being the branded rice segment and the crop protection segment.

The food segment is expected to grow by 17% with the market recovering and positive signals from new products in the export market.

The seafood segment plans to increase slightly by 5% compared to last year as the market remains sluggish and the selling price is still low.

This plan was developed in the context that 2024 is still expected to be a challenging year with the global economy showing no clear signs of recovery and uncertainties in monetary policy, inflation control, and geopolitical instability worldwide.

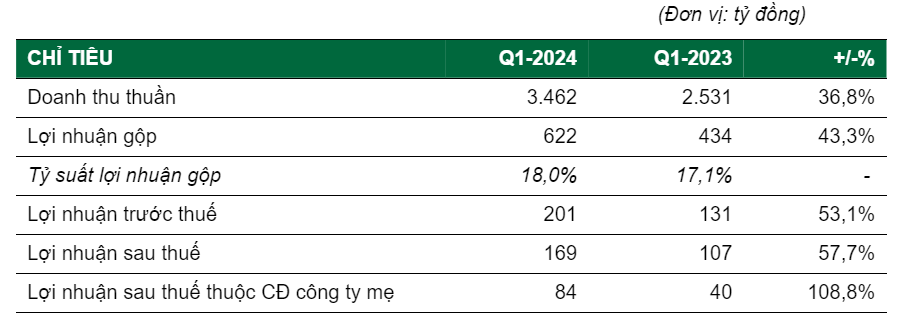

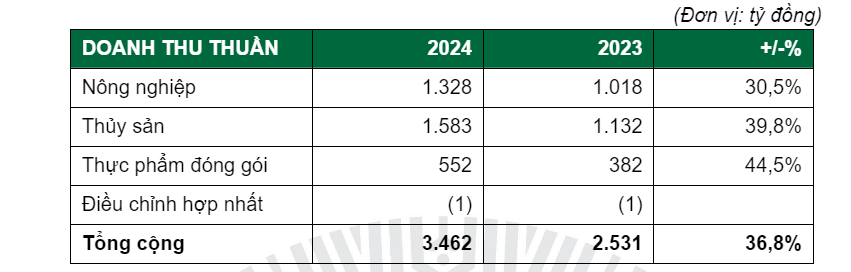

At the 2024 AGM, the Group also officially announced the business results for Q1/2024, with net revenue reaching VND 3,462 billion, a 36.8% increase year-over-year, thanks to all of the Group’s business segments growing by 30-45%. Of which, shrimp export revenue accounted for 42%, increased by 45% compared to Q1/2023, and crop protection accounted for 28%, with a 40% growth.

The consolidated gross profit margin increased by 0.9 percentage points to 18%; pre-tax profit reached VND 201 billion, up 53% compared to the same period in 2023; and after-tax profit reached VND 169 billion, up 58%. The parent company’s after-tax profit for shareholders reached VND 84 billion, more than twice the profit of Q1/2023.

Business results for Q1/2024 compared to the same period in 2023:

The Group’s high profit growth came from most of the business segments with high sales revenue due to the recovering market demand and results of the sales strategy, cash flow optimization, taking advantage of supplier discounts, and raw material optimization to reduce the cost of goods sold and manufacturing costs.

In addition, the positive Q1/2024 growth is due to the low base in the same period in 2023 amidst challenging general market conditions.

At the end of Q1, PAN Group had achieved 23% of the business plan and 19% of the profit target after tax and profit for shareholders of the parent company. Although not the peak production season, the Group had a favorable start in Q1.

Expected 5% cash dividend

At the 2024 AGM, PAN Group also reported on its 2023 business performance with consolidated revenue reaching VND 13,205 billion, a slight decrease of 3% compared to 2022, and completing 90% of the plan. The main reason is the decline in the seafood and packaged food sectors due to negative developments in the general domestic and export markets.

However, this decline was offset by growth in the agriculture sector, with the main growth drivers being the crop protection business and the packaged rice segment, in the context of high rice prices.

Chairman of the Board of Directors Nguyen Duy Hung and General Director Nguyen Thi Tra My at the AGM

In 2023, Vietnam’s economy and financial system went through extremely difficult times. During that time, PAN Group had about VND 1,000 billion in bonds due. All bonds were paid on time, without the need for external borrowing.

Along with a healthy asset structure with a safe leverage ratio, the advantage of deep-processed products, traceability, and high-profit margins helped PAN Group overcome the “headwinds” and achieve a profit above plan.

Accordingly, the after-tax profit for shareholders of the parent company reached VND 408 billion, an increase of 9% compared to 2022, although the 2022 profit recorded an extraordinary gain from the transfer of the factory. Excluding this extraordinary gain when making the comparison, the profit from core business activities in 2023 saw a growth of up to 23% compared to the same period.

With the positive profit situation in 2023, PAN Group plans to pay a cash dividend at a rate of 5% of the par value and will strive to maintain this minimum level in subsequent years, ensuring the interests of shareholders. PAN’s goal is to maintain a cash dividend policy and gradually increase the rate each year.