MWG Reports Positive Q1 Results, Driven by Air Conditioner Sales

A store of MWG‘s Luxury Store chain in Ho Chi Minh City – Photo: Huy Khai

|

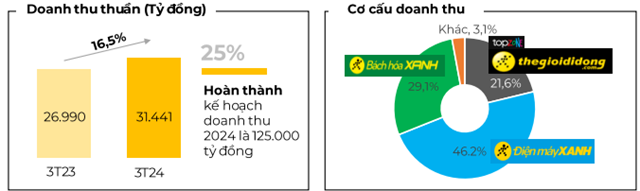

In the first three months of 2024, MWG reported net revenue of over VND 31.4 trillion, a 16.5% increase year-over-year, accounting for 25% of its annual target of VND 125 trillion.

Dien May Xanh (DMX) contributed 46.2% to the revenue, the highest among the chains, followed by Bach Hoa Xanh (BHX) with 29.1%, and The Gioi Di Dong (TGDĐ), including TopZone, contributing 21.6%.

Source: MWG

|

As of the end of March 2024, MWG operated a total of 5,596 stores, including 1,071 TGDĐ stores, 2,184 DMX stores, 1,696 BHX stores, 526 An Khang pharmacies, 64 Ava Kids stores, and 53 EraBlue stores.

Since the beginning of the year, the TGDĐ, DMX, BHX, and An Khang chains have all reported a decrease in the number of stores compared to the start of the year, while Ava Kids remained unchanged and EraBlue increased significantly. Compared to the same period last year, the number of stores has decreased significantly, particularly in the TGDĐ and DMX chains, following a challenging operating period for the industry and MWG‘s comprehensive restructuring.

Source: Author’s compilation

|

Air Conditioner Sales Continue to Excel

The combined revenue of the TGDĐ and DMX chains in the first three months of the year reached VND 21.3 trillion, an increase of 7% year-over-year. The primary driver was the home appliance category, which grew by double digits, with air conditioners showing an increase of nearly 50%.

It is worth noting that in the challenging year of 2023, most of MWG‘s product categories experienced negative growth, with the exception of air conditioners.

Gross profit margin improved in Q1 2024, which according to MWG can be attributed to the home appliance category’s stable gross profit margin, which has increased its contribution to revenue. Additionally, the company’s advantage of a comprehensive product portfolio, diverse shopping options, promotional programs, and attractive financial support solutions, which are a result of market share consolidation and expansion efforts in 2023, has also played a role.

MWG also reported that operating efficiency and absolute profit have shown positive changes after six months of rigorous restructuring and reviewing operations to achieve leanness and efficiency.

Online sales reached approximately VND 3.5 trillion, accounting for 16% of total revenue for the two chains.

Bach Hoa Xanh Revenue Increases by 44%, Maintains Break-Even Point

In the first three months of the year, the BHX chain’s revenue surged by 44% compared to the same period last year, reaching over VND 9.1 trillion, equivalent to an average of VND 1.8 billion per store per month. According to MWG, the growth was driven by both fresh food and FMCG categories.

The number of average transactions reached approximately 500 receipts per store per day, an increase of 40%, and the average value per receipt increased slightly compared to the same period last year.

MWG stated that due to restructuring efforts, expenses were well-controlled despite the peak period during the Lunar New Year holiday, even during high sales. On a core operating basis, BHX was able to maintain a break-even point after all expenses, corresponding to current operating conditions (except for February, which was an exceptional month due to the chain’s extended Tet holiday closure).

Looking ahead to Q2 2024, MWG expects business results to improve even further as average revenue tends to continue increasing in April, and BHX is closely monitoring targets to reduce operating expenses as a percentage of revenue, particularly logistics costs.

On the stock market, the improvement in business performance is reflected in the share price of MWG. Since the beginning of 2024, MWG‘s share price has increased by more than 28% to VND 54,900 per share as of April 26, with an average liquidity of nearly 10.8 million shares per day.

| MWG Share Price Movement since Early 2024 |

In relation to MWG shares, on April 23, six of the nine member funds of the foreign shareholder group Dragon Capital purchased a total of nearly 4.7 million MWG shares, increasing their ownership in the retail giant from nearly 86.8 million shares (5.93%) to over 91.4 million shares (6.25%).

Based on the closing price of VND 49,800 per share on April 23, it is estimated that the Dragon Capital group spent approximately VND 232 billion on the transaction.

|

Transaction Results of Dragon Capital Group on April 23, 2024

Source: MWG

|