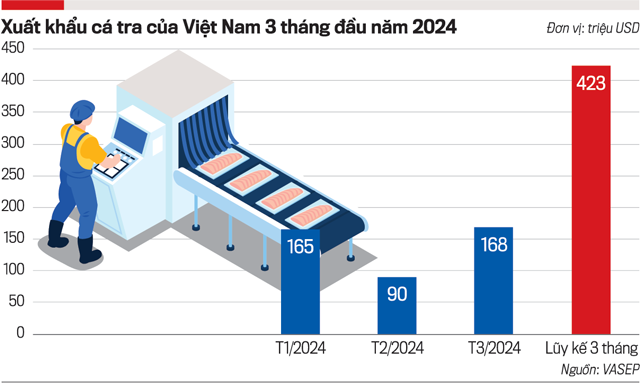

Decline in Pangasius Exports in Q1 2024

According to the Vietnam Association of Seafood Exporters and Producers (VASEP), the decline in pangasius exports during the first quarter of 2024 is primarily attributed to a decrease in imports from major markets like the European Union, China, and South Korea.

Traditional Market Declines

VASEP provides specific data, indicating that Vietnam exported 165 million USD worth of pangasius in January 2024, almost double the amount compared to the same period in the previous year. However, exports took a sharp downturn in February 2024, dropping to 42,000 tons, marking a 40% decrease from the previous month and a 36% reduction compared to February 2023. The export value also fell to 90 million USD, a 32% decrease compared to the same period in 2023.

”In March 2024, pangasius exports reached only 168 million USD, a 12% decrease compared to March 2023. Overall, pangasius exports for the first three months of 2024 totaled 423 million USD, a marginal 0.05% decrease compared to the same period in 2023.”

According to the Vietnam Association of Seafood Exporters and Producers.

In terms of export markets, China and Hong Kong (China) remained the largest markets for Vietnamese pangasius during the first quarter of 2024, although export volumes declined significantly. In March 2024, pangasius exports to China fell by 22%, with an average export price of 1.94 USD/kg, a 1.5% decrease compared to the end of 2023.

The United States, Vietnam’s second-largest export market for pangasius, also experienced a decline. In February 2024, exports reached 16 million USD, an 8% decrease compared to February 2023. However, due to strong performance in January 2024, exports for the first two months of 2024 amounted to 34 million USD, a 25% increase compared to the same period in the previous year. In March 2024, pangasius exports to the US saw a slight decline compared to February 2023.

Historically, the EU was Vietnam’s largest pangasius importer, with sales peaking at 511 million USD in 2010, accounting for 36% of Vietnam’s total pangasius export revenue at the time. However, pangasius exports to this market declined significantly in subsequent years. In 2022, Vietnamese pangasius exports to the EU saw a sudden increase due to a surge in demand after a prolonged period of impact from the COVID-19 pandemic. In 2023, pangasius exports to the EU declined by 19% compared to 2022. In the first two months of 2024, pangasius exports to the EU reached only 21 million USD, a 28% decrease compared to the same period in 2023.

UAE Emerges as a Bright Spot

According to figures from Vietnamese Customs, in March 2024, Vietnam exported over 2 million USD worth of pangasius to the United Arab Emirates (UAE), a 62% increase compared to March 2023. For the first three months of 2024, exports to this market totaled over 7 million USD, a 67% increase compared to the same period in the previous year.

The UAE primarily imports frozen pangasius fillets (HS code 0304) from Vietnam, with over 2 million USD in March 2024, representing a 51% increase compared to March 2023 and an 81% increase compared to the previous month. However, this was a 33% decrease compared to January 2024. This product accounted for 93% of Vietnam’s total pangasius exports to the UAE. In the first quarter of 2024, the UAE imported close to 7 million USD worth of frozen pangasius fillets from Vietnam, a 56% increase compared to the same period in the previous year. Additionally, in the first three months of 2024, the UAE also imported fresh/frozen/dried pangasius (HS code 03) and value-added pangasius worth 517,000 USD and 152,000 USD, respectively, representing a 15-fold increase and a 62% increase compared to the same period in 2023.

According to the United Nations Food and Agriculture Organization (FAO), the UAE consumes over 220,000 tons of seafood annually, largely dependent on imports. There is still potential for increased pangasius exports to this region as the UAE population grows, per capita income rises, and the pace of urbanization accelerates. Growing disposable income and the younger generation’s preference for seafood protein, along with an increase in tourism, are projected to further drive seafood consumption. Furthermore, the UAE Central Bank has raised its 2024 growth forecast for the country’s economy from 4