Specifically, DSC registered to list more than 204.8 million shares on HOSE, corresponding to a charter capital of over 2,048 billion VND.

Prior to that, through the second text-based opinion poll in 2023, the General Meeting of Shareholders of DSC approved the cancellation of stock trading registration at the Hanoi Stock Exchange (HNX) and the listing of all shares on HOSE.

* To Thanh Cong Group, DSC Securities wants to be listed on HOSE

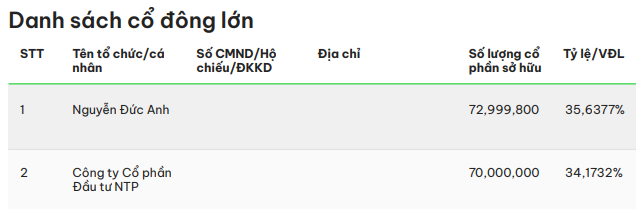

According to the list of shareholders as of January 8, 2024, the Company has 2 major shareholders including 1 institutional shareholder, NTP Investment Corporation, holding nearly 34.2% (70 million shares) and 1 individual shareholder, Mr. Nguyen Duc Anh – Chairman of the Board of Directors of the Company, holding over 35.6% (nearly 73 million shares). The remaining shareholders include nearly 1,207 individual shareholders holding nearly 30.2% and 1 institutional shareholder holding a negligible percentage.

Source: 2023 Annual Report of the Company

|

DSC Securities Joint Stock Company (DSC) was originally established as Da Nang Securities Corporation in 2006 with a charter capital of 22 billion VND, based in Da Nang. DSC has been traded on the UPCoM market since January 2018, with the ticker symbol DSC. In 2021, the Company changed its name to DSC Securities Joint Stock Company and relocated its headquarters to Hanoi, while increasing its charter capital to 1,000 billion VND. By 2023, the Company increased its charter capital to over 2,048 billion VND through the public offering of nearly 100 million shares and the issuance of nearly 5 million ESOP shares.

Source: 2023 Annual Report of the Company

|

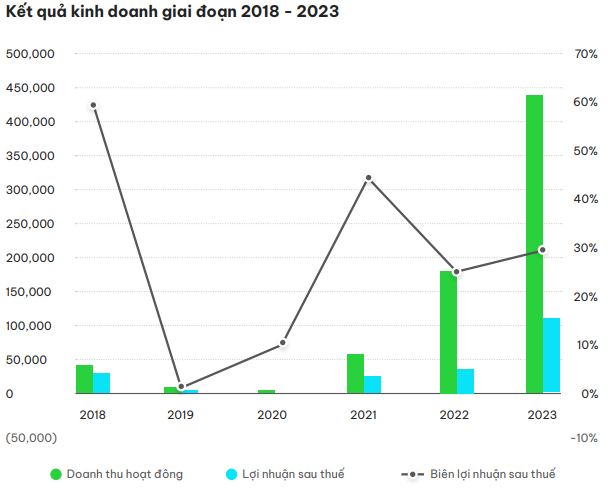

In 2023, DSC achieved operating revenue of over 438 billion VND, a 2.6-fold increase compared to the previous year, with all main business areas experiencing strong growth. Among them, the largest source of revenue was profits from financial assets recognized through profit/loss (FVTPL) at 148 billion VND, more than 3 times the previous year. Profit from loans and receivables was over 135 billion VND, nearly 3 times the previous year. Revenue from securities brokerage business was nearly 104 billion VND, 4 times higher.

Net profit in 2023 was nearly 120 billion VND, 3.6 times higher than the previous year and exceeding the annual plan by 56%.

Source: 2023 Annual Report of the Company

|