BSR’s Business Results in Q1 2024

|

Business results of BSR in Q1/2024

Source: VietstockFinance

|

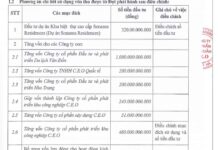

In Q1, BSR recorded nearly 30.7 trillion VND in net revenue, down 10% year-on-year. After deducting the cost of goods sold, gross profit reached nearly 1.3 trillion VND, a decrease of 39% compared to the same period last year.

Other indicators in the period also fluctuated significantly. Financial revenue fell by 36% due to a decrease in exchange rate differences, to 520 billion VND; however, financial expenses also decreased by 60% due to a reduction in exchange rate losses, to 256 billion VND. Sales expenses were recorded at 148 billion VND, down by more than half compared to the same period last year, while administrative expenses increased by 26% to 111 billion VND.

Finally, BSR’s net profit reached over 1.1 trillion VND, down 30% year-on-year.

Dung Quat Refinery

|

According to BSR’s explanation, the factory temporarily halted production for its fifth major maintenance (TA5) from March 15, 2024. It is known that this maintenance was originally scheduled to take place in 2023, but was postponed to 2024 as per the decision of the 2023 Annual General Meeting of Shareholders. The maintenance lasted less than 48 days, so a part of the impact will be recorded in Q2/2024.

In addition, BSR reported that although the price of crude oil in Q1 increased compared to the same period last year, the gap between oil prices and finished products (cracking spread) was lower than the previous year, leading to a decline in profit.

At the end of Q1, BSR’s total assets were nearly 74 trillion VND, down 13% compared to the beginning of the year. Of which, nearly 57 trillion VND were current assets, a decrease of 16%.

The company held more than 40 trillion VND in cash and cash equivalents, up 6% from the beginning of the year. However, inventories decreased sharply by 47%, to 8.2 trillion VND.

Construction in progress increased by 78% to more than 2.1 trillion VND, due to the recognition of 929 billion VND in expenses for implementing the first phase of the Enterprise Resource Planning (ERP) system (only 5 billion VND at the beginning of the year).

On the other side of the balance sheet, most of the company’s liabilities are short-term, recording more than 16 trillion VND, a sharp decrease compared to the beginning of the year (28 trillion VND). The current ratio and quick ratio reached 3.6 times and more than 3 times, respectively.

Short-term borrowings decreased by 18%, to nearly 9 trillion VND, all of which were bank loans.