Today’s ETF reorganization that tracks the VNdiamond index experienced significant volatility during the ATC session, but the market regained its balance by the end of the session. The VN-Index closed the week up 4.67 points, advancing to the 1,221-point mark. Market breadth was similar to yesterday, with 223 gainers and 200 decliners.

Capital was concentrated in large-cap stocks with Banking increasing by 0.55%, Real Estate by 0.33%, Securities by 0.13%, Construction Materials by 1.08% and Oil & Gas by 0.42%. The main contributors to the market’s rally today were TCB with a 1.16-point gain, VCB with an 0.81-point gain, MSN with a 0.66-point gain and HVN with a 0.65-point gain, closing at the ceiling price due to record-breaking business results in the first quarter.

Other contributors included HDB, ACB, HPG, and VRE. On the downside, the biggest laggard was GVR followed by FPT, LPB, NVL, VIB, and DGC. The cash flow remains cautious, but the matching orders increased to a value of VND 19,000 billion, with foreign institutions unexpectedly making a strong net buy of VND 528.4 billion, and a net buy of VND 694.1 billion in matching orders alone.

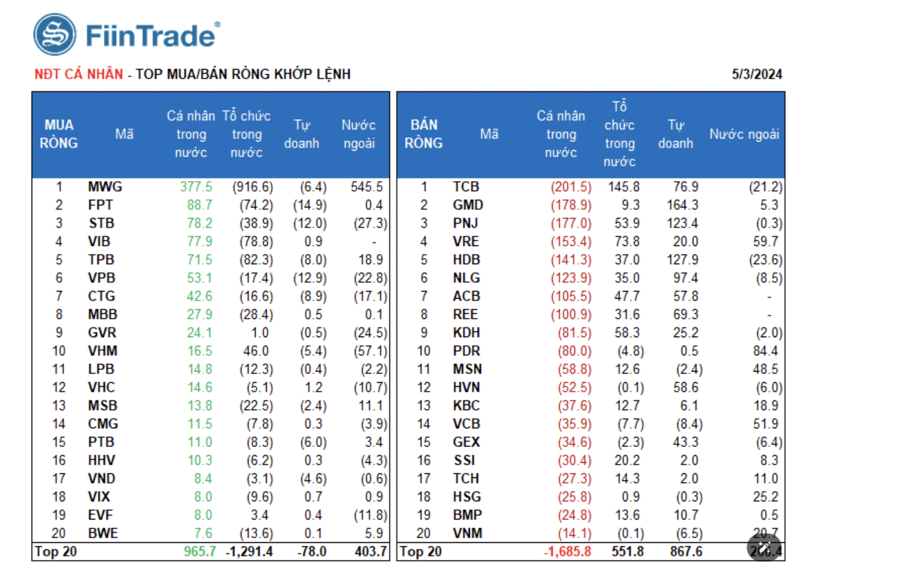

Foreigners’ main net buy orders were in the Retail and Real Estate sectors. The top foreign net buy orders were MWG, PDR, VRE, VCB, MSN, HPG, HSG, VNM, KBC, and TPB.

The foreign net sell orders were in the Banking sector. The top foreign net sell orders were VHM, STB, GVR, HDB, VPB, FRT, CTG, SHB, and EVF.

Local investors were net sellers to the tune of VND 725.7 billion, with VND 730.2 billion in net sell orders. In terms of matching orders alone, they were net buyers in 6 out of 18 sectors, primarily in the Retail sector. The top net buy orders from local investors were MWG, FPT, STB, VIB, TPB, VPB, CTG, MBB, GVR, and VHM.

The net sell orders were in 12 out of 18 sectors, primarily in the Real Estate and Industrial Products & Services sectors. The top net sell orders were TCB, GMD, PNJ, VRE, HDB, NLG, REE, KDH, and PDR.

Domestic institutions were net buyers by VND 872.3 billion, with a net buy of VND 743.8 billion in matching orders alone.

In terms of matching orders alone, domestic institutions were net buyers in 7 out of 18 sectors. The sectors with the strongest net buy orders were Industrial Products & Services and Banking. The top net buy orders from domestic institutions today were GMD, HDB, PNJ, NLG, TCB, REE, HVN, ACB, GEX, and KDH. The top net sell orders were in the Basic Materials sector. The top net sell orders were HPG, FPT, VPB, STB, CTG, DGC, VCB, TPB, FRT, and CTR.

Domestic institutional investors were net sellers to the tune of VND 700.5 billion, with net sell orders amounting to VND 707.6 billion in matching orders alone. In terms of matching orders alone, domestic institutions were net sellers in 10 out of 18 sectors, with the largest value in the Retail sector. The top net sell orders were MWG, TPB, VIB, FPT, STB, MBB, MSB, VPB, CTG, and BWE. The largest net buy value was in the Real Estate sector. The top net buy orders were TCB, VRE, KDH, PNJ, ACB, VHM, HDB, NLG, REE, and FRT.

The negotiated transaction value today reached VND 2,175.7 billion, an increase of +11.5% compared to the previous session and contributed 11.4% to the total transaction value.

Individual investors negotiated 36.9 million LPB shares (equivalent to VND 718.8 billion). In addition, there was another large negotiated transaction in FPT shares, with more than 1.4 million shares (equivalent to VND 198.6 billion) traded between foreign institutions.

The proportion of cash flow allocation increased in Banking, Retail, Steel, Food, Warehousing, Logistics and Maintenance, Oil and Gas Equipment and Services, Aviation, and decreased in Real Estate, Securities, Construction, Chemicals, Software, and Plastic, Rubber & Fiber.

In terms of matching orders alone, the proportion of transaction value continued to increase in the large-cap VN30 group, while decreasing in the mid-cap VNMID and small-cap VNSML groups.