|

Quarterly Earnings Performance of HAX from 2020 to Present |

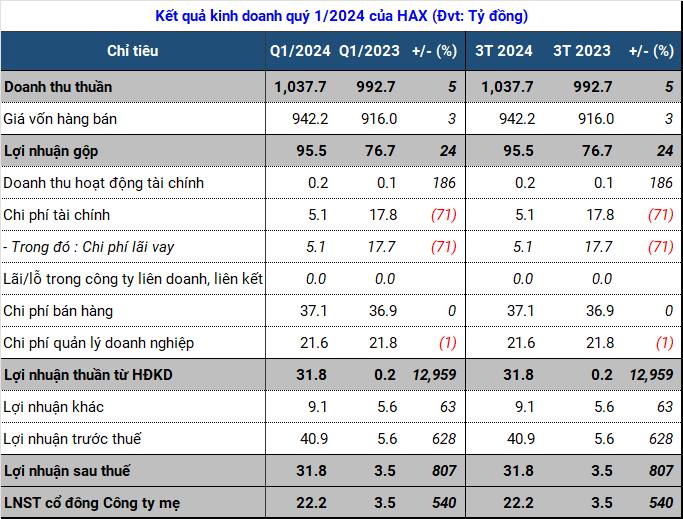

The luxury car market at the beginning of 2024 did not appear to be particularly promising, as the revenue of over 1 trillion dong in the period for Green Car Service Joint Stock Company (Haxaco, HOSE: HAX) only increased slightly, by 5%, compared to the first quarter of 2023.

The cost of goods sold for the major Mercedes-Benz car dealer increased by 3%. While sales and management expenses remained unchanged, interest expense decreased significantly, helping HAX increase net income by 540%, reaching 22.2 billion dong. The company only spent 5.1 billion dong on interest payments, mainly bank interest, while in the same period of the previous year it was up to 17.8 billion dong.

In addition, other revenues also contributed to HAX’s increased profit in the first quarter, generating 9 billion dong, a 63% increase, but no specific explanations were given.

This year, HAX expects to achieve pre-tax profit of 200 billion dong, four times the actual figure in 2023. The first-quarter result reached 20% of the annual target. According to Chairman Do Tien Dung, fulfilling the profit plan for 2024 will not be excessively challenging.

Source: VietstockFinance

|

At the end of the first quarter of 2024, HAX’s total assets reached 2.1 trillion dong, an increase of nearly 100 billion dong compared to the beginning of the year. Short-term receivables from customers increased the most, by around 120 billion dong. Cash flow from operating activities was negative 42 billion dong, while in the same period of the previous year it was positive 480 billion dong, due to a sharp decrease in inventories.

During the period, HAX divested capital in Automobile Production, Trading and Services Joint Stock Company PTM, reducing its stake from 98.32% to 51.62%. The number of employees increased by 189 to 1,151.

The Vietnamese auto market is projected to grow by 10% in 2024 compared to 2023 (reaching 428,000 vehicles sold in 2024), driven by economic recovery and incentives from manufacturers.

A report by SSI Research stated that the market will remain challenging in the first half of 2024 due to weak consumer demand and buyers waiting for new models, but overall, the market is expected to recover in 2024 in both volume and value thanks to several factors, such as economic recovery in the second half of the year, new car models being introduced, the easing of the chip shortage for automobiles, and borrowing interest rates being more attractive compared to 2023. SSI forecasts an approximately 9% growth in auto sales in 2024 compared to the previous year.

Chairman HAX assessed that the auto industry cycle will recover most strongly from 2026 or 2027. However, at present, apart from the uncertain economic and political factors, HAX still has many advantages, such as being well-positioned for growth in the coming years. At the 2024 Annual General Meeting of Shareholders, Mr. Dung said that the company is looking to increase the number of MG dealerships in several provinces and cities across all three regions, while limiting the expansion of Mercedes-Benz dealerships.

In a separate development, HAX will proceed with the payment of dividends for 2023 in cash and the issuance of shares to increase share capital from equity sources. The ex-dividend date is May 09, 2024.

Specifically, the company will pay dividends on May 24, 2024, at a rate of 3% of the face value (1 share will receive 300 dong). The company also plans to issue an additional 14 million shares, at a ratio of 100:15 (shareholders owning 100 shares will receive 15 new shares).

Thus, Mr. Dung (who owns 17.47% of HAX‘s capital) will receive 4.9 billion dong, while Mrs. Vu Thi Hanh (Mr. Dung’s wife, who owns 16.61%) will receive 4.6 billion dong.

|

Changes in HAX’s Charter Capital, Dividends Paid to Owners, and Net Income Over a 10-Year Period |