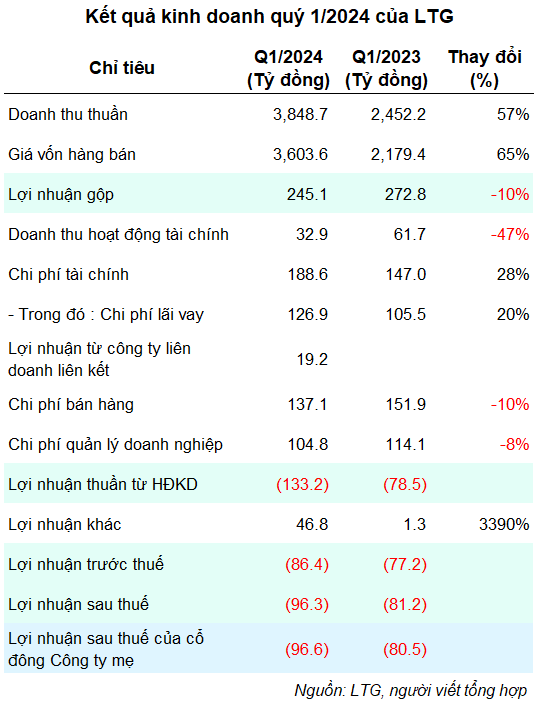

In Q1/2024, Loc Troi reported net revenue of nearly VND 3,849 billion, an increase of 57% year-over-year. Foodstuffs – rice and paddy contributed up to 85% of total revenue, reaching VND 3,286 billion, nearly double that of the same period; offsetting a 40% reduction in revenue from the crop protection segment to VND 371 billion.

During the period, the cost of goods sold increased sharply by 65%, leading to a 10% decrease in LTG’s gross profit to VND 245 billion; the gross profit margin narrowed from 11% in the same period to 6%.

Another negative factor is that financial expenses increased by 28% to nearly VND 289 billion in this period, mainly due to interest expenses and exchange rate losses, with the increase even faster than other revenue/income items.

After deducting expenses, LTG recorded a net loss of nearly VND 97 billion, higher than the loss of VND 81 billion in Q1/2023. The unfavorable start could cause the Company to “miss the target” of pre-tax, interest, and depreciation profit of VND 1,000 billion as presented to the General Meeting of Shareholders.

Previously, 2023 was also a “difficult year” for Loc Troi when its net income after audit was nearly VND 17 billion, a 94% “evaporation” compared to the VND 265 billion in profit reported in the unaudited financial statements and a 96% reduction compared to 2022.

On the balance sheet, as of March 31, 2024, LTG’s total assets were nearly VND 11,913 billion, an increase of VND 445 billion (equivalent to 4%) compared to the beginning of the year. Notably, inventories increased sharply by 43%, reaching over VND 2,816 billion; in contrast, cash and cash equivalents decreased by 63% to VND 226 billion.

On the other side of the balance sheet, liabilities increased by 6% compared to the beginning of the year to nearly VND 8,939 billion, mainly short-term debt. Short-term borrowings and financial lease liabilities increased slightly, reaching VND 6,246 billion, accounting for 70% of total debt.

The 2024 Annual General Meeting of Shareholders of Loc Troi will not be held on April 24 as originally planned and has been extended to be held no later than June 30, 2024, based on the proposal of major shareholders and with the approval of the Board of Directors.

A notable content to be submitted to the General Meeting of Shareholders for approval by the Board of Directors of LTG is the adjustment of the 2023 dividend payment plan from cash to shares, although the ratio of 30% remains unchanged.

Loc Troi “makes a U-turn” to adjust 2023 dividend payment of 30% by shares