The Ho Chi Minh City Infrastructure Investment Joint Stock Company (HoSE: CII) is currently negotiating to acquire a large BOT project. The project is in its final stages and toll collection is expected to begin by the end of this year or mid-2025.

Main content:

- The BOT project is being negotiated by CII to purchase from a major investor in the industrial infrastructure sector.

- CII’s management evaluates the project to be equivalent to 70-80% of the Hanoi Highway project, which the company is currently collecting tolls on.

- Real estate projects are still in the process and have not generated revenue for this year.

Mr. Le Quoc Binh, CEO of Ho Chi Minh City Infrastructure Investment Joint Stock Company (HoSE: CII), recently revealed that the company is in negotiations to acquire a large BOT project. The project is in its final stages and toll collection is expected to begin by the end of this year or mid-2025.

The information was announced by Mr. Binh at an extraordinary shareholders’ meeting held today, February 27, 2024, in Ho Chi Minh City.

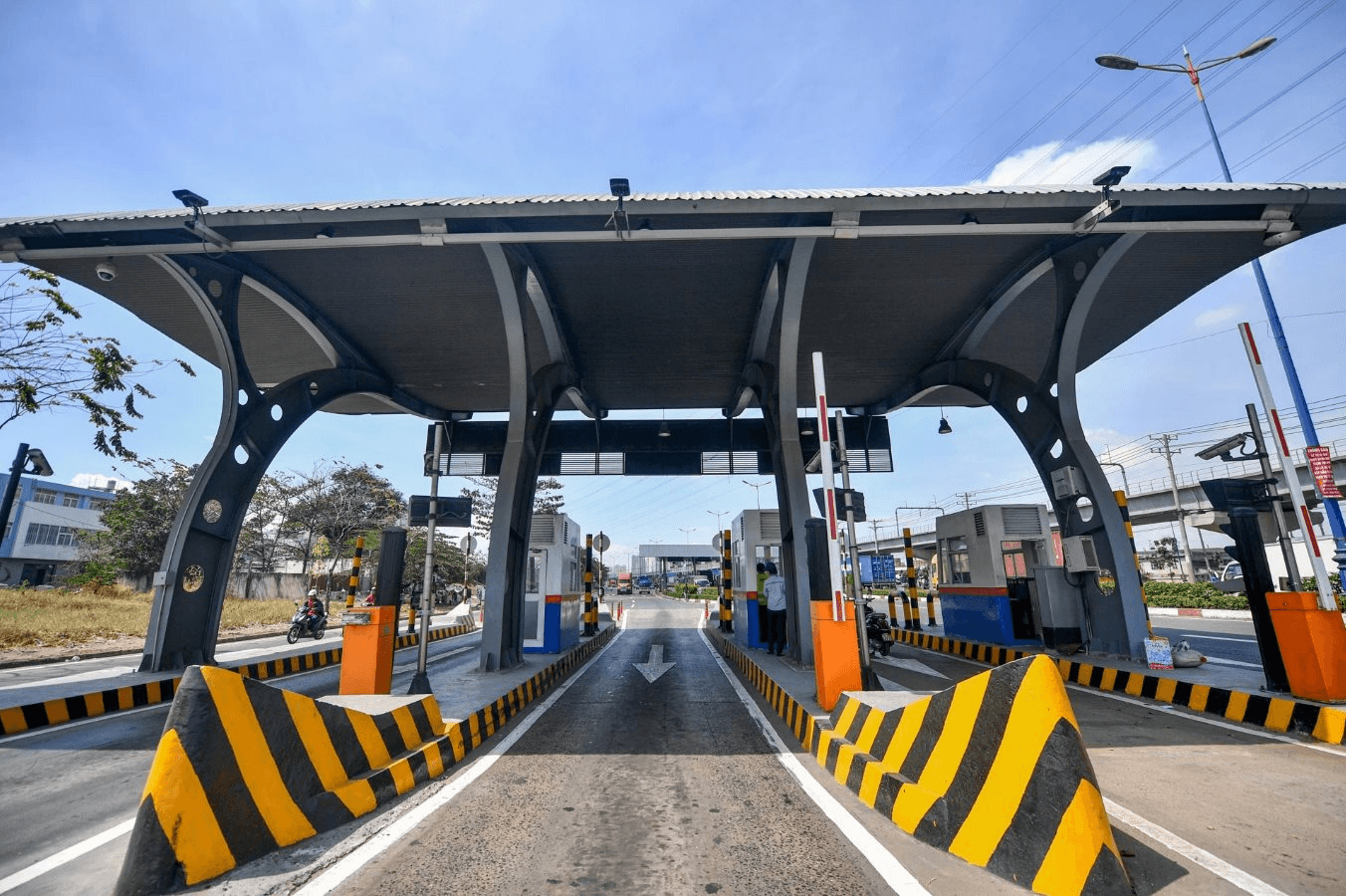

Mr. Binh did not disclose the project name and transfer partner as both sides are currently in the negotiation process. However, the head of CII stated that “this project is very promising, located on the road connecting industrial zones of 5 provinces with the largest port in Vietnam at present.”

“We were proactively contacted by the investor” – said Mr. Binh.

Assessing the potential of this project, Mr. Binh said it is “about 70-80% compared to the Hanoi Highway project”.

The Hanoi Highway is one of the 7 BOT projects that CII manages and collects tolls on. This project brings in about 800 billion VND in toll revenue for the company each year. Therefore, if the fee is calculated, the new project could generate an equivalent amount of 500-600 billion VND in revenue for the company each year. However, in order to own the project, CII will have to invest a relatively large amount of money or share toll collection rights with the investor.

“This is an investor in industrial infrastructure, they need infrastructure connecting industrial zones. The projects are very large-scale, including seaports, industrial zones, BOT infrastructure… While they do not have expertise in BOT, they chose CII for transfer after the project is completed,” explained Mr. Binh, the reason why the investor did not retain the project but chose CII to transfer a “good” BOT project.

“They need a reputable, long-term partner” – added the CEO of CII.

This year, CII’s revenue still comes from toll collection of the BOT projects it manages. During the recent Lunar New Year holiday, the company’s daily toll collection reached a record of up to 11 billion VND.

Real estate projects have not generated revenue in 2024.

Regarding the Lagi project (Binh Thuan) being implemented by CII and Nam Bay Bay (HoSE: NBB) in Binh Thuan, the company said it is still ongoing. Other real estate projects of Nam Bay Bay are also in a similar situation, despite legal advantages thanks to the new Land Law.